As the Reserve Bank of India commemorates its 90th anniversary, it stands as a beacon of financial stability and economic foresight, having navigated the Indian economy through its myriad phases of growth and challenges. The RBI’s journey encapsulates a steadfast dedication to nurturing a resilient financial system that supports India’s transformation into a global economic powerhouse.

From its inception, the RBI has been at the forefront of monetary and financial policy formulation, adapting its strategies to the evolving economic landscape. In its role as the central bank, the RBI has balanced the dual objectives of controlling inflation and fostering economic growth, a task that has required a nuanced understanding of the dynamic interplay between domestic and global economic forces.

The RBI has also played a crucial role in fostering India’s developmental finance landscape. By establishing and nurturing financial institutions like the National Bank for Agriculture and Rural Development (NABARD) and the Small Industries Development Bank of India (SIDBI), the RBI has facilitated targeted funding to agriculture and small-scale industries, sectors vital for India’s economic base. This strategic focus has supported grassroots economic growth and promoted sustainable development across diverse sectors of the economy.

READ I RBI monetary policy: Steady rates steer India through choppy waters

RBI monetary policy framework

The evolution of the RBI’s monetary policy framework is a testament to its commitment to achieving macroeconomic stability. Initially focused on maintaining price stability and ensuring adequate flow of credit to the productive sectors of the economy, the RBI has progressively integrated a more complex set of objectives, including financial inclusion, currency stability, and managing public debt.

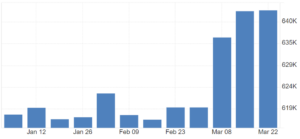

Another pivotal aspect of the RBI’s function has been its management of India’s foreign exchange reserves. The RBI’s adept handling of foreign exchange assets has been central to maintaining the country’s economic sovereignty and ensuring a stable external sector. By judiciously managing these reserves, the RBI has safeguarded the economy against external shocks and maintained a favourable international financial standing, which has been crucial for India’s trade and investment flows.

India foreign exchange reserves ($ million)

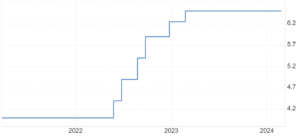

RBI policy repo rate (%)

Inflation control has been a cornerstone of the RBI’s mandate. Tackling inflation in a country as diverse and complex as India involves not just managing the money supply but also understanding the multifaceted drivers of inflation, including food and fuel prices, and the impact of global economic trends. The RBI’s approach has evolved from a straightforward focus on monetary aggregates to a more sophisticated inflation-targeting framework, balancing growth and inflation through nuanced policy levers.

Guiding force of financial sector

The RBI’s role in shaping the banking and financial sectors has been equally significant. It has overseen the liberalisation of the Indian banking sector, guided the reform process to enhance transparency and efficiency, and implemented stringent regulatory measures to ensure financial stability. The RBI’s efforts in cleaning up bank balance sheets, particularly through the resolution of non-performing assets, reflect its proactive stance in maintaining the health of the financial system.

Under the aegis of the RBI, India’s financial markets have undergone significant reforms aimed at enhancing transparency, efficiency, and global integration. The RBI’s initiatives, such as the introduction of market-determined exchange rates and the liberalisation of capital markets, have been instrumental in creating a more dynamic and open financial system. These reforms have not only facilitated greater foreign investment but also spurred innovation and competitiveness in the Indian financial sector.

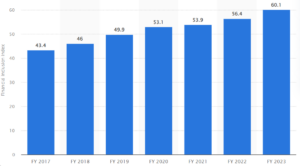

India financial inclusion index

Financial inclusion and technological innovation have been key themes in the RBI’s recent agenda, reflecting its recognition of the changing contours of the financial ecosystem. Initiatives like the Unified Payments Interface (UPI) have revolutionised digital payments, making India a frontrunner in the digital financial services space. These efforts are in line with the RBI’s broader goal of ensuring that the benefits of economic growth and financial sector development are broad-based and inclusive.

The RBI’s role in crisis management, particularly during financial downturns and market volatility, underscores its importance in maintaining systemic stability. Its proactive measures during the global financial crisis of 2008 and the more recent economic disruptions caused by the COVID-19 pandemic have been critical in mitigating financial risks and ensuring the smooth functioning of the banking and financial sectors. Through timely interventions, such as liquidity support to banks and financial institutions, the RBI has effectively cushioned the economy during periods of stress.

The RBI’s autonomy and its relationship with the government have often sparked debate, yet its ability to navigate these dynamics underscores the institution’s maturity and the critical role it plays in the country’s economic governance. Balancing independence with accountability, the RBI has consistently striven to align its monetary policy objectives with the broader goals of national economic policy, ensuring that its actions contribute positively to the overall development of the country.

As the RBI looks towards the future, its focus will increasingly be on managing the challenges of a rapidly globalising economy, including the risks posed by volatile capital flows and the complexities of integrating with a digital global financial system. The bank’s ongoing commitment to financial stability, inclusive growth, and sustainable development will continue to be pivotal in shaping India’s economic trajectory.

The RBI’s 90th anniversary is not just a milestone but a reflection of its enduring legacy and the pivotal role it continues to play in India’s economic journey. As India strides towards greater economic achievements, the RBI remains a key architect of the country’s financial stability and growth, navigating the complexities of the economy with a vision that is both global in its perspective and deeply rooted in the Indian context.

Looking ahead, the RBI faces the challenge of navigating the economy through an increasingly uncertain global environment, characterised by technological disruptions, geopolitical tensions, and climate-related risks. The central bank’s strategic direction will need to focus on enhancing digital financial services, addressing climate change risks in the financial sector, and further integrating with the global economy while safeguarding financial stability. As it charts its course for the future, the RBI’s enduring legacy of prudence, resilience, and innovation will continue to be its guiding light.

Dr Charan Sigh is a Delhi-based economist. He is the chief executive of EGROW Foundation, a Noida-based think tank, and former Non Executive Chairman of Punjab & Sind Bank. He has served as RBI Chair professor at the Indian Institute of Management, Bangalore.