The Reserve Bank of India has mandated banks and other finance companies to enter into compromise settlements with borrowers classified as wilful defaulters or frauds, in order to ensure maximum recovery from distressed assets. In a circular released on June 8, the RBI stated that these settlements would not prejudice any criminal proceedings against the borrowers. Furthermore, the central bank has directed banks to establish a minimum cooling-off period of at least 12 months before extending new loans to borrowers who have undergone compromise settlements. In simple terms, wilful defaulters or fraudulent companies can be eligible for new loans after 12 months of executing a compromise settlement.

The RBI has also mandated that regulated entities establish board-approved policies for undertaking compromise settlements and technical write-offs. The responsibility for deciding on compromise settlements has been delegated to the board of directors of the lending banks.

READ | India’s strategic role in BRICS — bridging East and West

A compromise settlement refers to a negotiated agreement between the borrower and the regulated entity to fully settle the claims against the borrower in cash. This may involve some loss of the amount owed by the borrower. Technical write-offs involve removing non-performing assets from the banks’ books without waiving the bank’s right to recover the debt. Essentially, the bad loan remains outstanding at the individual borrower’s level.

Who are wilful defaulters

Wilful defaulters are borrowers who refuse to repay loans, regardless of their ability to do so. The RBI’s decision to allow compromise settlements with wilful defaulters and fraudsters can have wide-ranging repercussions and may even result in the loss of more public funds. Many people do not agree with the RBI’s argument and believe that wilful defaulters should face stricter consequences instead of being allowed to settle their debts. This move may also incentivise borrowers to default on their loans, knowing that they can negotiate a settlement later. Consequently, this could undermine credit culture and discipline among borrowers.

Two of India’s largest bank employee unions on Tuesday also urged RBI to review and withdraw this decision to allow compromise settlements for wilful defaulters saying that such a move would hurt the integrity of the banking system.

India is already infamous for borrowers who have absconded with public funds. Gitanjali Gems, owned by fugitive businessman Mehul Choksi, remains the top wilful defaulter with an outstanding debt of Rs 7,848 crore as of March 31, 2022.

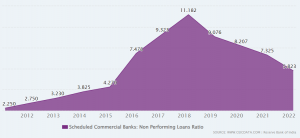

Non-performing assets of scheduled commercial banks (%)

Indian banks face a severe non-performing asset (NPA) problem and sometimes write off bad loans to reduce the number of such assets on their books. In the past decade alone, NPAs have been reduced by Rs 13,22,309 crore through write-offs. Banks use this practice to demonstrate lower NPAs, which are an important indicator of a bank’s financial health. However, this approach is not a definitive solution to the NPA problem, and the practice of evergreening loans is causing significant harm to the banking industry.

Earlier, RBI Governor Shaktikanta Das had cautioned Indian banks against concealing stress and evading governance issues. Without explicitly naming any banks, Das also warned against overly aggressive growth strategies and the use of innovative methods to artificially sustain delinquent loans. The latest mandate from the RBI goes against the grain of the Governor’s advice to banks.

Banks and corporations often misuse restructuring as a means of evergreening problematic accounts to maintain low reported levels of non-performing assets (NPAs). Evergreening loans refers to the practice of extending further loans to the same borrower on the brink of default in order to keep the loan classified as performing. Between 2000 and 2014, corporations were allowed to opt for lenient restructuring methods, resulting in many companies acquiring new loans from banks to sustain their loan portfolios. While the implementation of the bankruptcy code has reduced evergreening, the recovery rate remains dismally low.

Will the new RBI mandate help banks

On the surface, this move appears to expedite the resolution of bad loans by offering an alternative mechanism for lenders to settle loans with wilful defaulters. It is also expected to help banks recover a portion of the outstanding loan amount and remove non-performing assets from their balance sheets. The RBI may also be seeking quicker resolutions, as compromising between the lender and borrower eliminates the need for time-consuming legal proceedings.

For banks, the recovery of debt owed to them is of paramount importance as it safeguards the interests of depositors and other stakeholders. Failure to recover NPAs would ultimately harm depositors and other stakeholders. In this context, compromise settlements may yield positive outcomes if they are executed with the underlying objective of maximising recovery while minimising expenses and time. A note by Union Bank of India emphasises that banks, as public sector entities, should prioritise the interests of tax-paying stakeholders over the interests of borrowers.

However, simply issuing mandates will not suffice, and the central bank must not only ensure efficient implementation of the resolution process but also establish additional safeguards to prevent future exploitation by defaulters.