As the world battles extreme weather events triggered by climate change, nations and businesses are racing against time to find clean sources of energy that can replace fossil fuels. As the fastest growing major economy in the world, India is in the forefront of the race to find reliable substitutes of fossil fuels. The government recently announced the Rs 20,000 crore National Green Hydrogen Mission towards this end. The green hydrogen policy will support R&D and pilot projects for production of electrolysers. The generous allocation of Rs 20,000 crore came as a surprise for the industry which was expecting ₹3,000-4,000 crore.

Green hydrogen is central to India’s strategy to achieve net zero or carbon neutrality where greenhouse emissions are balanced by removing them from the atmosphere. The government had announced the National Hydrogen Mission in August 2021 with the objective of making the country the green hydrogen hub of the world. Despite the concerns about the viability of producing enough green hydrogen to meet the energy needs of the growing economy, the Adani group and Reliance Industries have unveiled ambitious plans to produce and sell green hydrogen at $1 per kilogram by 2030.

READ I Green hydrogen: Uncertainties mar efforts to ramp up capacity

A green hydrogen ecosystem

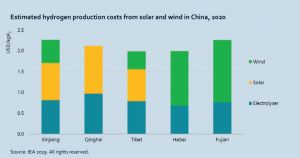

The country looks to produce 5 million tonnes of green hydrogen by 2030. The government wants to reduce the cost of green hydrogen from $3-6.5 per kilogram to $1 per kg. This will need an investment of Rs 8 trillion which will create six lakh additional jobs. The biggest challenge is to generate demand to ensure that there is no supply-demand mismatch. India will need to put in place frameworks for the creation of a robust green hydrogen ecosystem, market regulation, R&D and training mechanism. The government has already announced incentives for transportation and storage of green hydrogen.

The government expects to produce 25 million tonnes of green hydrogen every year by 2047. Green hydrogen could help India cut its carbon emissions by 3.6 gigatonnes by 2050 and replace energy imports to the tune of $246 billion.

Last year, the Union power ministry had announced concessions on inter-state transmission charges, banking charges, and land acquisition. The government has also announced plans to set up exclusive green hydrogen and ammonia manufacturing zones. The first such cluster will come up near Mangalore in Karnataka over the next five years. The Union government is likely to introduce production linked incentives for electrolyser manufacturers.

The Chinese challenge

The National Chemical Laboratory in Pune is working to develop viable electrolyser technologies. Electrolysers split water into hydrogen and oxygen using electricity. Versions of electrolysers are in use for more than 100 years. Green hydrogen is produced when renewable energy is used to split water. India will need 32 GW electrolyser capacity to produce five million tonnes of green hydrogen. It will also need 115 million litres of water per day. Without major breakthroughs in technology, becoming a green hydrogen hub would just mean export of water.

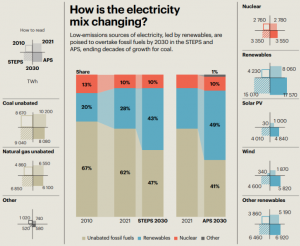

There is a huge spike in electrolyser production with green hydrogen plants passing the pilot stage to industrial scale. China accounts for more than 40% of the global electrolyser output today. India’s northern neighbour is likely to dominate the global electrolyser market as it did in solar panel manufacturing. India will need to extend cooperation to the Western world to avoid the Chinese domination of this key industry.

While the competition is heating up to reduce cost and increase efficiency, China has managed to produce electrolysers at a fourth of the cost needed in western countries. The western countries have the lead in making more efficient electrolysers. The Inflation Reduction Act of 2022 introduced by the Biden administration has its focus on clean tech manufacturing and will pump money into domestic green hydrogen production.

Chinese manufacturers are focusing on low-cost alkaline electrolysers that need more electricity than the solid oxide and proton-exchange membrane (PEM) electrolysers produced in the US and Europe. Chinese manufacturers are improving on their alkaline electrolysers and are expected to flood global markets soon.