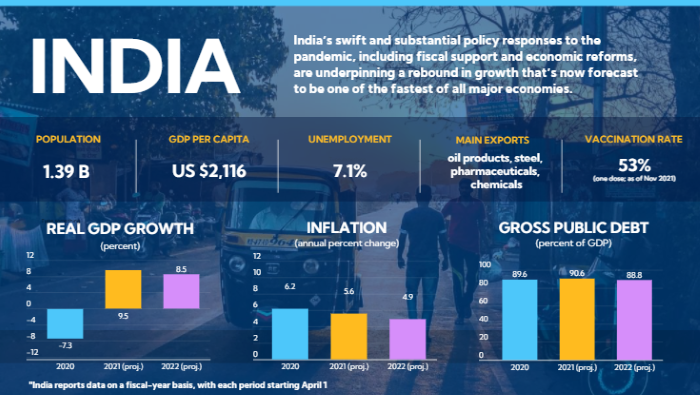

RBI monetary policy committee meeting: The GDP projections for the current financial year and the next show robust growth for the Indian economy, but it is on the low base of last year. The IMF estimates that India will grow 9.5% in 2021 and 8.5% in 2022. Estimates by different agencies converge around this number. Thus, India will be the fastest growing major economy in the world.

The recently released GVA data for July to September is encouraging but could have been better. The latest trends in industrial production including core industries are mixed, especially in September 2021 and therefore the recovery has to be carefully interpreted. Private consumption expenditure (and government expenditure) is lower than in previous quarters. The sale of commercial vehicles is higher in the second quarter of the current year than in the previous year while purchase of private vehicles is lower.

READ I Indian economy to post sharp recovery despite Omicron threat: Arvind Virmani

Inflation and monetary policy

The consumer food price index in October 2021 was lower than in the previous year. In 2021, the worst-hit sectors were oil and fats (33.5%), fuel and light (14.35%) and transport (10.9%). The concern here is the wide variation in CPI among states — Odisha (1.78%), Bihar (2.24%) and Jharkhand (2.68%) compared with Himachal Pradesh (6.14%), Delhi (6.15%), Telangana (6.6%) and Jammu and Kashmir (6.97%).

The wholesale price index (WPI) has increased between October 2020 and October 2021. The WPI for all commodities is high at 12.54%, fuel and power at 37.18% and manufactured products at 12.04%. The food price index is comfortable at 3.06%. The gross non-performing assets were estimated to be 7.48% in March 2021. In March 2022, the NPAs are expected to be 9.8% in case of baseline scenario and 11.22% in severe shock scenario. However, the stress levels are certainly lower than the previous years and banks are buffered well with reserves.

Sectoral deployment of bank credit is also good with credit to agriculture and allied activities performing well and having a growth of 10.2% in October 2021 as compared with 7.2% in October 2020. Credit growth to industry went up to 4.1% in October 2021 from a contraction of 0.7% in October 2020. Medium industries saw a growth of 48.6% in October 2021 compared with 20.8% last year. Retail and MSME segments form 40% of bank credit. They are expected to see higher accretion of NPAs and stressed assets this time.

READ I Cryptocurrency: India should go in for an outright ban

Global trends in inflation

Spillovers are important in a well-integrated global economy. In this context, monetary policies could be following different trajectories as inflation is behaving differently in different countries. Inflation is high in the UK, US, Turkey, Russia and Brazil. The US Fed hasn’t raised policy rates, but a correction can be expected soon amid fear of stagflation.

The Bank of England is also continuing with its same rate of 0.1% for a long time. The Eurozone and Australia also haven’t raised policy rates despite inflation around 2.3%. Russian Federation has raised its Bank Rate to 7.5% with inflation hovering around 7.4-7.9%. Brazil too effected an increase to 7.75% with inflation rising to 9%.

Gold prices are projected to surge to Rs 53,000 over the next 12 months. The DD for gold jumped to 47% in YoY to 139.1 tonne in July-Sept 2021 compared with 94.6 tonne a year ago. Oil prices are projected to be at $72 per barrel from the current price of $82 per barrel, as production is expected to outpace demand.

READ I Climate change: Focus on CO2 may hurt mitigation efforts

Income inequalities, Covid to influence MPC

In the case of monetary policy, a few points need to be considered. First, the increasing income inequalities due to Covid-19 need to be addressed. While fiscal policy will have an important role to play, monetary policy will be required to support the process. The stress in the economy will reflect on the balance sheet of banks. Second, there have been concerns about climate change and these have had an impact on the production process in the economy, especially in agriculture.

The monetary policy determines micro and macro prudential norms. Therefore, the RBI should perhaps consider sustainable/green stress tests on banks and conceive financial schemes that help address the issues of income inequalities and a greener economy.

Financial inclusion has been the lynchpin in India’s efforts to address income inequalities. Many new accounts have been opened under the Jan Dhan Yojana. The RBI should now consider expanding the coverage of accounts to MSMEs that are mostly unregistered. In a recent webinar on the MSME sector hosted by the EGROW Foundation on November 26, the differences of opinion between the government and the Reserve Bank on the subject of MSMEs were highlighted by speakers.

The new Covid variant Omicron has increased uncertainty in global markets and there are fears that economies may not be able to stage a recovery until 2023 and even the year 2024 may be impacted. In view of the above analysis, it would be appropriate if the RBI maintains an accommodative stance and does not venture to change the repo rate.

Dr Charan Sigh is a Delhi-based economist. He is the chief executive of EGROW Foundation, a Noida-based think tank, and former Non Executive Chairman of Punjab & Sind Bank. He has served as RBI Chair professor at the Indian Institute of Management, Bangalore.