GST regime @5 years: When the goods and services tax (GST) came into force on July 1, it was touted as a magic pill for all the ills plaguing India’s indirect tax regime. The initiative towards “One Nation, One Tax, One Market” was expected to shore up revenue collection in the country and to strengthen Centre-state relationship. While the new tax regime overcame the initial glitches and managed to increase revenue mopup, the objective of strengthening cooperative federalism remained a distant dream.

The enthusiasm shown by the state governments in striking the historic deal has started to wear off. The sore point is the 14% compensation to state governments that the Centre promised for the initial five years of the new tax regime. This five-year period came to an end on June 30, throwing state finances into disarray suddenly.

READ I Explained: High inflation, import surge behind high GST mopup

What is cooperative federalism?

Cooperative federalism is a concept under which a stable relationship between the Centre and states is desired. The principle guides all the governing bodies to come forward and cooperate to resolve common social, political, economic and civic problems. The Constitution makers endeavoured to create synergy in governance by distributing essential powers and responsibilities to the Centre and states. Under the 7th Schedule of the Indian Constitution, all the powers are divided between central and state lists, while a concurrent list gives some residual powers to the Centre.

Thanks to the GST Council, both Centre and states participate in making decisions regarding goods and services that may be subjected to or exempted from the taxation, and creating model GST laws. They also decide upon various slabs of GST. Hence, the council is a joint forum of the Centre and the states. However, GST alone hasn’t been able to solve the Centre-state feuds.

While GST was supposed to be a win-win for both the Centre and the states, the end of GST compensation is leaving states in a lurch as the golden five year-period of 14% compensation has expired. In the recently held GST Council meeting, the issue remained unresolved. The end of GST compensation will put state finances under several strain, forcing them to look for other sources to increase their revenues.

READ I VPN guidelines must balance cyber security, privacy needs

Hobson’s choice on tax rates

Imposing higher GST rates may look lucrative but soaring inflation renders the option unviable, at least for the time being. Both the Centre and the states are currently feeling the heat of the consequences of the pandemic and a slowing economy.

Several states are heavily dependent on the GST compensation as more than a quarter of their revenues come from GST compensation. These states include Punjab, Goa, Uttarakhand, Delhi, and Himachal Pradesh. Hence, they are seeking an extension of the compensation period.

What did GST system achieve?

GST came into force with the 101st Amendment of the Constitution. From July 1, 2017, the government started to levy a uniform tax on goods and services which subsumed 17 local levies like excise duty, service tax, VAT, and 13 cesses. With GST, the government replaced local sales and entry levies and brought 13 lakh taxpayers under a unified indirect tax regime. GST remains the most complex and ambitious tax reform in Indian history.

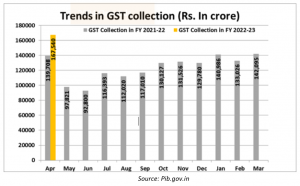

GST also brought a paradigm shift in the use of technology to bring about tax compliance and made over Rs 1 lakh crore revenue collection every month a new normal. These days, the collections are consistently 50% higher owing to a stabilisation in technology and to high inflation. Among its other achievements, the new tax regime benefitted logistics and e-commerce, checked evasion and provided real-time data on supply chains, helping small firms access cheap funds.

Goods and Services Tax buoyancy is taking place around Rs 1.40 lakh crore a month owing to a sharp economic revival after the coronavirus pandemic and much better compliance due to technological enhancements. GST is also moving on a path to better tax buoyancy as is evident by last year numbers. Last year’s gross GST revenue was up 30%, while nominal GDP was 19.5%.

How to make GST regime a win-win?

Several organisations have tried and failed to help the federal government and the states to come into an agreements, but to no avail. This has left cooperative federalism in India a difficult proposition to achieve. One way to strengthen cooperative federalism is by allowing states more freedom to make laws, offer fiscal support and promote decentralisation of power. As far as GST is concerned, the government may look to continue giving out the compensation to the states until a better alternative with mutual agreement is found. Leaving the states in a lurch especially in the present circumstances of inflation merely creates distrust.

Earlier in May, the Supreme Court had said that the recommendations made by the GST Council are not binding as they should be made by a mutual dialogue between the states and the Centre. The decision was lauded by several states such as Kerala and Tamil Nadu which were of the opinion that they can now be more flexible in accepting the recommendations as suited to them.