The Electric vehicle market has started picking up after the pandemic crisis, but a recent amendment by the government seems to have put a spanner in the growth momentum. The ministry of road transport and highways recently amended the AIS156 norms, India’s stringent testing and certification standard. This objective is better safety after a number of fire incidents involving EVs this summer. The amendments may have a direct bearing on the production and sales of electric vehicles in the country.

The amendments to the AIS156 norms will be implemented in two phases — one from December 1 and the second from April 1. The new rules will force the companies in the sector to rehaul battery packs, battery management systems, as well as tooling for the aluminium casing and capital equipment. Companies are worried about the cumbersome process to get a series of approvals. Securing them won’t be an easy task, especially in a short period. In fact, original equipment manufacturers may have to completely halt production, thereby affecting sales and ability to deliver EVs in time. In November, EV makers had witnessed record sales owing to festive season demand.

READ | Plastic pollution: An international treaty soon to tackle the menace

Speaking of the electric two-wheeler market, Hero Electric and Okinawa which jointly account for more than half of India’s high-speed electric two-wheeler market have lost their market following industry-wide government crackdowns on alleged flouting of manufacturing rules.

The electric vehicles boom

The electric vehicle segment has become a lucrative area for automotive companies which are vying for a piece of the growing market. The adoption of electric vehicles is happening alongside the increasing awareness and willingness to take climate change seriously. With higher demand for EVs, manufacturers are confident of the future and are ramping up production to meet the rising demand.

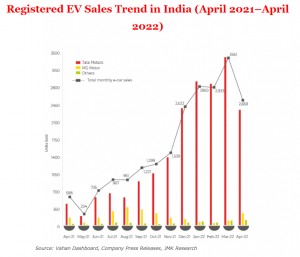

Registered EV sales trend in India

Homegrown Tata Motors and MG Motor dominate the passenger electric vehicles segment with the former having a near monopoly in the nascent, yet burgeoning market. Maruti Suzuki India, Kia, Mahindra & Mahindra, and Hyundai also have major ambitions in the segment. Tata Motors sold 15,198 vehicles in 2021-22, cornering a market share of 85.4%. The company witnessed a 353% growth in sales in the year compared with 2020-21. The other players are also lining up products in the segment in an effort to emulate the success of Tata Motors. Luxury carmakers BMW, Mercedes-Benz, and Audi are also planning to enter the lucrative market. At least 20 electric vehicle models will be launched by 2023-end.

While all players have great expectations from electric vehicles, EVs currently account for just 1% of the domestic passenger vehicles market. The companies sold 17,802 electric passenger vehicles in FY22 compared with 4,984 units in FY21. India has nearly 5,151 public charging stations for electric vehicles. The maximum number of EVs has been registered in Uttar Pradesh which has more than 4.14 lakh EVs, followed by Delhi at 1.83 lakh and Maharashtra at 1.79 lakh, according to a government response to a question in the Rajya Sabha.

The enthusiasm about electric vehicles is not confined to companies only, with the government and consumers who are willing to shell out a higher price for EVs. Volatility in fuel prices coupled with concerns about the deteriorating environment is forcing policy makers and governments to fasten the adoption of EVs. Cheaper mobility solutions are one of the topmost priority at present.

While the push for adoption is coming from the government and consumers alike, a miniscule number of passenger vehicles comprises electrical. This is a supply side issue which may be intensified due to new safety norms. Further, companies are yet to perfect technologies so that they can match their claims.

According to various consumer reports, several automotive brands fall short of their mileage per charge claims which at times doesn’t even match half of what is advertised. This is when EVs don’t come cheap.

READ | Zero Covid policy: Chinese rollback too little too late

The country will need to ramp up charging infrastructure to match adoption rate of EVs. From the current 5,151 charging stations, India needs to have at least 46,000 points to comply with global benchmarks. An adequate charging infrastructure is central to pushing consumers to buy EVs as it solves the fears of not finding charging stations in the vicinity.

Electric mobility has been in vogue and the Indian government has caught up to the trend. To make India carbon neutral and to reduce dependency on fossil fuels, it has incentivised production of EVs. It has announced a production-linked incentive scheme worth Rs 18,100 crore in battery manufacturing, and Rs 26,058 crore for EV manufacturing, along with a cut in GST rates from 12% to 5%.

The government’s support in the form of incentives and subsidies like FAME II and PLI schemes meant that various start-ups could enter the market, posing serious challenge to the leaders in car and two-wheeler markets. The government has stopped giving FAME-2 subsidies to a majority of players after certain players were found to be importing EV batteries and chargers, flouting FAME-2 norms.