Income tax exemption limit change: The market is abuzz with rumours about what Budget 2023 would be like. A lot of expectations ride on the upcoming budget of the Narendra Modi government to be presented by finance minister Nirmala Sitharaman on February 1. It is widely speculated that the government may raise the income tax exemption limit from the current Rs 2.5 lakh.

The year 2022-23 witnessed high tax buoyancy and the revenue targets may be exceeded by a huge margin. Budget 2023 is the last full Budget before the general elections and the stakes are high for the ruling BJP. So, the Budget is likely to be a populist one. However, this is not the sole reason for the expectations of an increase in tax exemption limit.

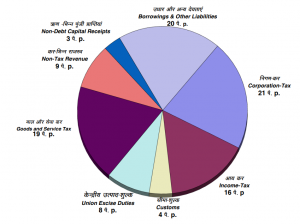

India revenues break-up

As of now, the threshold for income tax exemption is Rs 2.5 lakh. This limit is higher for special categories such as senior citizens. The IT exemption limit for people between ages 60 and 80 is Rs 3 lakh, while the limit for those above 80 years is Rs 5 lakh. Here are a few reasons why the government may consider an increase the tax exemption limit.

Leaving more money with consumers

In the post-pandemic world, the governments and policymakers are walking a tightrope to balance inflation and economic growth. If the government raises the exemption slab, the consumers will have more disposable income in their hands which ultimately means more growth of the economy. Higher disposable income means higher consumer demand which could help the economy to recover and boost investments. It is a win-win situation for the government which is already under pressure to incentivise investment and growth.

Higher inflation

The GDP growth has slowed in recent months due to global headwinds and rising interest rates globally. Costlier food and daily items have been putting pressure on common people. During times like this, the government must support households by exempting tax from those who are not well placed to battle the current conditions. It is expected that the world is likely to go into a period of recession next year.

READ Long winter: Europe’s energy crisis is far from over

A change in tax structure is long overdue. With the increase in the cost of living and inflation, it makes great sense for the government to increase tax exemption limit.

Bringing more people under tax net

Higher exemption limit and more flexibility on the tax front will help the government expand is taxpayer base. More people are likely to pay taxes in a liberal system. As of July 31, 2022, the total number of income tax returns filed for AY 22-23 is about 5.83 crore, according to data released by the income tax department.

Absence of social security

As there is no universal social security benefit available to the citizens regardless the level of their income, middle and high-income earners need to provide for their own security which makes it pertinent for the government to leave lesser earners alone. It may also result in much lower outgo or expenditure for the government. The raising of the exemption limit may also help the government achieve one tax system but also make it simple for the taxpayers to not have to choose from two tax regimes.

The government needs to simplify the tax structure in the upcoming Budget. A rationalisation of tax rates is needed as there cannot be a single rate applicable to every type of income. Several of the measures introduced in the last few years with the stated objective of widening the tax base have only deepened it instead.

This means all the efforts so far has been on extracting maximum from a handful of people, instead of increasing the number of taxpayers. So, more attention and resources are needed to bring more people into the tax net, not to make existing taxpayers pay more.