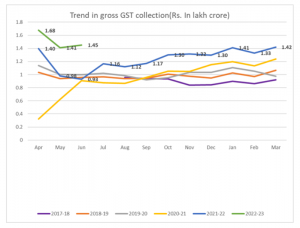

The Indian economy may be facing global headwinds, but the crisis hardly finds reflection in the goods and services tax collections in June. The GST mop-up of Rs 1,44,616 crore is the second highest since the introduction of the new indirect tax regime in 2017, prompting finance minister Nirmala Sitharaman to say that Rs 1.4 lakh crore has become the rough bottom line for GST collections.

For the economy struggling against a global economic crisis, supply chain disruptions, soaring inflation, and rising interest rates, the record GST collection may just be what the doctor ordered. After a period of struggle, carmakers recorded robust sales in June while rising freight movement and fuel consumption hinted at an economic recovery. But the government and the RBI are circumspect in the face of the possibility of a global recession affecting the fragile recovery.

READ I Positives in RBI report no defence against a global recession

While the jump in GST collections augurs well for the economy starved of good news, most of the increase can be attributed to runaway inflation and the increase in imports. The GST mop-up in June was 56% higher than the year ago period, while consumption was just 2% above the pre-pandemic levels. This means the GST collections have been boosted by inflation. The WPI inflation in the month is expected to be around 15-16% in the month despite the impact of a favourable base effect.

The other factors behind record tax collections are better compliance and rising exports. India’s imports in the first week of June surged 77% to $16 billion. So, the GST collections may just be highlighting the brighter side of the country’s fiscal situation.

GST system under strain

The GST Council meeting held in Chandigarh ended without taking a call on the five-year constitutionally guaranteed compensation plan to states that ended on Thursday. End of GST compensation will put state finances under several strain. The states will need to look for other sources to shore up their revenues. Higher GST rates will be an easy option, but further hikes will lead to higher inflation which is undesirable under the present circumstances. For a large number of states, more than a quarter of revenues come from GST compensation.

An analysis by PRS Legislative Research shows that at least 13 states are heavily dependent (25% and above) on the compensation transfer. Punjab, Goa, Uttarakhand, Delhi, and Himachal Pradesh are the states most dependent on compensation. In Punjab’s case 47% of its guaranteed revenue come from this transfer.

READ I PSU bank privatisation: Will the government bite the bullet?

The Supreme Court in May caused quite a stir by ruling that the GST Council recommendations are not binding on the Union and state governments. The Court clarified that Article 246A gives Indian Parliament and state legislatures the power to make laws on GST and said that the Council’s decisions are only persuasive and not binding.

This means states have the power to reject GST Council decisions on tax rates, despite surrendering their right to fix tax rates on goods and services, except fuel and alcohol. The GST Council is chaired by the Union finance minister while all state finance ministers are members. All decisions need to be ratified by a majority of not less than three-fourths of weighted votes cast. The Union government has a third of total weighted votes.

The judgment came amid widespread discontent over the working of the GST regime. Several state ministers are unhappy with the way in which the Council is transacting its business. The SC observations may prompt them to call for a relook at the system.

While the Union government is confident that the ruling will, in no way, affect the functioning of the council and the overall tax regime, the states may question attempts by the Centre to steamroll the Council’s decisions. The judgment may also result in more consultations on several disputes surrounding GST.

The differences with the Union government notwithstanding, the state governments may not decide in favour of differential tax rates under GST. While they may be tempted to raise SGST rates to boost revenue generation, they may soon find it unviable. Several recent developments highlight the importance of revisiting the legal and institutional frameworks of the GST regime. The system cannot function in the atmosphere of mutual distrust between the Centre and states.