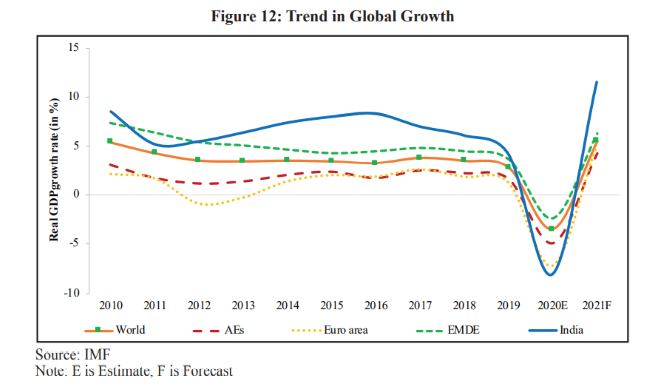

The Indian economy is passing through one of its worst phases since Independence. The first two quarters of the current financial year saw economic growth slipping to -23.92% and -7.54%, as the economy was hammered by the Covid-19 outbreak and the stringent lockdown measures adopted by the government. The government and international forecasters have since revised the dismal projections for the Indian economy. Most of them see a V-shaped recovery in the next financial year.

These projections seem optimistic, influenced by India’s successful management of the pandemic crisis. But they may have overlooked the impact of the massive disruptions in the current financial year. Several key sectors of the Indian economy were affected badly including the 6.5 crore micro small and medium enterprises that contribute 30% of the country’s GDP and employed close to 12 crore people before the pandemic struck.

READ I Technology and business growth: Seven guidelines for small and medium enterprises

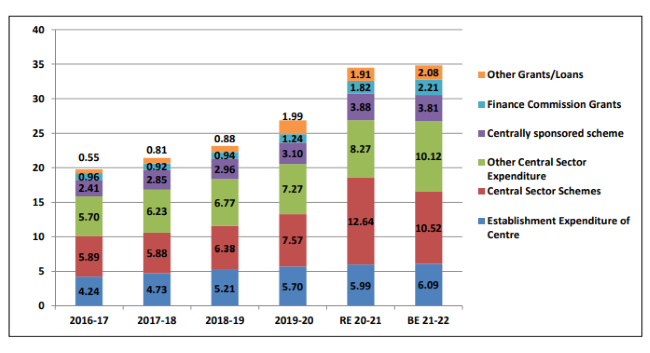

Composition of expenditure (Rs lakh crore)

Growth engines of Indian economy go silent

India had 8.6 crore salaried jobs in the financial year 2019-20. The number crashed to 6.5 crore by August 2020. The impact of the crisis is reflected in the private final consumption expenditure numbers, the most significant contributor to economic growth. The PFCE contracted 9.4% in the current financial year, compared with a growth of 5.6% last year and 7.6% in 2018-19. As there isn’t much investment activity in the private sector that accounted for most of the job losses, the government was expected to spend huge amounts to create employment opportunities and generate demand in the economy.

Has finance minister Nirmala Sitharaman done enough to put the Indian economy back on track? The answer is a resounding No. The Union government’s total expenditure for the current financial year is Rs 4.08 lakh crore higher than the budgeted figure. A major chunk of this was spent on MGNREGA and higher subsidy pay-outs. A sizable part of this (Rs 1.5 lakh crore) will be spent on repaying the outstanding food subsidy loans of the Food Corporation of India, while Rs 62,000 crore will be used to clear fertiliser subsidies.

READ I Lonely at the top: Five hurdles to the rise of Chinese economy to the top

Budget 2021 fails to shun fiscal conservatism

Did the finance minister manage to shun fiscal conservatism in Budget 2021? Again, the answer is no. The Union government’s total expenditure will rise by less than 1% in the next financial year, though there will be a more than 20% increase in capital expenditure. The spending-to-GDP ratio will be 13.5%, according to the 15th Finance Commission, which is lower than the projected nominal GDP growth of 14.5%. This shows the government will cut expenditure and go in for aggressive fiscal consolidation in a crisis year. High government expenditure would have been a positive signal to the Indian economy after a year of contraction.

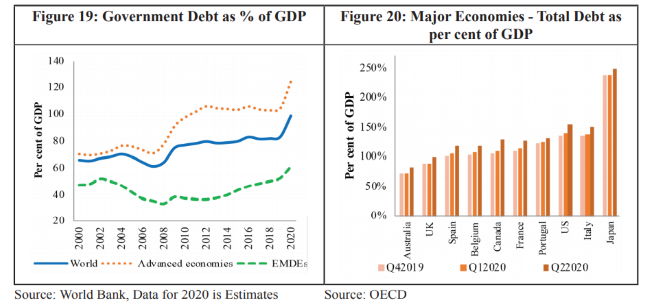

India’s public debt-to-GDP ratio was 72% in 2019, compared with the average 42% in the case of countries with similar sovereign ratings. The figure for the US was 106.90% in 2019, which climbed to 107.60% in 2020. A large part of India’s sovereign debt is owned domestically, which may protect the country from a full-blown sovereign debt crisis. Despite this, Indian economy is vulnerable to the contagion of a global debt crisis, if debt levels remained high.

READ I Housing boom: Mumbai real estate market in for an upswing

Global efforts towards economic revival

Let’s compare the Narendra Modi government’s efforts to revive growth in Indian economy with those by the US and Eurozone governments to get a clearer picture. The US is likely to incur a budget deficit of $2.3 trillion this year, nearly $900 billion less than the deficit last year. However, the figure may rise by another $1.9 trillion when the Congress approves President Joe Biden’s $1.9 trillion relief package. The stimulus packages by the Trump administration had pushed the Federal deficit to 15% of the GDP, the highest level since the end of the World War II, and thrice the deficit in 2019.

The Eurozone governments also stepped up borrowing in response to the coronavirus pandemic and the economic crisis triggered by it. Europe’s response to Covid-19 will mean an additional €1.5 trillion in debt. The massive borrowing has pushed eurozone’s government debt above the combined GDP of the grouping for the first time. The crisis saw many members of the grouping incurring deficits more than 10% of their gross domestic products.

With three of economy’s growth engines — domestic demand, export growth, and private investments – stopping to function, government spending is the only hope for the crisis-ridden Indian economy. This is hardly the time for fiscal conservatism as spending less could derail the fragile economic recovery.

(Anil Nair is a New Delhi-based journalist and commentator. He is Editor, Policy Circle.)

Anil Nair is Founder and Editor, Policy Circle.