The Narendra Modi government is set to present its last full Budget before the next general elections. While the government finds itself under pressure to present a populist budget, it has to do a fine balancing act to meet demands from various stakeholders within strict constraints. The government is expected to cut down spending on food and fertilizer subsidies to Rs 3.7 lakh crore ($44.6 billion) in the next financial year beginning April.

If the government acts on this compulsion, the subsidies will be 26% less than last year’s allocation. The primary goal remains to rein in the fiscal deficit that has ballooned during since the outbreak of the Covid-19 pandemic. Food and fertilizer subsidies together account for about one-eighth of India’s total budget spending of Rs 39.45 lakh crore this fiscal. However, cutting food subsidies is easier said than done for the government as it is a politically sensitive time with elections looming on the horizon. The government is also looking to save money on the free ration scheme which was launched amid the coronavirus pandemic.

READ | AI revolution: India must embrace technology to be world leader

The latest subsidy policy will be announced on February 1 2023 by Finance Minister Nirmala Sitharaman in the Union Budget 2023. The government plans to cut fertiliser subsidies too because the expectations of lower crude oil prices are rife. Despite the constraints faced by the government, various sectors are vying for its attention, seeking subsidies so that they are better prepared for the challenges ahead. This year, the government support has become even more important considering the looming recession.

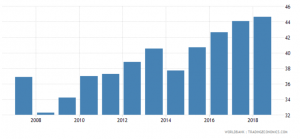

Subsidies and other transfers (% of expenditure)

The latest to join the chorus for subsidy is the Society of Manufacturers of Electric Vehicles which has sought an extension of subsidies for EVs under the FAME II scheme. The association has also requested to include light to heavy commercial vehicles in the scheme to promote electric mobility. The industry body believes that a uniform 5% GST on spare parts for electric vehicles will be better for the industry.

Subsidies and Budget 2023

While the pressure on the government is immense, it will be better off reducing subsidies on various fronts. While tax revenues are buoyant and petroleum taxes are reduced, the expenditure side of the subsidy outlay has ballooned once again. This has been burdensome for the exchequer. The condition on the fiscal deficit front is disheartening and is close to the pre-Covid peak of 6.5% in the financial crisis year of 2009-10. The budget expectations are high for sectors such as defence, education and health care, but bringing down the fiscal deficit while delivering on expectations is the challenge.

The only solution in plain sight is cutting the subsidies and handouts such as free foodgrain. That is likely to lower the deficit to below 6% of GDP. Even then, the fiscal situation remains too precarious, given the elevated level of public debt.

Analysts and policymakers have suggested that the government needs to support additional outlays by fresh revenue, possibly by raising the average GST level simultaneously with a convergence of rates.

The biggest challenge that the government is facing right now is how to fasten the pace of the country’s economic growth rate, given the current economic downturn. Inflation has also been a consistent problem. Boosting growth, while controlling inflation, is the biggest economic challenge for any country. When there is no growth, there wouldn’t be enough consumption, but increased consumption also leads to increase in inflation. It is expected that the government will look into increasing the tax exemption slab from current Rs 2.5 lakh to Rs 5 lakh in order to give fillip to growth. Maybe that will salvage the subsidy conundrum to some extent.

Prachi Gupta is an Assistant Editor with Policy Circle. She is a post graduate in English Literature from Lady Shri Ram College For Women, Delhi University. Prachi started her career as a correspondent with financialexpress.com. She specialises in policy impact studies.