Banking reforms in India: The year 2020 has been a disastrous one for the Indian economy. The Covid-19 pandemic and the lockdown measures saw Asia’s third largest economy contracting by 23.92% and 7.54%, respectively in the first two quarters of the financial year 2020-21, and the whole year may see a contraction of 7.7%. The Indian economy was already going through a slowdown when the pandemic struck. The Narendra Modi government used the prolonged economic crisis to roll out a number of reforms in the last one-and-a-half years.

Budget 2021 presented by finance minister Nirmala Sitharaman on February 1 also contained a number of reform measures, the most important among them being the much-needed banking reforms .

READ I Indian economy: Focus on fiscal consolidation will hurt fragile recovery

Budget 2021 unveils bold banking reforms

The Union Budget 2021 reiterated the Modi government’s commitment on financial sector reforms. The budget has promised to take up the privatisation of a general insurance company and two PSU banks in the next financial year (2021-22). The finance minister has also proposed the setting up of an asset reconstruction and management company that will take over the non-performing assets of the public sector banks. While the commitment to reforms is evident in it, Budget 2021 did not give the details on how and when the process will be kicked off.

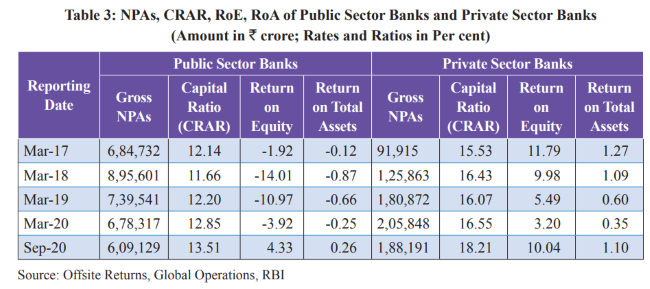

The gross non-performing assets (NPAs) of PSU banks fell from Rs 8.96 lakh crore in March 2018 to Rs 6.09 lakh crore in September 2020. But recovery of bad loans recorded an impressive recovery with 11 out of 12 PSU banks reporting profits in the first half of the current financial year. However, Reserve Bank of India data show that bad loans rose by 365% after Narendra Modi took over as the prime minister. The gross NPAs of India’s commercial banks stood at 7.5% of gross advances in September 2020. The number may rise to 13.5% in September 2021. The proposal to create a ‘bad bank’ will take at least two to three years to fructify.

The PSU banks have been losing ground to aggressive private banks in the last two decades. They are struggling with rising non-performing assets and inadequate capital, making it impossible for them to keep pace with the private banks. The government went into a consolidation drive in 2019, bringing down the number of PSU banks from 27 to 12 through a series of mergers.

READ I RBI monetary policy: Rate cuts unlikely for the rest of 2021

Efficient regulation key to success of reforms

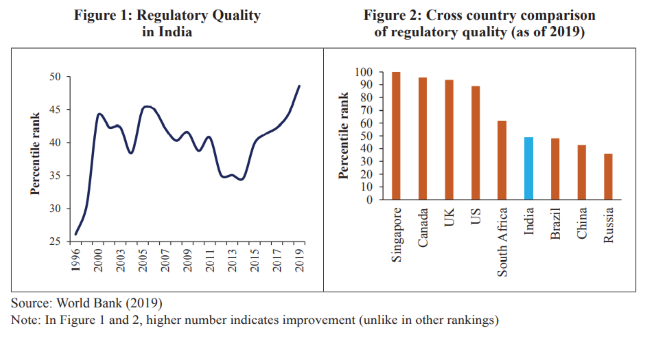

The government needs to rethink the existing regulatory framework that may not be conducive to the bold reforms that the finance minister has proposed. For example, an internal working group of the Reserve Bank of India (RBI) has favoured allowing corporates to run commercial banks with some changes in banking laws to mitigate the risks involved. While the RBI is yet to take a view on this proposal, it cannot skirt the risk factors linked to allowing private corporates to run banks.

Also, privatisation of PSU banks may involve some of them going into the hands of private firms. The regulatory framework should be simple enough for the industry and the regulator to understand, while being stringent enough to deter rogue players who may violate the rules. It should define “interested parties” that may include group companies and promoters’ relatives.

READ I Budget 2021: Several sops for MSMEs, start-ups; but nothing to solve fund crunch

More power to the regulator

It is also very important to strengthen the banking regulator, the Reserve Bank of India, which should be armed with discretionary powers to handle violations. The banking reforms could fail without a powerful regulator. The belief that a mere transfer of ownership of PSU banks will solve all problems troubling the sector could prove to be the undoing of the reforms.

To deal with the increasing complexity of economic offences, India needs a unified investigating agency that will probe all financial crimes. The same criminal activity may involve multiple legal violations, triggering the involvement of multiple agencies such as the income tax department, the state police, the CBI, directorate of revenue intelligence, and enforcement directorate. The lack of coordination between these agencies will result in turf war and inordinate delays.

READ I Budget 2021 scorecard: What is on offer for different sectors of the economy

The efforts of the finance minister to strengthen the public sector banks by recapitalising them is a welcome step, but this move could burden the already stretched finances of the Union government. Another way of doing this is by divesting the government stake to private investors, a plan that could be derailed by aggressive bank employee unions. A better option for strengthening the PSU banks may be boosting their capital base through public offers.

There is no denying that there is a dire need for bold reforms in the banking sector. But the government must be wary of pushing the banking reforms without considering the costs and benefits of these steps. Its tendency to bring in changes in haste without meaningful consultations with all stakeholders could set back the key reforms in banking sector.

Anil Nair is Founder and Editor, Policy Circle.