The Reserve Bank of India’s first monetary policy statement of 2024, delivered on February 8, 2024, provides a comprehensive assessment of the current and evolving macroeconomic situation, reflecting on both global and domestic economic conditions, inflation trends, interest rates, and liquidity conditions. The RBI’s focus on maintaining a fine balance among price stability, financial stability, and external sector stability is more critical than ever, especially in a world facing mixed economic signals, geopolitical tensions, and financial market volatility.

The global economy presents a dichotomous picture: on one hand, there is a cautious optimism about achieving soft landings in major economies with inflation edging closer to targets and growth outperforming expectations. On the other hand, geopolitical conflicts and new uncertainties, like disruptions in the Red Sea, inject a degree of unpredictability into global economic prospects. Amidst this global uncertainty, India’s economy shines as a beacon of growth and stability. The RBI’s proactive and calibrated policy measures on monetary, regulatory, and supervisory fronts have bolstered this economic resilience, accelerating growth while ensuring a downward trajectory in inflation.

READ I Rural economy: Can budgetary band-aids sustain post-COVID progress

RBI’s monetary policy stance

The Monetary Policy Committee’s decision to keep the policy repo rate unchanged at 6.50%, along with maintaining the standing deposit facility (SDF) rate at 6.25 percent and the marginal standing facility (MSF) rate and the Bank Rate at 6.75 percent, underscores a nuanced approach to navigating the current economic landscape.

This stance is aimed at striking a delicate balance between curtailing inflation and fostering economic growth, within the framework of achieving the medium-term target for consumer price index (CPI) inflation of 4 percent within a +/- 2 percent band.

Inflation and growth outlook

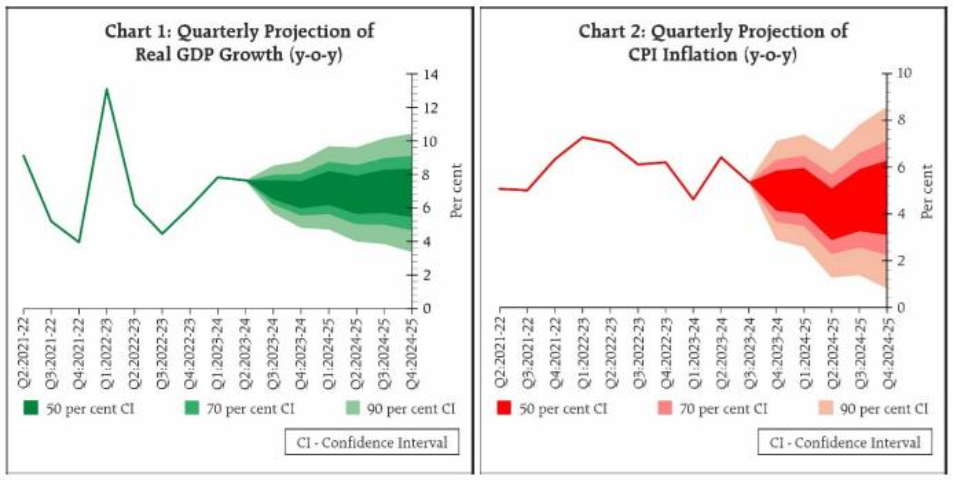

The RBI’s outlook for inflation and growth is cautiously optimistic. Global growth is expected to remain steady in 2024, buoyed by a resilient performance in the preceding year. Domestically, the economy is on an upswing, with real GDP growth projected at 7.0 percent for 2024-25, driven by robust investment activity, rising consumer confidence, and a positive business sentiment. However, the inflation narrative is mixed. From a trough in October 2023, CPI inflation has seen an uptick, driven mainly by food prices, though core inflation has moderated to a four-year low. The RBI projects CPI inflation at 5.4 percent for 2023-24, with a more benign outlook of 4.5 percent for 2024-25, assuming a normal monsoon.

The shift from a surplus to a deficit in system-level liquidity marks a significant transition, necessitating adept liquidity management by the RBI. The proactive liquidity injections and fine-tuning operations underscore the RBI’s commitment to ensuring orderly market conditions and financial stability. Furthermore, the stability of the Indian rupee, amidst global currency fluctuations, highlights the underlying strength of India’s economy and its macroeconomic fundamentals.

As India strides confidently on a growth path, the RBI’s commitment to maintaining price and financial stability remains unwavering. The balance between supporting economic growth and containing inflation is delicate but achievable with vigilant and responsive monetary policy. The RBI’s additional measures, including the regulatory review for electronic trading platforms and enhancements in digital payment systems, reflect a forward-looking approach to fostering innovation and inclusivity in the financial sector.

The RBI’s assessment and policy decisions are emblematic of a central bank in tune with the complexities of the global and domestic economic environment. By steering a course that prioritises inflation targeting within a framework that supports growth, the RBI is laying the groundwork for a sustainable and inclusive economic trajectory. The challenges ahead are manifold, but with continued vigilance and proactive policy measures, the RBI is well-positioned to navigate these uncertainties, ensuring that India’s economic progress remains on a firm and stable path.

The RBI’s approach aligns with central banks worldwide facing similar dilemmas. The US Federal Reserve has hinted at slowing down its rate hikes, acknowledging the progress made on inflation while remaining watchful of global headwinds. The European Central Bank, conversely, may need to raise rates further to combat persistent inflation. Emerging markets like Brazil and Turkey face additional challenges due to currency depreciation and capital outflows. India’s nuanced approach, balancing growth and inflation within a volatile global landscape, reflects its strong macroeconomic fundamentals and proactive policymaking.

Anil Nair is Founder and Editor, Policy Circle.