There is an overwhelming sense of optimism in the Economic Survey 2021-22, released a day before Budget 2022, surprisingly at a time when various international agencies have been airing words of caution. Finance minister Nirmala Sitharaman presented the Narendra Modi government’s tenth budget amid three risk factors — the steep rise in crude prices in the international market to $90 per barrel, the imminent risk arising from the reversal of bond purchases by the central banks of advanced economies, and the totally unpredictable trajectory of Covid-19.

The Economic Survey tries to downplay these risks that threaten the economy and Budget 2022 takes off from there. Rather than taking cognizance of these immediate challenges that hold true for most of the world, the Survey has portrayed a rosy picture of the economy, providing a false sense of security by citing the rising stock of foreign exchange reserves, a large increase in GST collection and the ability of the economy to attract capital from everywhere, which pushed the BSE Sensex to an all-time high.

In fact, the sense of optimism which emanates from these is hugely problematic. Forget about economists that are critical of the government; even the mandarins in policy circles from the Bretton Woods institutions, various central banks and the Reserve Bank of India have cautioned against these factors.

READ I Budget 2022: A step in the direction towards $5 trillion economy

India Inc.’s foreign debt exposure

India is not alone in being inundated with capital inflows. Ever since the unprecedented expansion of the central bank balance sheets in early 2020, there has been a flight of capital in search of yield. Emerging market economies like India and China have been able to attract large amounts of external capital. A number of Indian companies have issued unprecedented amounts of international debt securities. Recently, RIL had successfully mobilised $4 billion abroad at very competitive rates. In fact, there has been a large mobilisation of funds through the issuance of green bonds by a number of Indian corporates.

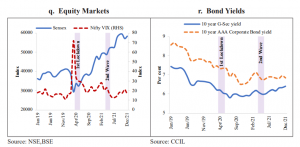

Even edtech start-ups like Byju’s have mobilised funds for making acquisitions abroad. There has been unusual froth in the private equity market with start-ups getting hefty valuations. Inflows from foreign institutional investors coupled with the rise in the number of retail investors in India, evident from the steep increase in the number of demat accounts, have pushed the Sensex to record highs in 2021.

The bull run has been triggered by the abysmally low rates of interest in the global economy. To expect that these days of favourable capital flows would continue unabated irrespective of the decisions made by the Federal Reserve and the ECB would be wishful thinking. It is wishing away the volatile nature of such flows.

The entire emerging market universe, that has transformed itself into a casino for carry traders is awaiting the decisions of advanced country bankers. But compared with the rising tide of global liquidity between 2003 and 2008 that witnessed steep increase in investment ratios within the country, the economy is edging only to the investment ratios witnessed seven years back.

READ I Budget 2022: A missed opportunity to trigger investment growth in agriculture

Budget 2022 optimism and market surge

The soaring market and the rise in other asset prices have resulted in a wealth effect of sorts, pushing consumption by the highest deciles of the Indian population. This has resulted in a steep rise in GST collections. Even when the picture on the employment front continues to be grim, this rise in tax collections has been conveniently misread by the government and its advisors to be real signs of recovery. The mandarins at the finance ministry, who were waiting for an excuse, have been quick to reduce the allocation for MGNREGA to Rs 73,000 crore. Making the government even more excited is the rise in tax collections on account of global crude prices.

It is sad to see how the government looks at the pandemic as if the danger is over. Even as the whole of Europe is reinventing its public health delivery systems through funds mobilised through corona bonds to make them robust enough to withstand any future shock, we are busy trying to revert all action on the health front. The gaps in public health infrastructure became evident in India like never before. Restoring public institutions and enhancing accessibility should be an immediate priority.

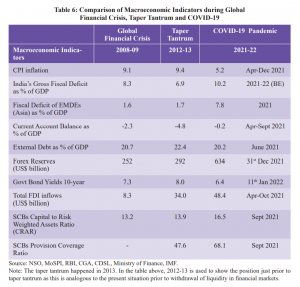

The confidence from the rising stock of foreign exchange reserves which at present is over $600 billion could prove to be misplaced. Since 2000, there has been a deficit on our current account but for three or four years. A large part of the forex reserves is from the inflows on the financial account. Most importantly, the external borrowings which have a residual maturity of less than one year account for 40% of our reserves. Those drawing confidence from the mountain of reserves should know well that the central banks would not dare to run down the reserves even when capital outflows occur, lest a speculative attack against the currency sets in.

We should be prepared for the worst – that is what economic policymaking is all about. In the eventuality of a reversal of the current trajectory of capital flows resulting in a depreciation of the rupee, the exchange risks would push the corporates to another round of deleveraging. This would be too large a cost for the country to bear. It would be appropriate if a stress test is done on the corporate balance sheets to reassure that they have hedged against such risks, else it will be like 2013 all over again.

Krishnakumar S is a New Delhi-based economist. He teaches economics at Sri Venkateswara College, University of Delhi.