Telecom operator Vodafone-Idea had filed a petition in the Delhi High Court seeking the refund of the integrated tax paid on international roaming and long-distance services. This tax is among a long list of taxes that is choking the growth of telecom operators. The Delhi HC has issued a notice to the ministry of finance on VI’s plea.

Telecom companies in India have been facing a significant tax burden — licence fees, spectrum usage charges, and various other taxes and levies. The industry says these taxes are unjustified and have been affecting their profitability and growth. In addition, they claim that the government’s move to levy a higher goods and services tax (GST) on telecom services compared with other sectors has also impacted their revenues.

READ | Women’s Day 2023: Gender parity still a distant dream

Further, the regulatory environment in India’s telecom sector has been criticised for being complex, inconsistent, and unpredictable, leading to a lack of clarity and transparency for the industry. The frequent policy changes, delays in spectrum auctions, and lack of a level playing field have impacted the sector’s growth and competitiveness.

The telecom success story

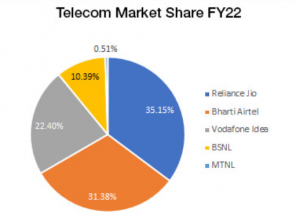

Telecom industry has been a major success stories of the post-liberalisation India. The industry has consolidated in the last two decades with Reliance Jio and Bharti Airtel dominating the sector. The once powerful, Vodafone Idea and state-run BSNL have been reduced to bit players in the market. While the consumers benefited from the industry expansion, the industry has been facing headwinds because of high debt, low profitability, and inability to make adequate capital investment.

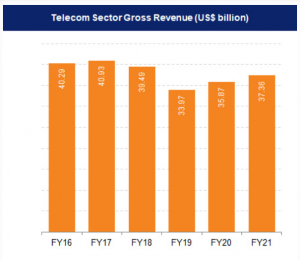

A report by brokerage firm Jefferies recently published a report highlighting the problems of the telecom sector and its future prospects. It says the inability to raise tariffs is hurting telecom companies as the revenue growth has stagnated, affecting the potential. It says the domination of Reliance and Airtel is hurting smaller rivals.

The report recognises the increase in the profit margins of the top three players, but says high sales, marketing, and interest costs could put pressure on margins. While there is some excitement on the 5G front, the brokerage has raised doubts about Vodafone Idea’s ability to compete with Jio and Airtel because of its high debt levels.

Did India sabotage its telecom industry?

In 2019, a Supreme Court judgement wreaked havoc on telecom companies. It ordered Bharti Airtel and other legacy telecom companies, including Vodafone Idea, to pay billions of dollars to the government. This came at the end of a long dispute between the sector and the government on how to calculate the government’s share of revenue as part of the fee for handing over telecom spectrum.

While the companies argued that only their revenue from the use of spectrum should count, the government insisted that a share of every other revenue such as rent must be counted. The Supreme Court ordered the companies to pay the government not just the dues but a hefty penalty with interest. The total amount the companies owed at that time touched $13 billion. Vodafone Idea owed $4 billion of that, and Bharti Airtel around $3 billion.

The telecom woes

Right after the debut of Mukesh Ambani-owned Reliance Jio in the sector, the Indian telecom industry has become highly competitive with multiple players vying for market share, leading to pricing pressure and declining margins. The entry of Reliance Jio in 2016 disrupted the market with aggressive pricing and freebies, leading to the consolidation of industry and exit of some players.

The telecom companies have been struggling with high levels of debt due to intense competition, regulatory issues, and expensive spectrum auctions. The mounting debt has affected their ability to invest in infrastructure and upgrade networks, impacting the quality of service and customer experience. The lack of investments in the telecom sector has led to a slow rollout of advanced technologies such as 5G, impacting the sector’s growth potential. The high debt levels and regulatory issues have made it difficult for telecom companies to raise funds and invest in the future.

While some of these issues may have been self-inflicted, the industry players have been urging the government to address the structural and policy-related challenges to ensure a sustainable and vibrant telecom sector in India.

Other side of the story

While the telecom companies have been claiming that they are taxed unfairly, it is important to note that taxes are an essential source of revenue for governments to fund public services and infrastructure. The government argues that the taxes levied on the telecom sector are necessary to fund investments in telecommunications infrastructure and to ensure that telecom services are available to all citizens, especially in rural and remote areas.

The Indian telecom industry is one of the strongest in the world and the number of internet subscribers in the country is expected to double to 829 million and overall IP traffic is expected to grow four-fold at a CAGR of 30%. What this sector needs is further investment for growth. The government must also look at lowering the license fee of 8% of the Adjusted Gross Revenue (AGR) including 5% as Universal Service Levy (USL) which is one of the highest in the world.

The telecom industry has also at times maintained that some of the operators participated recklessly in spectrum auctions leading to exaggerated prices. Reducing spectrum auction rates can help in further investment in this sector.

As said earlier, the entry of Reliance Jio in the telecom sector created pricing wars and stifled competition. Reliance had deep-pockets and hence sustained low-data prices. TRAI should fix a minimum price to save the industry from the price war and to create healthy competition between service providers. Industry says the regulatory biases are making foreign investors hesitant to participate in the sector. Sooner this mess is cleared, the better.