Electric vehicles industry in India: Electric two-wheelers have become costlier with subsidy cuts by the government kicking in from Thursday. The subsidy on electric two-wheelers under the flagship FAME II scheme has been cut from 40% to 15%. Leading players such as Ola Electric and Ather Energy have announced increase in the prices of various models.

The government has fallen behind the targets set for the second phase of the FAME scheme. The Union government scheme for promoting the sales of EVs, Faster Adoption and Manufacturing of (Hybrid &) Electric Vehicles, will expire in March 2024. The government has, so far, met just over 40% of the target. The original goal was to subsidise more than 1.5 million EVs.

READ | RBI seeks to fortify banks against hidden stress, governance gaps

The government does not plan to extend the scheme beyond FY24 and instead intends to focus on achieving the remaining target of subsidising 914,707 EVs. The electric four-wheeler and three-wheeler segments have received the lowest allocation of subsidies and are significantly behind their respective targets. On the other hand, the electric two-wheeler and electric bus segments have received more incentives and have made progress towards the targets. To help these segments meet their targets, the ministry of heavy industries has been diverting funds from the three-wheeler category to the two-wheeler and electric bus categories.

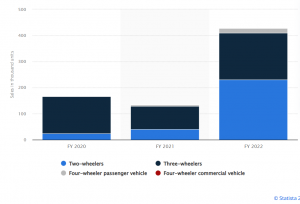

India electric vehicles sales from financial year 2020 to 2022

Last month, Policy Circle had discussed how the next round of the FAME scheme is crucial for driving India’s EV goals. The electric vehicle industry is hopeful of continued government support through the FAME scheme as it is necessary to revolutionise the automobile industry. FAME II began in April 2019 with an allocation of Rs 10,000 crore for a three-year period. As of February 28, 2023, only Rs 2,835 crore of the allocated amount had been spent.

Under the FAME scheme, financial incentives are provided to buyers of EVs, reducing the upfront ownership cost and making EVs more affordable. This initiative aims to phase out petrol and diesel vehicles while promoting domestic manufacturing of EVs, components, and batteries, thereby reducing dependence on imports.

As governments worldwide strive for a sustainable future and given the significant contribution of crude oil-based vehicles to global warming, EVs are essential parts of the climate change mitigation plans. EV sales have experienced exponential growth in the country, with total sales surpassing one million units in 2022, marking a 206% increase on the previous year. However, when considering total vehicle sales, EVs accounted for only 4.7% of overall sales, reaching 1,054,938 units in 2022.

The government has set ambitious targets for increasing EV sales to 70% of commercial passenger vehicles, 30% of private cars, 40% of buses, and 80% of two and three-wheelers by 2030.

Challenges to the electric vehicles industry

Although the ministry of heavy industries received applications for 980,000 electric two-wheelers (E2Ws), incentives for nearly half of them were halted due to alleged non-compliance with the FAME guidelines. Some players were found to be violating the phased manufacturing programme (PMP) guidelines, while others failed to submit the required documents as per the norms. Consequently, these manufacturers were excluded from the claims.

Despite the higher upfront cost of EVs, which also contributes to buyer reluctance, the Indian government has reduced subsidies for electric two-wheelers, effective from June 1, 2023. This will result in a significant price increase for electric two-wheelers currently benefiting from the subsidy under the FAME-II scheme.

Currently, India’s EV industry is highly competitive with a large number of players. Tata Motors and MG Motors India are leaders in the passenger car segment, while Hero Electric, Okinawa, Ola Electric, and Ather Energy are leading players in the two- and three-wheeler segment. Mahindra & Mahindra has garnered a significant share in the three-wheeler segment.

The compliance issues with certain manufacturers led to the suspension of incentives for specific electric two-wheelers. However, there are other issues that have hindered the growth of the EV industry. These include allegations of corruption and misappropriation of funds by bypassing localisation and ex-factory price norms. Currently, the ministry is investigating more than a dozen original equipment manufacturers (OEMs) for misappropriation.

Other obstacles such as a lack of confidence in the EV ecosystem also pose challenges. One of the biggest hurdles is the limited availability of adequate charging infrastructure in most parts of the country. Currently, only larger cities are prioritising the installation of charging infrastructure.

Many surveys have indicated that customers are hesitant to switch to EVs due to the limited range which raises concerns about running out of charge before finding a charging point. The development of better and more affordable battery technology is crucial for the widespread adoption of electric vehicles in India. In short, effective implementation of the FAME scheme and continued government support for EVs is crucial for the industry to make a significant impact.