By Naliniprava Tripathy and Nandita Mishra

Integrated Reporting is seen as the future of corporate reporting. Several Indian organisations such as the Tata group, JSW Steel, HDFC Bank, Mahindra & Mahindra, Bharti Infratel have already adopted it. However, India still lags behind countries like Japan, Brazil, and South Africa, and needs a major push towards this new system of reporting. Integrated reporting offers a number of benefits to stakeholders — both internal and external.

The International Integrated Reporting Council (IIRC) is a global alliance of companies, regulators, investors, standard setters, academicians and accounting professionals, committed to improving corporate reporting. Integrated reporting espouses a unified approach to corporate reporting to inform how a business creates value over time. Therefore, it encompasses equally financial and non-financial information. Integrated reporting informs about capital allocation, increases accountability, supports integrated thinking, and helps in value creation.

READ I Different strokes: Decoupling government policy on air pollution and climate change

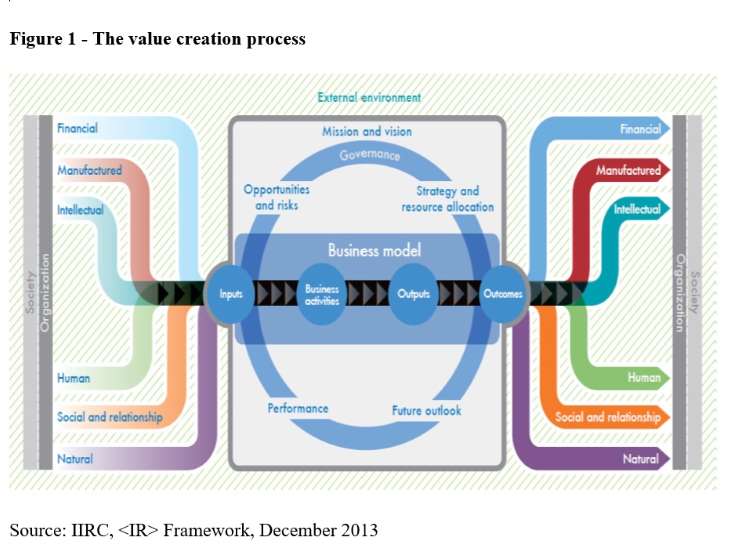

With the vision to align capital allocation with the corporate behaviour to achieve broader goals of financial stability and sustainable growth of companies for value creation, the framework validates the connection between a firm’s strategy and hidden social, human, and natural capital underpinning it. The value creation system through company’s business model is shown in fig-1. IR helps organisations make sustainable decisions. It encourages business houses to ponder holistically about their strategy, make cognizant decisions and manage risks and opportunities to create stakeholder self-reliance and improve future performance. The IR framework delivers principle-based guidelines for companies to adopt integrated reporting.

The most important advantage of integrated reporting is the understanding of the relationship between financial and non-financial performance. Further, IR enforces the companies to improve their information systems quality as well as in-house controls and monitoring systems. Integrated reporting also precludes minor reputational risk; condense the gap between the company and external parties by providing holistically and transparently the performance, position, philosophy, vision, and mission of an organisation in both financial and sustainability terms. It also provides a platform for discussion, engagement, and relationship with all stakeholders. Since it needs to produce an integrated report, it promotes better employee engagement through internal coordination and collaboration.

READ I Anticipating Chinese retaliation for India’s FDI restrictions

One of the critical challenges to the success of integrated reporting is its adoption and implementation. The support of the board of directors and the CEO is extremely important for the adoption of integrated reporting. Another challenge of integrated reporting implementation is understanding material issues that need to be reported. The IR framework is now adopted by more than 2,000 organisations over 70 markets. In India, the adoption of integrated reporting has increased after the SEBI circular in 2017.

In the current scenario of pandemic and financial stress, the need for integrated reporting is more pronounced than ever. For better adoption and penetration, the IIRC is asking stakeholders to share their feedback to ensure that IR framework responds to the evolving market. The consultation draft is a result of more than 300 responses, which IIRC received and published in March 2020. Integrated reporting consists of many vital principles such as a multi-capital approach, a business model for creating value, connectivity of information, concise reporting, integrated thinking, and creating value for all stakeholders. In a world that is under threat from global pandemic and climate change, all these principles are crucial.

READ I On a wing and a prayer: India’s travel and tourism industry looking for a bailout

IIRC plans to release its revised IR framework as it completes 10 years this December. Now the revision is in its second phase of consultations with over 20 virtual focus group meetings being held all over the world. Out of this 20, two will be hosted in India on July 16, 2020, and August 4, 2020. Since IR will enhance global reputation for companies and the whole country, India needs to encourage its companies to adopt the revised framework.

(Dr Naliniprava Tripathy is Professor, Finance and Accounting, IIM, Shillong. Dr. Nandita Mishra is Associate Professor, Finance & Accounting, Amity University, New Delhi)

Naliniprava Tripathy is an Indian economist based in Shillong. She teaches finance at IIM Shillong.