Start-up Association of India was the only industry body that requested the Department for Promotion of Industry and Internal Trade to review its decision to put all foreign direct investment proposals from neighbouring countries under the government approval list. It was obvious that the move caused a great deal of disquiet among the start-up community. The concerns expressed by the start-up body over the press note dated April 19 underlined the excessive dependence of Indian start-ups on Chinese venture capital firms as well as the dearth of domestic sources of capital available to them.

Though India has been the home of entrepreneurial traders since the ancient times, the emergence of start-ups in India is a relatively a new phenomenon, not more than a decade-and-a-half old. However, the momentum has undergone a significant shift since 2013 with entrepreneurial outlook, regulatory environment and innovation culture becoming the prime movers behind business growth and employment creation.

READ I FDI from China: India must balance strategic and economic interests

Birth of a start-up ecosystem

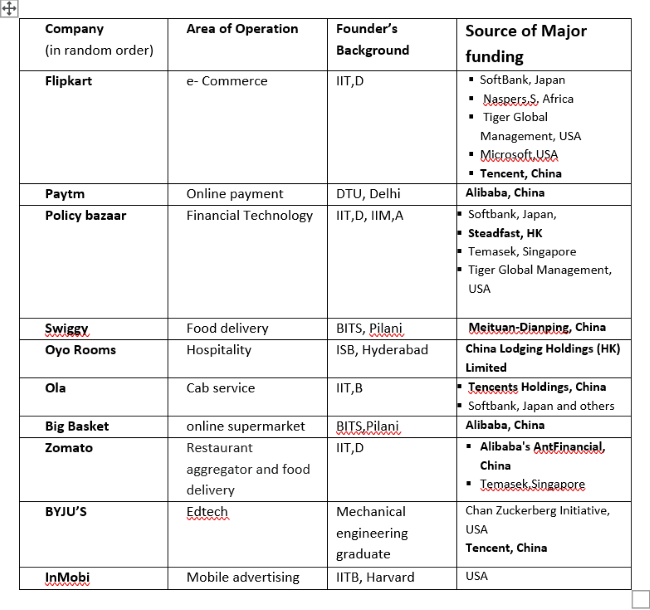

There were only a few start-ups in India a decade ago, but many of them have become household names today by offering their services and products across the country. With the success of Flipkart, Ola, Oyo, Swiggy, Zomato and the like, the Indian start-up eco-system has indeed come of age. The maturing of the eco-system responsible for the growth of start-up culture was the result of multiple factors starting with the economic reforms of 1991. The high growth trajectory of Indian economy witnessed thereafter, the IT boom, emergence of a middle class with disposable income, availability of a large number of engineering graduates, and the exposure to innovation culture prevalent in the US pushed young graduates from elite institutes to convert their ideas into business ventures. The list of successful Indian start-ups along with their area of operation, founder’s background and the source of major funding would offer insights into the factors determining the success of the businesses.

In the early stage of a start-up’s life cycle, angel investors provide the seed capital. The next round of raising capital is no less important as the scaling up of the operations would make them viable and competitive in the market. Finding the right investor is not an easy task even for a marketable product. At this stage, the role of venture capital firms becomes crucial. Global VCF investors, especially the Chinese investors, have been active in India in the last decade identifying the right start-ups having potential for growth and participating in their equity capital.

The government’s decision to screen all funds coming from China has made the start-ups feel uneasy as this is likely to affect their funding plans. Notwithstanding the presence of some active Indian venture capital firms such as Sequoia Capital India, Blume Ventures and Accel Partners, the domestic ecosystem lacks resources. On the other hand, the US and European investors have become more inward-looking due to the downturn in their economies. Given the scenario, allaying the funding woes of start-ups should be a priority as this will enable them to concentrate more on other aspects of the business.

READ I How India lost out to China, rest of Asia in development race

Start-up India initiative

The Start-up India initiative was launched on August 15, 2015 aiming to build a strong eco-system in the country for nurturing innovation and entrepreneurship to drive sustainable economic growth and generate large-scale employment opportunities. An action plan was also rolled out by the nodal body DPIIT (then DIPP) in January 2016 to support entrepreneurs in areas such as “simplification and handholding, funding support and incentives and Industry-academia partnership and incubation”. DPIIT also defined a start-up: “An entity shall be considered as a start-up up to a period of 10 years from the date of incorporation/ registration and turnover of the entity for any of the financial years since incorporation/ registration has not exceeded Rs 100 crore.”

Under the action plan, DPIIT recognised start-ups eligible for benefits such as self-certification under labour and environmental laws, relaxations in public procurement norms, faster exit under the Bankruptcy Code, rebates on patent & trademark filing fees, an expedited examination of the patent applications, and exemption from income tax on capital gains and also on investments received above fair market value. Realising that one of the key challenges faced by start-ups in India has been getting finance due to lack of collaterals or existing cash flows, the government has also set up a fund of funds with a total corpus of Rs 10,000 crore. So far, under Start-up India Program, more than 32,000 start-ups have been recognised by the DPIIT; and around 320 have been funded. In India, the start-up culture is getting stronger and is playing a vital role in strengthening the economy. Credit should go to young entrepreneurs, government initiatives, and also to the encouraging participation of the private sector.

