By Surya Tewari

Covid-19 has thrown a tough challenge before the country — to tackle the pandemic and the economic emergency at the same time. While the government has put lives ahead of livelihoods in its response to the pandemic, revival of the economy is equally important for sustaining the efforts to save lives.

The government is trying to revive the economy in a graded manner. Modalities and guidelines are continuously being issued by the home ministry on which businesses and industries can be reopened. On May 1, 2020, new guidelines have been issued. Under Para-15 of the consolidated guidelines released on April 15, 2020, some industries and industrial establishments can operate with certain standard operating procedures. The para also includes the operation of manufacturing and other industrial establishments in special economic zones (SEZs). For this purpose, these establishments will have to make necessary arrangements for workers to stay within or in adjacent buildings. As for workers coming from outside, special transportation arrangements should be arranged by the employers while ensuring social distancing.

READ: WTO using Covid-19 pandemic to push expansionist free trade agenda

Given the prevailing situation, the SEZs could be a factor in the revival of the economy as they have performed relatively better in terms of exports, investment, and employment generation. According to the annual report of the ministry of commerce and industry, SEZs contributed 30% of total exports amounting to a total of Rs 7,01,179 crore in 2018–19. Until December 31, 2019, the total investment in SEZs was Rs 5,37,658 crore, and they created around 2.2 million jobs.

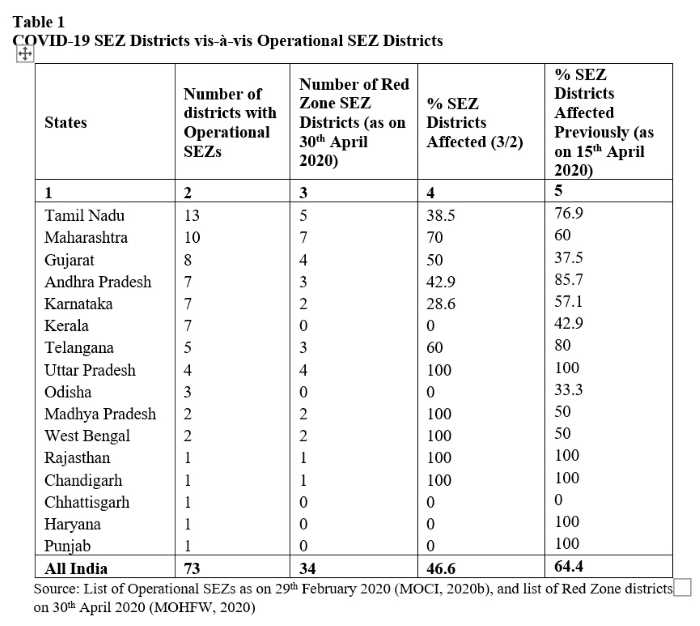

The resumption of economic activities in SEZs is a right step taken by the government to revive the economy. However, the decision may not be of much help. According to latest commerce ministry figures, there are 240 operational SEZs in the country, spread across 73 districts of 16 states/UTs. Of these 73 districts, 34 fall under Covid-19 red zones at present. Previously, 43 were under the red zones declared by the government. As per the new guidelines, districts are categorised under red zones based on incidence of cases, doubling rate, and the extent of testing and surveillance. Previous classification of red zone was based on the reporting of cumulative cases and doubling rate.

READ: Screening FDI: Need of the hour in the time of non-transparent capital flows

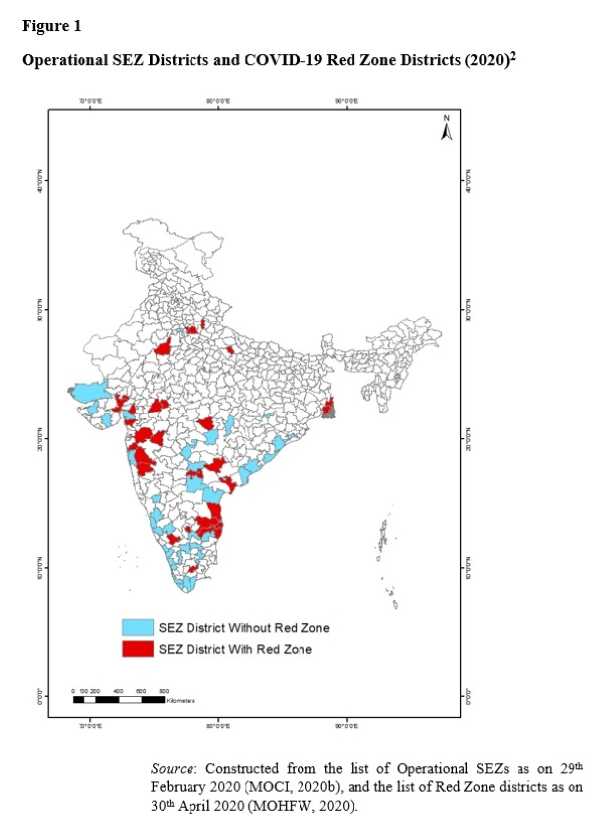

Chart 1 shows the spread of operational SEZ districts vis-à-vis red zone districts. A significant number of SEZs falls in the red zones in Telangana, and Maharashtra.

