The relationship between monetary policy, inflation, and economic growth remains a topic of perennial interest and debate. Central to this discussion is the understanding of how inflation, which according to Milton Friedman’s hypothesis is a monetary phenomenon, dictates the ebb and flow of economies worldwide. The principle, encapsulated in the quantitative theory of money, posits a direct link between the money supply and price levels, a relationship as intuitive in its simplicity as it is complex in its global implications.

At the heart of this theory lies the equation MV = PY, where M stands for money supply, V for velocity, P for prices, and Y for real income. The theory suggests that with constant velocity and output, an increase in money supply leads to a proportionate increase in inflation. This foundational economic concept is akin to the basic understanding that increasing a vehicle’s acceleration leads to an increase in speed – straightforward, yet profound in its implications.

The global economy provides a rich tapestry for examining these principles. India, for instance, stands out as a case study in potential versus actual economic growth. Despite being one of the fastest-growing economies globally, India is not achieving its full growth potential. Historical and contemporary analyses suggest that India could sustain growth rates exceeding 8%, far surpassing its current performance. This underachievement is not a reflection of incapacity but rather of unrealised potential, pointing to a need for recalibrated economic strategies.

READ I Brain drain: India struggles to stem talent loss

Monetary policy, inflation, economic growth

Inflation, a global phenomenon, has seen significant variances across countries. Recent geopolitical events, like the Russia-Ukraine conflict, have triggered notable inflation spikes in many Western economies. These surges in inflation are not isolated economic events but are intricately connected to broader global economic growth. The relationship between inflation and growth is well-established, where rising inflation often correlates with dampened economic growth, as evidenced in various Western economies recently.

The monetary policies of Western nations, especially in response to recent economic crises like the COVID-19 pandemic, draw critical scrutiny. The substantial fiscal stimuli implemented by these countries, as reflected in the expanding balance sheets of their central banks, contrast starkly with the more conservative approaches adopted by countries like India. This disparity raises questions about the long-term sustainability and potential repercussions of such expansive monetary policies. The economic stability achieved by these means may be short-lived, potentially leading to significant economic disruptions.

India annual economic growth rate

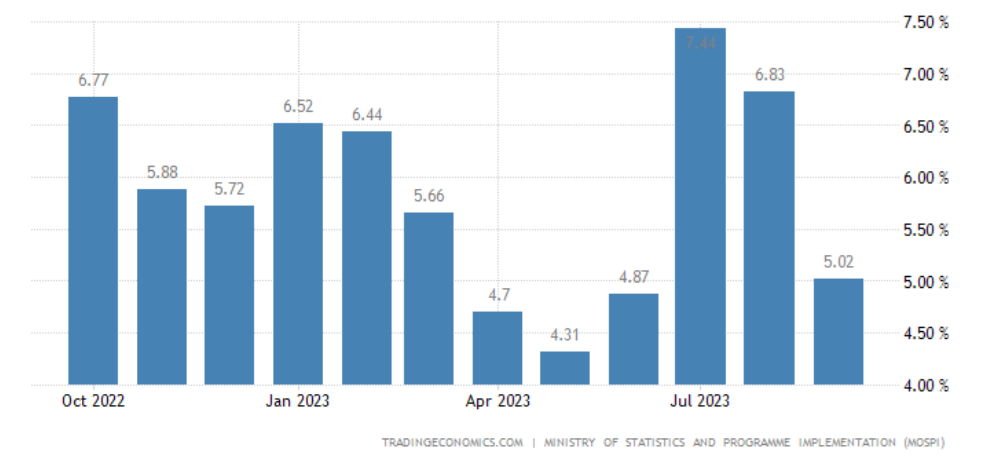

India annual consumer inflation rate

India’s response to similar economic challenges stands in contrast to the Western approach. The Indian government’s fiscal stimulus, characterised by its conservative and strategic nature, focused on asset building and capital expenditure. This approach not only demonstrated fiscal prudence but also reflected a deeper understanding of the long-term implications of economic policy decisions.

The policy decisions in Western economies, particularly regarding monetary policy and interest rates, have far-reaching impacts on the global economic stage, influencing trade, sectoral performance, and financial market stability worldwide. The fluctuations in global trade, the performance of various sectors like pharmaceuticals, leather, and engineering goods, and the overall stability of financial markets are inextricably linked to these policy decisions.

The need for prudent, conservative, and responsible policy-making in global economics cannot be overstated. The actions of major economies, which constitute a significant portion of the global GDP, have profound effects not only within their borders but across the global economic landscape. Emerging economies like India demonstrate resilience and strategic foresight in the face of global economic challenges. However, a more accountable and thoughtful approach to economic policy-making is imperative at the global level to ensure sustainable growth and stability in an interconnected world economy.

While the quantitative theory of money provides a useful framework for understanding the relationship between monetary policy and inflation, it is important to note that supply-side factors can also play a significant role in driving inflation. For example, supply chain disruptions caused by the COVID-19 pandemic have contributed to rising inflation in recent years. Similarly, geopolitical events such as the Russia-Ukraine conflict can also lead to supply shocks and higher prices.

Central banks have limited control over supply-side factors, but they can still take steps to mitigate their impact on inflation. For example, central banks can use monetary policy tools to dampen demand and reduce inflationary pressures. However, it is important to note that using monetary policy to address supply-side inflation can have unintended consequences, such as slowing economic growth.

The relationship between monetary policy, inflation, and economic growth is complex and multifaceted. Central banks need to carefully consider a range of factors when making monetary policy decisions, including inflation, economic growth, financial stability, and global economic conditions. It is also important for central banks to coordinate their monetary policies, given the interconnected nature of the global economy. By working together, central banks can help to promote sustainable economic growth and financial stability.

Dr Charan Sigh is a Delhi-based economist. He is the chief executive of EGROW Foundation, a Noida-based think tank, and former Non Executive Chairman of Punjab & Sind Bank. He has served as RBI Chair professor at the Indian Institute of Management, Bangalore.