READ I MSME sector: Eight ways India can back its small enterprises

An estimate suggests that around 3,000 start-ups joined the Indian start-up ecosystem in 2018, and the numbers are growing each day. According to a report by NASSCOM, start-ups in India are providing direct employment to around 4,00,000 people. However, a lot needs to be done to ensure that start-ups flourish, taking advantage of the expanding economy. The priority task for the government should be to provide a more conducive environment in terms of ease of doing business, apart from financial relief such as tax exemptions and creating physical infrastructure like incubators.

Genesis of high failure rate

It is a fact that 90% of the start-ups fail within the first five years in India which boasts of being home of the third-largest start-up ecosystem in the world after the US and China. The high failure rate among start-ups is not uncommon, as even in the US, the failure rate varies from 50% to 70%. The common reasons leading to failure of start-ups in India have been discussed, and some measures suggested for improving the success rate.

Financing needs: Lack of funding could be termed as the primary reason why start-ups fail in India. However, it is not just the non-availability of funds responsible for the same. The timing for raising fund is no less important, the founder needs to ensure that it is neither too early nor too late. At this stage, the leadership needs the right advice from professionals. Approaching the right venture capital investor is immensely useful as an experienced investor is not just a finance provider, but also acts as a valuable partner providing useful tips not only on financial matters but also in formulating a long-term marketing strategy. The success of Chinese VCF among Indian start-ups can be attributed to their exposure to the growth process of many Chinese tech start-ups and using the expertise they seek to repeat their success in India. The high-risk perception associated with financing start-ups is a major cause for low availability of bank finance to them, and in particular, Indian VCFs backed by PSUs are said to be shy in offering finance to a budding start-up. This is one reason why most of the new start-ups look to China-based VCFs since they seem to be prepared to take higher risks. Comparatively, Indian VCFs tend to put their money in more mature start-ups. This is another mindset hurdle that all stakeholders in the system need to deal with.

READ I India must prepare for a bout of migration by doctors, medical staff

Articulation skill of the leadership: A lot depends on the leadership or founder of the start-ups. Often the leadership does not succeed in selling his idea to the investor.

Disconnect with customers: Most start-up founders are from an elite and urban background and lack exposure to rural India. However, as nearly 65% of the Indian population live in rural areas, the end-users of the products come from low-income backgrounds in villages. Due to different living environments, start-ups often face disconnect with the customers and their needs. The leadership has to get feedback from the customers during product development and market testing. This will enable the start-ups to build a bridge with the customers, and make changes in the product accordingly.

Lack of innovative ideas: The lack of originality or innovative business model is another important cause of failure. The product is marketable only if it comes up with a solution to the consumers in making their life easy. Indian entrepreneurs often seek established technology and are hesitant to take on innovative ideas because of the risks involved as well as the longer time frame required for returns. For example, statistics reveal that innovators from India filed 1,583 international patent applications with the WIPO in 2018 which was only a small fraction of 53,345 applications filed by China in the same year. To change the mindset, promoting creativity and innovations at the school level should be a priority of the government. For promoting creative and innovative mindset among school-going children, Atal Tinkering labs (ATLs) have been set up under the Atal Innovation Mission in different schools across the country. In all, 8,878 schools have been selected for establishing tinkering labs. More such initiatives including the creation of academia-industry tie-ups for nurturing innovations in academic institutions are to be undertaken for encouraging innovations.

READ I The Big Red Arrow Pointing Up: How indices fail to explain Covid-induced recession

Guidance from industry veterans: The role of industry is critical in boosting the start-up ecosystem. An institutionalised collaborative mechanism between the industry and the start-ups would be able to provide a platform to share experiences with each other and help the start-ups in getting guidance and assistance from industry veterans. That experience sharing is invaluable.

The way ahead for start-ups

India is a capital-deficient country. There isn’t enough domestic capital to sustain economic growth. Start-up India initiative was launched by the government to drive economic growth and generate employment. Initiatives such as deployment of a fund of funds with a corpus of Rs 10,000 crore, a credit guarantee scheme, and a seed fund were initiated under the initiative. But the initiatives by the government will meet only a part of the requirement of a system of 45,000-50,000 start-ups. It is to be acknowledged that finance from VCFs is required at a crucial stage when the product or business model is found to be sustainable, market is identified, and capital is needed to scale up operations. In the globalised world, VCFs located across the world look for markets having the potential for best returns on their investment.

Our security interests have to be paramount, but at the same time, the government will have to ensure that it is not hurting investors. Since March this year, most of the start-ups are struggling because of a decline in revenues due to Covid-19 impact and a drastic fall in funding by venture capitalists. The impact on their business is so severe that in many cases, a halt in their operations or change in business model is being contemplated. The need of the hour is to have a business-friendly system in place that will act as a screening authority for investment proposals backed by a database on foreign VCFs while keeping financing channels open to achieve a higher success rate of start-ups.

(Krishna Kumar Sinha is an industrial policy expert based in New Delhi. He retired from Indian Engineering Services in 2017. The views expressed are personal.)

Krishna Kumar Sinha is an industrial policy and FDI expert based in New Delhi. His last assignment was as an industrial adviser in the department of industrial policy and promotion, DIPP, currently known as DPIIT, under the ministry of commerce and industry of the government of India.