Indian diplomacy and strategic autonomy: In a fractured world, India cannot afford to be seen merely as another large market waiting to be tapped. The true challenge lies in anchoring itself within the value chains, research networks, and governance structures that will shape future trade, economic resilience, and technological leadership. A wide roster of partnerships alone will not suffice. Without the heft of competitive manufacturing and the depth of institutions that can hold their own globally, India risks remaining on the margins of the very order it seeks to influence.

Indian diplomacy cannot achieve strategic autonomy by spreading attention thin across numerous alignments. Today, breakthroughs flow not just from transactional trade but from co-created ecosystems that demand alignment even amid differences. This is why multiple global blocs have emerged despite the drift of multilateralism. It is only through deliberate depth—and enough trade weight to compel attention—that India can command genuine leverage.

READ I Jio BlackRock’s AI mutual fund raises red flags

What does India offer the world?

Yet we must ask ourselves plainly: what does India truly offer that the wealthy Western economies cannot afford to miss over the coming decades? Despite our frustration with the brute monopolies of Western big tech, the reality is that the world, including India, remains deeply dependent on those technologies and ecosystems. Spreading our diplomatic bandwidth too thin risks leaving us with many conversations but few agreements of lasting substance.

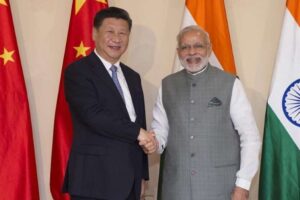

Equally, India must bring mercantilism back into its foreign policy and trade thinking. Without it, we risk becoming little more than a PowerPoint presentation of potential rather than a nation that secures outcomes grounded in what others genuinely value. Even to promote digital public infrastructure or Aadhaar to Western partners, we must view the world through the customer’s lens, not solely through our own narrative. China has done this with notable success by aligning its offers to what others need, rather than only to its own ambition.

Manufacturing as strategic bedrock

Manufacturing depth must stand at the heart of this strategy. Without it, India risks being viewed merely as a consumption economy for foreign investors and brands, rather than as a centre of competitive production and innovation. This weakens our bargaining power and could lock us into dependency, with our population consuming foreign products without developing local capabilities that build real wealth.

No amount of jargon or hashtags can disguise this truth. For a nation that holds one sixth of the world’s population, it is essential to develop manufacturing and trade depth. Anything less would squander India’s demographic advantage and blunt its strategic ambition.

Commercial pull vs strategic respect

We must also recognise that while our scale attracts countries eager to sell to us, this commercial pull should not be mistaken for strategic respect. For instance, the global digital and web giants, largely based in the United States, will inevitably seek minimal regulatory friction in their engagement with India.

Each of these firms has both the intent and the capital to expand into data-driven sectors such as privacy, finance and beyond. India must approach these overtures with clear-eyed realism, ensuring that national interests are safeguarded through balanced regulation which preserves digital sovereignty. This calls for a more assertive and calibrated diplomacy that recognises where commercial interest ends and strategic influence begins.

The idea of looking beyond the United States should remain a means to serve India’s real interests, not an end in itself. The US remains the world’s foremost source of advanced technology, deep capital markets and higher education networks, and also hosts the largest Indian diaspora, whose political influence is too significant to overlook.

India’s own technological ambitions, from semiconductor fabrication to artificial intelligence, are closely tied to American investment and expertise. Moreover, the Indian ITES sector still relies heavily on access to the US market for its bread and butter, if not the jam. The smarter strategy is to complement, rather than dilute, this partnership by engaging other like-minded democracies and regional powers where strategic interests align.

In diplomacy, rhetoric is for commitment

At the same time, we must acknowledge that we cannot yet compete with the singular attention Washington gives to China. India remains a middle power and a low-income economy that aspires to grow hard power over time. While American leaders may speak of deep friendship with India, it should not be misconstrued as a guaranteed commitment.

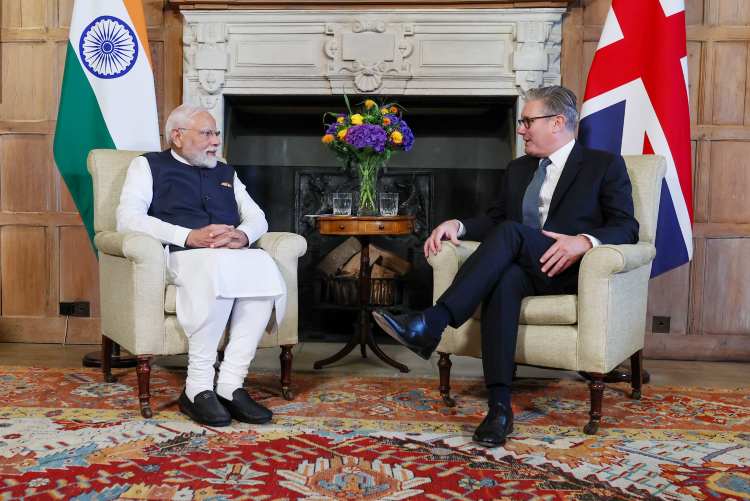

President Trump’s unfounded claim of brokering a ceasefire between India and Pakistan illustrates how swiftly American political calculations can shift and how the region may be viewed through a transactional lens. None of this suggests that India must be deferential, nor should we tie ourselves to a single pole. True strategic autonomy demands clarity in Indian diplomacy—on where we invest capital and where we simply keep dialogue open without overextending.

It also requires the courage to go deeper with partners whose interests align with ours, even if that sometimes means saying no to wider but shallower engagements.

Finally, we must become a learner nation. We should be willing to learn even from those we compete with, collaborate with or contest. This is not weakness but strategic maturity. It prevents us from boxing ourselves into rigid postures that history has shown to be costly. If India can combine such smartness with manufacturing strength and focused partnerships and agile diplomacy, it can aspire not merely to balance other powers but to shape the global order in the decades ahead.

Srinath Sridharan is a strategic counsel with 25 years experience with leading corporates across diverse sectors including automobiles, e-commerce, advertising and financial services. He understands and ideates on intersection of finance, digital, contextual-finance, consumer, mobility, Urban transformation, and ESG. Actively engaged across growth policy conversations and public policy issues.