After completing five years of operation, many small finance banks are aiming high, and have sought the Reserve Bank of India’s approval to become universal banks. Executives from various SFBs recently met RBI officials, seeking a structured pathway to transition into full-service banks and requesting permission to shed the ‘small finance’ tag. This change would broaden their customer base, enhance branding, and strengthen customer connections, particularly to attract more current and savings accounts, as the ‘small’ label deters customers.

Introduced in India in 2015, the first batch of 10 small finance banks received operational licences, with most commencing operations in 2016-17. These banks were established primarily to offer loans to small businesses, farmers, and underserved sectors, thereby advancing financial inclusion. They are required to allocate at least 75% of their loans to amounts under Rs 25 lakh. As of June 2023, twelve SFBs were operating across the country with 6,589 domestic branches. Following the merger of AU Small Finance Bank and Fincare, the number stands at 11. Initially, many SFBs began as microfinance institutions (MFIs).

READ | PLI scheme to power India’s solar manufacturing ambitions

Financial inclusion and regulatory considerations

While SFBs seek to expand their offerings, it is crucial to consider the potential impact on financial inclusion, a key objective behind their creation. The RBI might impose conditions to ensure small finance banks continue serving underserved sectors even after transitioning to universal banks. This could involve maintaining a minimum lending target for priority sectors or geographical areas.

SFBs are eager to transition into full-service banks to avoid the obligation of directing 75% of their advances to priority sectors, compared with the 40% requirement for universal banks. Some believe their current scale justifies more lenient regulations. As niche banks, small finance banks must maintain a net worth of at least Rs 200 crore, lower than that required of scheduled commercial banks.

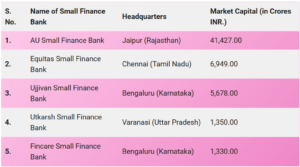

Largest small finance banks in India

The RBI is contemplating the conversion proposal and is receptive to the idea, although it underscores the need for stringent governance and compliance standards. Despite some fluctuation in 2022-23, the consolidated balance sheet of small finance banks expanded more rapidly than that of SCBs, reflecting positive progress over eight years.

SFBs face significant challenges in scaling their operations and adhering to regulatory standards. Despite their rapid growth, these banks must survive complex regulatory requirements,

including maintaining a high quality of assets and managing liquidity risks. The transition from a small finance to a universal bank requires meticulous planning and execution to ensure compliance with broader regulatory mandates, a challenge that has prompted many small finance banks to seek RBI’s guidance.

The digital transformation in the banking sector poses both challenges and opportunities for SFBs. While technology can streamline operations and enhance customer experience, the cost of implementing digital solutions can be high for smaller banks. SFBs must balance the need for digital upgrades with their financial capabilities, ensuring they can compete with larger banks in a technology driven market without compromising their financial health.

In the fiscal year 2022-23, small finance banks experienced financial growth, with a notable increase in interest earnings from loans, outweighing the interest paid on deposits. The bad loan ratio, which spiked in 2020-21 due to COVID-19, has been declining, allowing SFBs to lower their provisions for bad loans.

Research indicates that SFBs in India face challenges such as high transformation costs, managing non-performing assets, adhering to prudential norms, adapting to technological changes, maintaining profitability, and competing within the banking sector. Profitability remains crucial for their success. SFBs, especially those aiming for rapid growth, struggle to secure retail deposits, a challenge more pronounced in this sector.

Another challenge for small finance banks is accumulating CASA deposits, with most having a CASA ratio between 20-25%. According to a CareRatings report from January, SFBs trail the overall banking sector in CASA deposit ratios, relying more on costly fixed deposits for funding, which could affect long-term profitability. SFBs account for merely 1.1% of the total banking industry’s deposits.

Competitive advantages of SFBs

SFBs recognise that dropping the small finance label could enhance success. Customer perception plays a significant role; the current label confuses customers, leading them to equate small finance banks with microfinance institutions. A name change could clarify their status and potentially boost deposits. A few banks, like Saraswat Co-operative Bank and Kerala State Co-operative Bank, now use Saraswat Bank and Kerala Bank respectively, while most SFBs have removed the small finance label from their websites.

Despite challenges, small finance banks possess unique strengths. Their nimbleness and focus on specific customer segments can enable them to tailor products and services more effectively. Additionally, their understanding of underserved markets can be an advantage in attracting new customers.

The RBI’s regulatory sandbox initiative allows entities to test innovative financial products and services in a controlled environment. This can be particularly beneficial for SFBs seeking to leverage technology and develop new offerings without compromising regulatory compliance.