The world is still in the grip of the worst economic and humanitarian crisis since World War II. Some of the most powerful economies are on their knees, dragging the rest of the world into a deep recession. The International Monetary Fund expects the global economy to contract 3%, but the crisis may, in all likelihood, surpass such optimistic predictions.

Several years of globalization has made China the manufacturing hub of the world. China accounts for approximately a fifth of global GDP in purchasing power parity terms. China has a vice-like grip over global trade as the largest exporter and second-largest importer country. The world is either dependent on China for the final products, or intermediate goods without which production and distribution of goods are virtually impossible. Wuhan is a major industrial hub and an integral part of the global supply chain and a significant producer of high value-added goods. The impact of the pandemic and the subsequent shutdown in Wuhan spilled over to the rest of the world, affecting sectors such as automobiles, pharma, fertiliser, electronics, technology, travel/leisure, liquidity, and investment.

READ: Indian economy needs a booster shot, not slow medicine

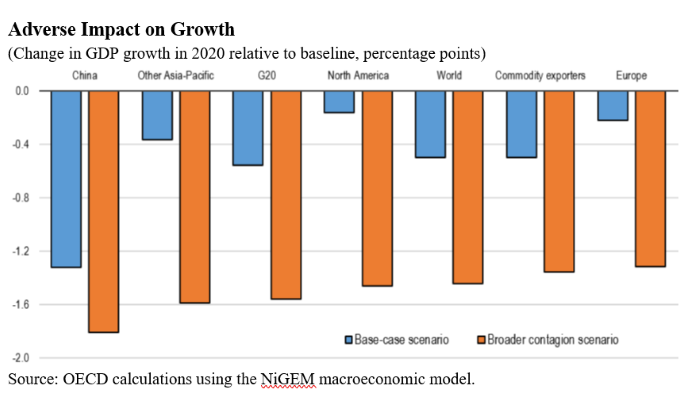

Covid-19 resulted in the collapse of industrial production, pushing the world into a severe economic crisis. It has triggered profound economic challenges that are exceptional, influencing supply, demand, and resulting in a market shock. The countries closely connected to China such as Japan, Korea and Australia are badly affected. While financial markets, travel industry and global supply chains have crashed, sectors such as trade, commodities and logistics are facing a severe crisis. The Covid-19 pandemic has demolished the global capitalist hubs such as New York, Tokyo, London, Paris, Dubai, and Mumbai.

The entire world is reeling under a financial crisis, however, the economies that are not closely integrated with China may escape with comparatively minor damage. With no new export manufacturing orders and investments being held back to high uncertainty, the future of global economy is bleak in the short term. China’s role in global supply chains as the largest producer of intermediate goods will decline. The delay in restarting production in affected regions will add to the weakening of the manufacturing industry in many countries. This situation is expected to persist for some time to come.

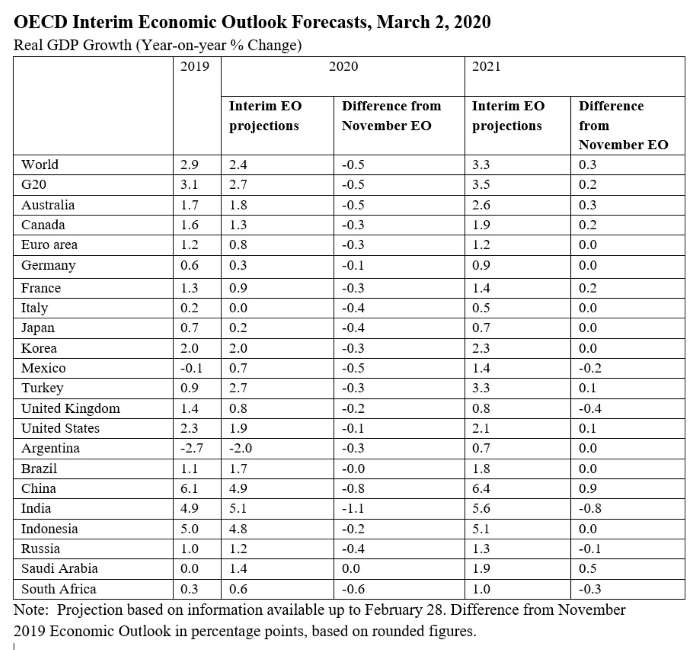

The recovery of global economic growth is expected to begin in 2021. However, the prospects of growth are extremely uncertain. The current projections are made on the assumption that the epidemic will be brought under control by the September quarter, helped by significant domestic policy easing. It is estimated that global growth projections could be further lowered this year.

READ: An imperfect future: Imagining the post-Covid world order

An Asian Development Bank study on the pandemic’s impact on the global economy traces it to several channels such as the fall in domestic consumption, the effect on tourism and travel, distractions in trade and production lines, and effects on health due to the disease and mortality risks. The ADB study estimates that there will be an income loss of $77 billion to $347 billion. China is expected to be the worst hit because it is linked to the global production chain.

The Washington-based Centre for Economic Policy and Research indicates that countries such as Japan, South Korea, and Singapore will also be affected badly by the supply chain contagion. The seven most significant economies, such as the US, China, Japan, Germany, the UK, France, and Italy are reeling under the pandemic. The study says Japan would incur 10% GDP loss, whereas Germany and the US both could lose up to 8%. The economic impact of the pandemic may also trigger a global debt crisis. Household and corporate demand around the world are affected by lower equity prices and higher risk premia.

READ: India’s storied middle class may be sliding into poverty

The overall influence of lower commodity prices is neutral. While commodity exporters incur a fall in revenues, commodity importing economies will benefit from lower prices. The monetary policy of each country needs to remain supportive to ensure that long-term interest rates remain low. Lower policy rates and robust government spending can help boost business and consumer confidence, scripting a revival in demand once the lockdown is lifted and travel restrictions are removed.

Against the backdrop of a weak global economy and downside risks, there is a need for policy actions that strengthen healthcare systems, boost demand and limit adverse supply effects. Further a multilateral policy dialogue is essential to evolve appropriate control and policy measures to limit the economic cost of the pandemic. Coordinated policy action by major economies can provide the most-effective stimulus. Additional fiscal and monetary policy support and structural reforms will help countries restore growth and improve the confidence of consumers and investors. A crisis of this magnitude will need flexible responses. The policy measures need to be rolled out fast to equip the market to respond quickly to pandemics and calamities in the future.

(Dr Naliniprava Tripathy is a professor of finance at IIM Shillong.)

Naliniprava Tripathy is an Indian economist based in Shillong. She teaches finance at IIM Shillong.