The slowdown experienced by the Indian IT industry in 2023 has continued into the present year, with sector revenue growth projected to be a modest 3-5% in FY25. This trend is expected to dampen hiring, which is likely to remain subdued until growth momentum accelerates, as noted by ICRA Ratings. The industry has seen muted hiring over the past five quarters, with a negative net addition, marking the second consecutive year of a 3-5% growth rate projection for the Indian IT sector by the credit rating agency.

In the first nine months of the current fiscal year, the industry reported a mere 2% revenue growth, falling short of the previously estimated 3-5%. The sector is grappling with economic downturn in key markets such as the US and Europe, leading to reduced discretionary IT spending by companies. This downturn has significantly affected the banking, financial services, and insurance (BFSI), and telecom sectors, which have seen greater contractions than others.

READ | Food prices sizzle: Can govt tame inflation before polls?

India’s IT sector emerged as a major economic force in the late 20th century, contributing significantly to GDP growth, foreign exchange earnings, and job creation. Despite the current slowdown, the sector remains adaptable, with a growing focus on skilling. This highlights the talent and innovation that continue to drive the Indian IT sector forward.

Great Indian IT industry downturn

Despite the slowdown, educational companies are thriving due to increased demand from IT professionals seeking to upskill in generative artificial intelligence (GenAI). GenAI, which generates new content from existing data, is revolutionising design, marketing, and software development. This surge in interest is reflected in the 195% year-on-year increase in GenAI course enrolments at companies like Blackstone-backed Simplilearn. GenAI is rapidly gaining traction for its applications in content creation, process automation, customer support, and data analysis, becoming essential for professionals in these fields.

For IT firms, GenAI represents a significant opportunity. Companies like TCS, Infosys, and Wipro are investing heavily in GenAI services. Infosys launched its GenAI suite “Topaz,” and Wipro introduced “ai360,” an AI-focused initiative, committing $1 billion to enhance AI capabilities over three years. These efforts underscore the growing recognition of GenAI’s potential in the IT industry.

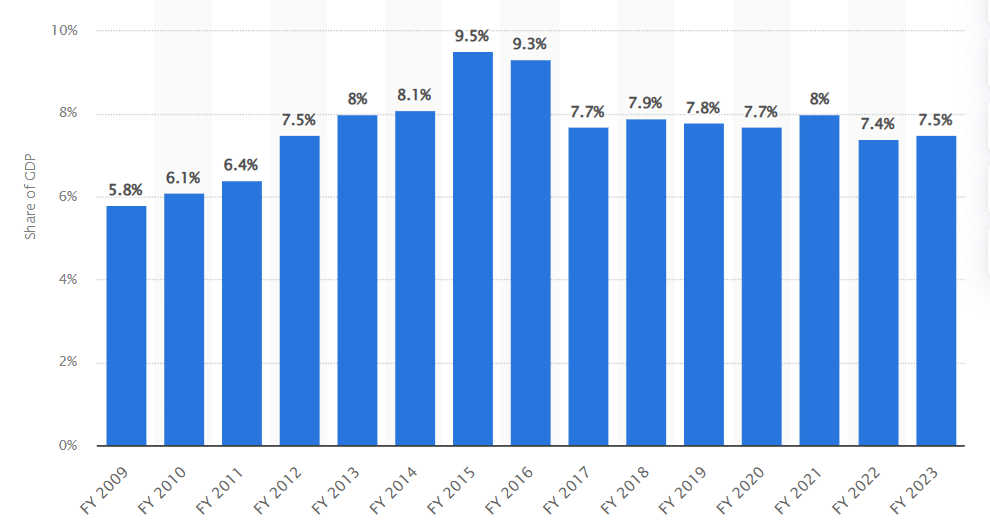

Share of IT/ ITeS industry in India’s GDP

The Indian IT sector, traditionally a pillar of employment and innovation, is facing an unprecedented slowdown. With revenue targets under pressure, companies are cutting costs, focusing on essential spending. However, this trend is somewhat mitigated by the continued demand for learning, especially in GenAI and cybersecurity, with a notable increase in Indian learners.

In addition to the interest in GenAI, there is a notable increase in demand for cybersecurity programs, reflecting the growing reliance on digital transactions globally. This trend is particularly strong in India, where nearly 72% of learners in these programs are based, underscoring the country’s significant contribution to the global IT workforce. The rising demand in these areas highlights the sector’s adaptability and the urgency with which professionals are seeking to acquire skills that align with the evolving technological landscape and security needs.

The sector is anticipated to rebound as macroeconomic challenges lessen, supported by strong order books and deals. Notably, TCS reported a significant total contract value (TCV) in recent quarters. Despite these strengths, the industry faces challenges in finding growth avenues in a tough market, especially with the ongoing threats from Western economies. However, the Indian IT sector’s operating profit margins remain healthy at 21-22% for FY25, supported by strong liquidity and modest capital and operational expenditures.

The long-term prospects for the Indian IT sector remain positive. The increasing adoption of cloud computing, big data analytics, and the Internet of Things (IoT) will continue to drive demand for IT services. Additionally, the government’s initiatives like Digital India and Skill India are expected to further strengthen the sector’s talent pool and infrastructure. By focusing on innovation, upskilling its workforce, and exploring new growth avenues, the Indian IT sector is well-positioned to overcome current challenges and maintain its position as a global leader.