As the Reserve Bank of India’s six-member monetary policy committee gears up for its crucial monetary policy announcement on April 5, the stakes are high, marked by the compulsions of the election year and the global economic uncertainties. The deliberations of the RBI monetary policy committee which began on April 3 are not just an economic routine but a strategic assessment of the Indian economy and its financial system.

Indian economy has shown remarkable resilience, with a Q4 2023-24 growth rate of 8.4%, surpassing expectations. This momentum is anticipated to continue, backed by a 34% rise in gross fixed capital formation. The industry sector is thriving, as evidenced by the robust performance of core industries such as coal, steel, cement, and electricity, with coal and steel registering double-digit growths. The index of industrial production also reflects a positive trend, expanding by 5.9%.

However, not all sectors are prospering. Agriculture faces challenges, with concerns over low water levels in reservoirs and potential impact of the El Niño effect. The El Niño could add to the agricultural sector’s woes, potentially leading to erratic weather patterns, including prolonged dry spells or unseasonal rains. Such climatic anomalies could disrupt farming activities, affecting crop yields, and inflating food prices, thereby straining the rural economy, and influencing the RBI monetary policy considerations. Nonetheless, construction, trade, hotels, and the financial sector are booming, along with significant growth in high-frequency data indicators such as vehicle sales and port activities.

READ I RBI @ 90: A legacy of resilience, inclusion, and innovation

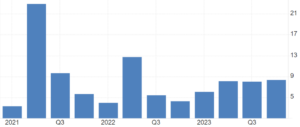

RBI monetary policy and GDP growth

The Indian economy’s vibrancy is also reflected in the remarkable growth of specific sectors. Jewelry, sports goods, footwear, consumer durables, and restaurants have experienced high growth rates, highlighting a diversified economic strength. This sectoral boom underpins the overall robust economic performance and indicates a shifting trend towards consumer-driven growth.

India annual GDP growth rate

India’s economic growth hinges not only on sectoral performance but also on robust infrastructure development. The government’s focus on infrastructure spending, including initiatives like the national infrastructure pipeline, is crucial for creating a conducive environment for businesses and facilitating seamless movement of goods. Additionally, rising private investments, both domestic and foreign, are essential for propelling the economy to the next level.

Inflation and fiscal health

The consumer price index, particularly food inflation at 8.7%, rings alarm bells, contrasting the benign wholesale price index. Yet, the fiscal domain boasts robustness, with GST collections hitting record highs, signaling a healthy revenue stream. The robust fiscal situation, exemplified by the surging GST collections, signifies a strong economic undercurrent. The fiscal buoyancy provides the government with greater leeway to manage public expenditures and potentially influence monetary policy through fiscal stimulus measures, thereby impacting overall economic stability and growth prospects.

India annual consumer inflation rate

A skilled workforce is paramount for India to leverage its demographic dividend and maintain its economic momentum. The skilling landscape, including vocational training initiatives and educational reforms tailored to industry needs, merits consideration. Furthermore, addressing labor market rigidities and ensuring employability of the growing workforce are crucial aspects to analyse. A skilled and adaptable workforce is vital for enhancing India’s competitiveness in the global job market.

The external sector, however, presents hurdles, as global economic slowdowns impede India’s export ambitions. Despite these challenges, service and IT exports have mitigated the trade deficit, maintaining the current account deficit at a manageable level.

Policy expectations and global context

The external sector’s challenges are compounded by the global economic slowdown, particularly in advanced economies, which poses a risk to export-oriented sectors. The trade dynamics, characterised by a widening deficit and the performance of key export and import categories, reflect the intricate interplay between domestic economic policies and global market forces, necessitating careful calibration of the RBI monetary policy.

The RBI monetary policy committee needs to adjust amid global economic uncertainties, domestic inflationary pressures, and the forthcoming electoral cycles in India and the US. With inflation wavering but not firmly within target ranges, policy rate adjustments are approached with caution.

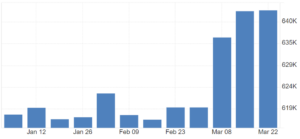

India foreign exchange reserves

Internationally, the US Federal Reserve’s stance on interest rates adds another layer to the monetary policy calculus. While domestic inflation remains within the RBI’s tolerance band, the persistent uptick in food prices and global rate dynamics will heavily influence the MPC’s decisions.

Most economists expect status quo in the upcoming policy review, with no immediate changes to the repo rate or policy stance. This approach reflects the need for clarity on monsoon patterns, growth sustainability, and international monetary policies. The possibility of rate cuts looms in the latter part of the year, contingent on evolving economic indicators and global trends.

The RBI monetary policy announcement is a critical event, encapsulating the challenges and opportunities facing the Indian economy. The policy will be pivotal in shaping India’s economic fortunes in the election year and beyond.

While India’s economic growth record is commendable, its tackling of socioeconomic disparities and ensuring inclusive development is not convincing. Analysing trends in poverty reduction, income inequality, and social welfare programs would provide a more comprehensive picture of India’s economic progress. Bridging the gap between the rich and the poor is critical for fostering social stability and ensuring sustainable economic development.