The future of cryptocurrencies: The year 2023 has been a disastrous one for cryptocurrencies. The market was shaken by the fall of FTX, the second largest crypto exchange. This put a spanner in the recovery witnessed at the start of the year. The earlier narrative was of the transformative potential of cryptocurrencies with a radical belief that digital currencies could actually become a new financial system and make one very rich. The craze for digital currencies was such that governments were forced to launch their own regulated versions of digital currencies. The Reserve Bank of India launched e-rupee, its central bank digital currency, this year.

So, what went wrong with the crypto dream? The value of cryptocurrencies had always been a controversial topic unlike the other forms of financial assets that are considered safe. The appeal of cryptocurrencies was also a reason for its demise. Cryptocurrencies lack regulatory oversight which added to its appeal in the beginning. No bank or government collects fees on any transaction which also remains unrecorded. Both privacy fiends and drug dealers alike found it alluring. Another big selling point for cryptocurrencies was its volatility which meant overnight wealth.

READ India set to be a leader in renewable energy, but may still miss own targets

The same appeal, however, also meant that if new investors begin to flee the crypto market, the value of cryptocurrencies will crash and burn. And that is exactly what happened with the crypto empire and culminated in the great FTX meltdown. FTX was not the only one to bleed; Coinbase, which is the largest cryptocurrency exchange in the United States, was flying high until the big crypto crash in May. By July, its stock price had plummeted by 81% in just this year, and it reported a $430 million first-quarter loss.

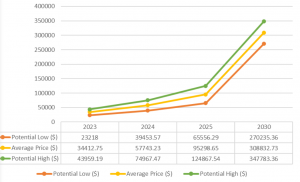

Bitcoin value forecast

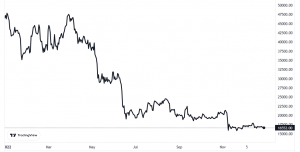

In 2022 summer, the biggest players were showing signs of distress with Bitcoin losing 70% of its value. Bitcoin registered a fall from $69,000 to around $20,000 this June. Its current value is $16,638.40. Some cheerleaders for the cryptocurrency still see the price drop as an opportunity. The value of the entire cryptocurrency market fell from a peak of $3.2 trillion in November 2021 to about $1 trillion this June.

Unravelling of mighty Bitcoin

The fall of cryptocurrencies was also due to the fact that unlike real life assets such as oil or gold, people still do not use crypto to conduct most real-life transactions. When inflation hit, people couldn’t afford to lose their money on intangible sources of savings like crypto and instead focussed on averting risks. Cryptocurrencies failed to offer any buffer from broader economic forces, making them risky assets.

What lies ahead for cryptocurrencies?

There is a widespread belief that the inflection point for cryptocurrency has been reached. There’s no doubt that crypto is finance, and some people did make money out of it. The extent to which the value of most cryptocurrencies declined makes the cynic’s case convincing even if plenty still believe in the crypto story. It is difficult to predict exactly what the future holds for cryptocurrencies. However, there were a few things that had the potential to shape the direction of the cryptocurrency market in the coming years

One of them was acceptance of digital currencies by mainstream institutions and retailers, which does not seem plausible given the current conditions. This backs the Indian government’s scepticism regarding cryptocurrencies all the more logical. Initially when the craze around digital currencies went skyrocketing, the government refused to budge on its stance on the same and even slapped a hefty tax slab on crypto trading to discourage investors. The government has been at loggerheads with investors. The Union Budget 2022 levied a tax on all crypto trades despite the fact that the country hasn’t legalised cryptocurrencies.

The Reserve Bank of India time and again maintained strong views about cryptocurrencies, reiterating that digital currency posed a serious threat to the macroeconomic and financial stability of the country. All said and done, analysts still believe that cryptocurrencies will make a comeback in the near future as the underlying blockchain technology that powers cryptocurrencies is still in its early stages and is constantly evolving. As the technology improves and becomes more widely adopted, it could lead to new and innovative uses for cryptocurrencies.