Table 1 shows the state-wise breakup of these districts. Overall, 47% SEZ districts in India are affected by COVID-19. In Uttar Pradesh, Madhya Pradesh, West Bengal, Rajasthan and Chandigarh, all operational SEZ districts fall under the red zones. Similarly, the proportion of SEZ districts affected by COVID-19 in Maharashtra, Telangana and Gujarat is higher than the national average. In Maharashtra, 70% of total operational SEZ districts are affected. Significantly, between first list of red zone districts declared on April 15 and the latest on April 30, Tamil Nadu, Andhra Pradesh have seen significant decline in number of districts under red zone. During this period, SEZ districts of Kerala, Odisha, Haryana and Punjab have come out of the red zone. Gujarat and Maharashtra on the other hand have seen a jump in the number of SEZ districts under COVID-19 red zone.

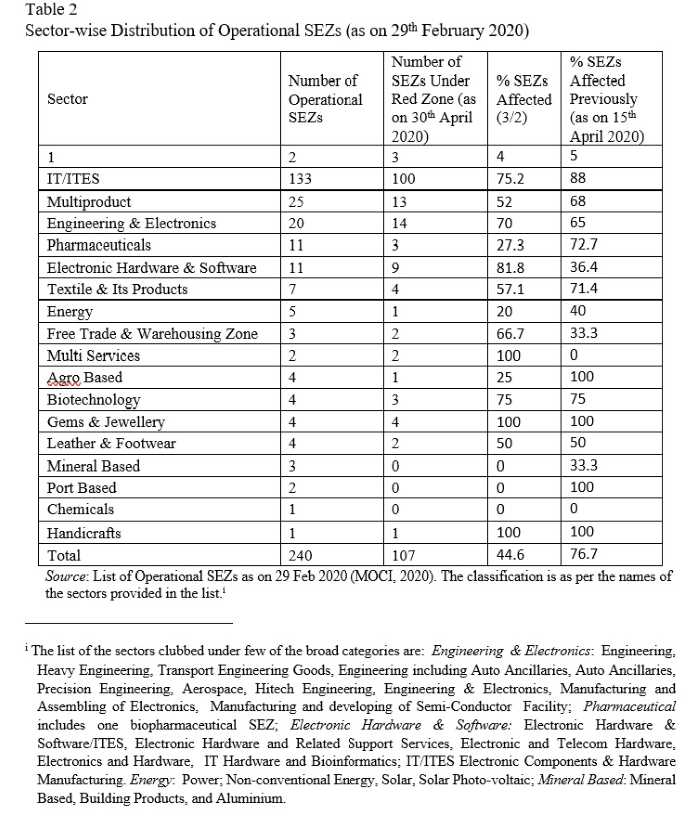

On a sector-wise basis, analysis in Table 2 shows that around 45% operational SEZs are currently in red zone. In IT/ITES sector, 75% SEZs are affected. More than half of the SEZs are affected in multiproduct, engineering & electronics, electronic hardware and software and textiles. Pharmaceuticals, a significant sector in the time of COVID-19 is now less affected (27.3%). Fifteen days back at the time of issuance of the first list of COVID-19 red zone districts, 73% of pharmaceutical SEZs were affected. In general, across all sectors the SEZs under red zone districts have come down. The decline is seen in overall percentage of affected SEZs that has reduced from 77% to 45%.

Among all sectors, IT/ITES sector, which constitute 55% of total operational SEZs in India, is the worst affected. But some of the SEZs in IT/ITES are still operating at sub-optimal level as SEZ rule allows their employees to work from home in certain conditions. More importantly, majority of these SEZs are dependent on outside customers; a further increase in their level of operation would depend on the situation in countries sourcing their services. The point is that SEZs belonging to manufacturing, warehousing services, and others cannot operate remotely because these sectors require the physical presences of workers. Therefore, proper medical and work-related guidelines are necessary.

