India is finding itself in a fix over gold smuggling. The world’s second largest importer of the yellow metal has found a strange corelation between gold imports and smuggling — whenever there is a surge in imports, smuggling also increases. The illegal import or export of gold causes heavy losses to the exchequer.

The government in July had raised import duty on gold from 7.5% to 12.5% to check rising imports. With an additional 3% GST, the consumers pay 18.45% tax on refined gold. Gold refineries pay 17.78% tax on gold doré, a semi-pure alloy of gold and silver, compared with 13.39% tax previously. Gold smuggling could increase by 33% to touch 160 tonnes in 2022 from the pre-Covid period because of higher tariffs. India’s gold imports had fallen 23% in July-September period from the same period a year ago following the tariff hike, according to World Gold Council data.

The official reports on smuggling and the actual amount of smuggled gold may differ, making data hazy. In the last financial year, India confiscated a total 833 kg of smuggled gold which was worth around Rs 500 crore, according to the Directorate of Revenue Intelligence’s Smuggling in India Report 2021-22. However, the year before that witnessed a decline in gold smuggling as flights to the Gulf region remained cancelled amid the Covid-19 pandemic.

READ | RBI raises repo rate by 35 bps, may have another hike before pressing pause button

Most of the smuggled gold come from the UAE which accounts for more than 25% of the global gold trade. Gold trade accounts for more than 29% of the UAE’s total non-oil exports. Between 20% and 40% of the global gold stocks pass through Dubai every year. In the five years leading up to August 2020, more than 11 tonnes of gold worth Rs 3,122.8 crore was seized in 16,555 smuggling cases at airports across the nation, according to a government response in the Parliament in September 2020.

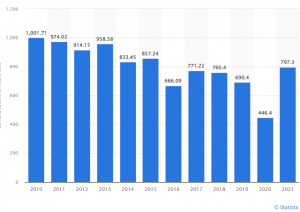

Annual demand of gold in India (tonne)

India is the second largest importer of the yellow metal after Switzerland. The country imported gold worth $55.8 billion (14.1%) in 2021. The United Kingdom, China and Hong Kong complete the list of top five importers which account for about 70% of the total imports. Asian countries imported gold worth $191.6 billion in 2021, accounting for 48.6% of the total imports.

Reasons behind gold smuggling

As discussed earlier, high tariff on gold imports is the primary reason. India is totally dependent on foreign countries to meet its huge gold demand as it produces only a negligible amount of the precious metal. India imports about 900 tonnes of gold a year, while the consumption stood at 797.3 tonnes in 2021. This is the highest in the last five years, according to World Gold Council data. India’s reliance on gold imports leads to an increase in trade and current accounts deficits of the country.

The higher import tax is creating problems in the domestic industry which resorts to illegal trade. Other than the elevated import duty on gold, stringent conditions for purchases from overseas have also prompted smugglers to find innovative ways to beat the customs officials. A part of the rising illegal imports can be attributed to a GST exemption under which jewellers can buy old gold worth less than Rs 2 lakhs without paying any tax. This has helped in increase of illicit imports as jewellers procure it as old gold purchase.

Then there is the price difference in gold rates compared with other countries. For example, the gold rate in Dubai usually is lower than India making it highly lucrative for smugglers. This means importing gold and selling it in India generates a significant profit, even after duties.

How to check gold smuggling

The industry associations say that a cut in import duty can curb gold smuggling. The finance ministry has been approached to consider reducing the tariff to about 10%. However, this may not be acceptable for the government which would like to keep imports low to contain the widening deficits. However, smuggling is no less a problem for the government as it leads to heavy revenue losses.

Gold is considered a safe haven asset by Indian families as it is a highly liquid store for money. Most of the household savings are still parked in gold, maybe because of tradition or maybe because tangible gold has more appeal than money in the banks. If the government looks to curb gold smuggling, it needs to first popularise other methods of investments to keep the demand low. Other than this, a comprehensive and effective tracking system, curbing illegal imports through stronger and better intelligence gathering etc may help in resolving the smuggling menace.

India’s porous borders with Nepal, Bangladesh, Bhutan and Myanmar are also a golden ticket to smugglers. In 2019, the Directorate of Revenue Intelligence (DRI) was quoted as saying that gold smuggling had surged from China, Taiwan and Hong Kong as well. The government may look into fixing this problem in an attempt to curb smuggling.