It seems the world is in a race to ramp up green hydrogen production and establish a robust market for the fuel. The Russian invasion of Ukraine triggered a spike in natural gas prices that suddenly made green hydrogen a viable fuel. This led to heavy investment in this fuel that emerged as an alternative to fossil fuels at a time the world is trying to cut greenhouse emissions.

A number of countries joined Europe in the race to establish hydrogen markets as part of their plans to move away from fossil fuels. Though a lot of hopes are riding on the proposed hydrogen projects, a global market and a supply chain, the industry is still at a nascent stage and will require heavy investments.

READ I Old pension scheme promises hit PFRDA hurdle

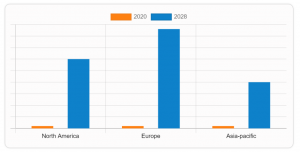

Green hydrogen market by region

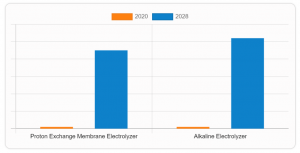

Green hydrogen market by technology

A few months into the Ukraine conflict, fresh investment worth $73 billion was made in green hydrogen. The US is offering a huge $3/kg tax credit under its Inflation Reduction Act. The EU launched a €3 billion bank to fund the sector. China has already made major strides in green hydrogen technology while some of the largest business houses are spearheading the development of this green fuel in India.

Green hydrogen is produced by splitting water using green energy generated from wind and sunlight. The world sees this fuel as an ideal replacement for fossil fuels in heavy industry and transport. Some of the heaviest polluters such as steel and cement manufacturers and heavy transport sector are looking to switch to cleaner forms of energy. Several car manufacturers such as Toyota, Hyundai, and BMW are betting big on hydrogen fuel cell vehicles.

READ I What is the loss and damage fund? Why is it key to war on climate change

Green hydrogen demand soars

Use of clean hydrogen is expected to rise seven times between 2020 and 2050. The current state of green hydrogen development is nothing to write home about. The world is still far away from producing cost effective green hydrogen as it lacks the technology to scale up dramatically.

Some countries have made remarkable progress in developing clean energy sources in the seven years after the signing of the Paris Agreement of 2015. The world will have green hydrogen projects of 134GW capacity by 2030. But this figure is insignificant compared with the capacity required to achieve net-zero by 2050.

Many of the green hydrogen projects are in different stages of planning with just 4% of them are under execution currently. There are uncertainties affecting the sector — no one is sure about the future demand, regulatory frameworks are absent, and the world doesn’t have the hydrogen-delivery infrastructure in place.

The biggest challenge is in scaling up the green hydrogen market. There are several factors that stop it from becoming a viable fuel alternative. The biggest problem is the inadequate renewable energy output. If all the proposed green energy projects are completed by 2030, they could together produce only a sixth of the current energy demand. The 134GW green energy output is enough to produce only 9-14 million tonnes of green hydrogen annually, against the current demand of around 100 million tonnes.

The global green hydrogen market is expected to be worth $225.55 billion by the turn of this decade, riding on the demand for cleaner fuel alternatives. However, uncertainties over long-term supply and low volumes available at present are discouraging end-use industries and infrastructure developers from investing heavily. This affects the potential of the clean hydrogen sector. A robust hydrogen industry is considered central to the decarbonising of the world.

In view of the obstacles to the development of this alternative fuel, the governments need to set up regulatory bodies and develop green hydrogen markets large enough to meet the demand from companies looking to switch to hydrogen from carbon fuels. They should also offer incentives to green hydrogen production as it is central to the national plans to achieve net zero by 2050.