According to the SOP issued by the home ministry, some of the important measures to be implemented by the industrial establishments include disinfection of premises, lodging and special transport facility for workers, mandatory thermal screening, medical insurance of workers, and staggered work arrangements. The administrative structure and physical conditions place SEZs in an advantageous position to operate while following the SOP. As these SEZs are divided in seven zones and with each zone headed by a development commissioner with secretarial assistance, operation in these SEZs can be effectively monitored.

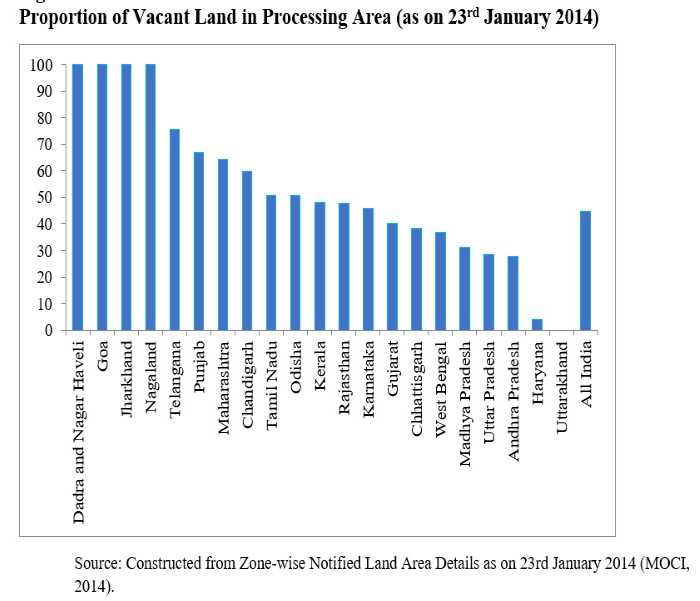

The most important issue in SOP relates to staying arrangements for workers within the premises or in adjacent buildings. The size of SEZs, their multi-functionality in terms of both processing (manufacturing of goods and rendering of services) and non-processing (residential, commercial and social infrastructure), and the availability of amenities provide scope for such arrangements. In special circumstances, temporary shelters can also be created for staying arrangements. The available land related statistics in SEZs shows that a sizable proportion of unutilised/vacant land is available in these SEZs that can be used to create temporary housing structure. Information in Figure 2 shows that overall, 45 per cent land under notified SEZs is vacant. In some of the important states like Telangana, Maharashtra, and Tamil Nadu, more than 50 per cent land is unutilised. Moreover, in Dadra and Nagar Haveli, Goa, Jharkhand, and Nagaland, the entire notified area meant for processing is unutilised.

Furthermore, these SEZs are fully secured zones as they are deemed to be foreign territory with respect to duties and tariffs. The entry and exit of persons are highly restricted in these zones. In such a scenario, no new arrangement would be required to regulate the number of persons inside these zones. The custom authorisation on the entry point of each SEZ to record imports and export of goods could be used in recording each transaction taking place in the SEZ. With this the units could be allowed to operate 24×7 with staggered shifts.

The availability of workers, however, might cause some interruption in the resumption of activities. A sizable proportion of workers in manufacturing and other services activities are migrants. If they have left for their homes, their return would depend on the easing of lockdown and restarting of railways. Those who are staying in temporary shelters can be brought back and after medical screening they can be engaged. But most of them would prefer to go home than to work.

READ: A seven-point plan for MSMEs to survive Covid-19

Availability of raw materials and delivery of final goods would be another issue and to tackle this situation the Ministry of Home Affairs has issued guidelines to allow their movement. Still some constraints would be in place in cross-border as well as interstate and intrastate movements in procuring the raw materials. In fact, this would be a major cause of worry in the medium-term period until the borders are freely open for trade. Firms can use their inventory of raw materials to resume production at sub-optimal level.

Another important issue is whether SEZs could help meet domestic demand? Though the number of manufacturing SEZs is not very significant, in this difficult time when production has stalled in the country and the world also sees significant shutdown, there is a need for these SEZs to operate at their level best. Since they are not obliged to export 100 per cent of their products, sale could be made in domestic territory as well on the payment of applicable custom duties. Sale in the domestic market has been a longstanding demand of SEZs and therefore there will be willingness on the part of the units to operate and cater to the domestic demand. Perhaps for six months or so or until the domestic units become fully operational, the duties could be reduced to bring SEZs at par with domestic units.

(Surya Tewari is a New Delhi-based economist. She is an assistant professor with the Institute for Studies in Industrial Development.)