Zero Covid policy: China has rolled back many of its contentious zero-Covid curbs bringing cheer to policy makers and businesses across the world. The relaxations announced last week by the State Council came after a politburo meeting of the Chinese Communist party which stressed on the importance of bringing the economy back to normal. Outside world will never know for sure what triggered the policy reversal — whether it was economic compulsions or agitation by Chinese workers who bore the brunt of the restrictions. But one thing is sure — the opening up of China will have a positive impact on the looming global recession.

The relaxations announced included isolation of asymptomatic or mild coronavirus Covid cases at home, a major departure from the earlier policy of putting them in hospitals and centralised quarantine centres. Now, people do not have to carry proof of a negative Covid test before entering public places in cities such as Beijing and Shanghai.

READ | Harm reduction can boost government’s tobacco control efforts

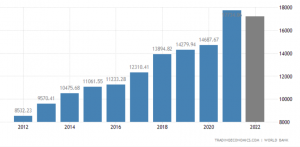

A robust Chinese economy is key to global economic growth. If the world’s second largest economy normalises under less restrictive Covid-19 norms, global demand would recover which, in turn, will boost China’s imports. This will augur well for the world which has been hoping to resume trade with China which accounts for more than 13% of the global economy and 20% in terms of purchasing power parity. A single percentage point gain in China’s economic growth would lead to a 0.2-point rise in the global GDP. So, China relaxing its zero-Covid restrictions will help the world economy will have a huge impact across international borders.

China gross domestic product ($bn)

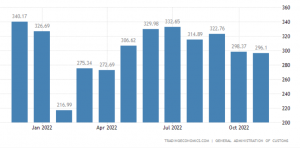

China exports ($bn)

China is one of the biggest buyers of natural resources which it deploys to power the nation’s brimming industrial sector. Lower demand in China because of the lockdown measures or ongoing political unrest has a direct bearing on the global economy. This is why global commodity prices have crashed in the last few years despite a damaging war in Ukraine. China has also played an increasingly pivotal role in global supply chains in the past 30 years of economic liberalisation.

With no steady supplies from China, inflation rippled through the western countries as demand for manufactured goods roared ahead amid supply chain disruptions. While demand was only going up, factories in China struggled with severe delays on deliveries. Shortages of key components ensued amid sky-high freight costs.

The Chinese economy is now entering a delicate period when it will face a set of challenges that do not fit with the experiences of other countries. For one, spending by consumers is unlikely to rise soon after being subdued so long. China’s factories which are the engines of global trade confront weakening demand from key trading partners like the US and Europe.

What is zero Covid policy

China is a global economic powerhouse and hence has a sway on the giant multinationals and governments. In an effort to keep Covid-19 infections minimal, the government introduced strict rules which impacted normal life and exports boom through 2020 and early 2021. By the end of 2021, the country witnessed a drop in exports of goods and services as a percentage of GDP, from 36% in 2006 to 20% in 2021.

The numbers are telling. In the second quarter of this year, China’s economy grew by a measly 0.4%. The strict zero-Covid policy threatened China’s position as the manufacturing hub of the world as companies struggled to meet production targets. The unemployment rate reached an all-time high of 20%.

The trade data for November showed why the government had to relax restrictions. Both the exports and imports shrank by the largest margin in years owing to slowing global demand. The exports fell 8.7% to $296 billion from last November, while imports contracted 10.6% to $226 billion. The trade data point to the vulnerability of Chinese economy to global demand. The country had a trade surplus of $70 billion last year.

When restrictions started affecting their lifestyle, Chinese workers at an iPhone factory in Zhengzhou rioted against the pandemic rules in a rare show of public anger. Even when there wasn’t an outbreak of Covid-19, pandemic protocols were kept extremely tight in China. Travel into the country was restricted with citizens being forced to use a contact-tracing app to enter public places. This is when most of the world has moved on from the pandemic blues.

The rules took a heavy toll on citizens and the economy, aggravating an already-precarious situation created by the Russia-Ukraine war. Dozens of cities were closed in China and a population of 313 million were under lockdown. Citizens were denied access to food and medical supplies. Vast numbers ended up in overcrowded quarantine centres.

With the current rollback, analysts are now in watch mode to see how far the move will help the Chinese economy and the world that is staring at a possible global recession.