Persistent food prices continue to be the biggest worry for the Indian economy. While inflation has shown signs of moderation, concerns remain about rising consumer prices, particularly for essential food items. This is putting pressure on household budgets and economic growth. Food inflation in India based on consumer prices rose to 8.66% in February, fuelling concerns about increased consumer price pressures in the upcoming months.

Consumer Price Index (CPI)-based inflation eased to 5.09% in February, maintaining within the Reserve Bank of India’s (RBI)’s tolerance range of 2-6% for the sixth consecutive month, despite consistently exceeding the 4% medium-term target for over a year. Rural inflation remained steady at 5.34%, while urban inflation saw a slight decrease to 4.78%. Food and beverage inflation increased to 8.66%, indicating persistent price pressures in these categories.

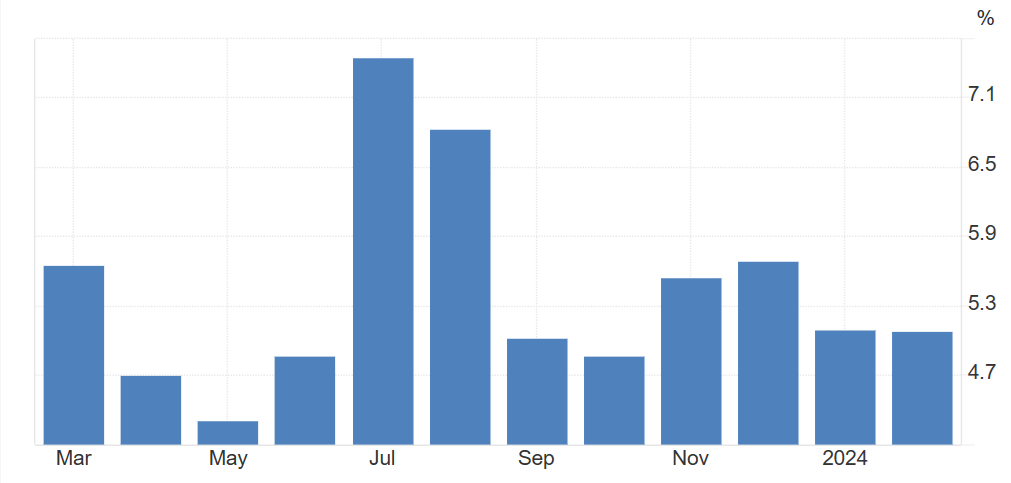

India annual retail inflation (%)

READ | EMPS scheme sparks debate on subsidies, sustainability

The Wholesale Price Index (WPI)-based inflation declined slightly to 0.2% from 0.27% in the previous month, food article prices, particularly for cereals (6.63%), vegetables (19.78%), and milk (5.46%), continued to rise. According to data from the ministry of commerce and industry, WPI inflation has remained positive for the fourth consecutive month, driven by reduced price increases in fuel and manufactured products.

The government announced a Rs 2 cut in petrol and diesel prices, acknowledging the regionally and globally high inflation in this category. High fuel prices have been a significant concern in India. Taxes on oil and petroleum products significantly contribute to the retail prices paid by consumers, and have been a substantial source of revenue for the Union government. This dependency on tax revenue from fuel highlights the government’s fiscal reliance on the energy sector, a point of contention in discussions about economic policy and consumer burden.

The government’s decision to cut fuel prices acknowledges the significant impact of high fuel costs on consumers. However, this highlights a deeper issue – the government’s reliance on tax revenue from fuel products. This dependence creates a conflict of interest, as reducing taxes to ease consumer burden could affect government finances.

This price cut follows criticism of the Modi government for not passing on the benefits of global crude price slump over the past decade. Taxes on oil and petroleum products, a significant revenue source for the Union government, heavily influence retail prices. The global commodity and energy price corrections have helped moderate inflation in fuel, power, and manufactured products, offering the government an opportunity for intervention.

Food prices remain a cause of concern

Food inflation remains worrying, with high prices for cereals like wheat (2.34%) and pulses (18.48%). Vegetable prices, particularly onions (29.22%) and potatoes (15.34%), are soaring. However, declines in fruit prices (-3.99%) and protein-rich foods like eggs and meat (-0.47%) have provided some relief.

Food price volatility poses significant risks to broader inflation and economic growth, primarily driven by personal consumption. The government has unsuccessfully tried to control food inflation, including banning onion exports. Potato production is expected to fall nearly 2%, and water shortages could further impact summer crop production, with reservoir storage at only 40% capacity.

Consumer Price Index (CPI) inflation, which directly reflects the impact on consumer pockets, is a more important metric compared with WPI. While WPI tracks inflation at the wholesale level, CPI measures price changes for goods and services purchased by households. Since food items hold a significant weight in the CPI basket, rising food inflation is likely to translate to higher CPI inflation in the coming months, impacting consumer spending and overall economic activity.

Water availability is critical for summer crop cultivation, and current reservoir levels are concerning. According to the Central Water Commission, as of March 14, reservoirs’ live storage across India stood at 40% of capacity. This level of water storage is especially worrying for the southern regions, where the shortfall compared to the 10-year average is most pronounced at 29%. Such water scarcity could adversely affect summer crop yields and exacerbate food inflation pressures.

RBI Deputy Governor Michael Patra highlighted the impact of persistent food inflation on private consumption and rural economies. However, there is optimism that improved weather conditions and a recovery in rabi sowing will benefit agricultural output and food inflation.

In other areas, manufactured product prices continued to deflate, with a 1.27% decrease for the twelfth month, reflecting lower prices in several categories. Manufactured products constitute 64.2% of the WPI index.

WPI inflation is projected to rise to around 0.5% from April 2024, with global commodity prices expected to remain subdued. The government must closely monitor geopolitical tensions in West Asia and food inflation. Maintaining inflation within the target is crucial for sustainable, inclusive growth, especially in the challenging economic climate leading up to elections.