The RBI has issued guidelines for digital lending platforms following several complaints over high interest rates, aggressive recovery practices, fraud and data privacy breaches. The new guidelines will mandate RBI-regulated entities and lending service providers to disclose the all-inclusive cost of digital loans and will bar them from raising credit limits without borrower’s consent.

The new rules stipulate the RBI-regulated entities to ensure that loan servicing and repayments are done directly in the borrower’s bank account without third party pass-throughs and pool accounts. The disbursements also need to be done directly into the account of the borrower. Any fee or charge payable to lenders must be paid directly by the regulated entity.

The lenders should also declare a cooling-off period when the borrowers can repay the principal and charges without any penalty. All loan service providers engaged by the regulated entities must have a nodal grievance redressal officer to deal with complaints.

READ I Co-operative sector: Kerala should revamp its scam-tainted credit societies

RBI norms skirts fake app menace

The need to regulate digital lending was felt when complaints came up in 2020 against Chinese apps that harassed borrowers to suicide. RBI cancelled the licences of several entities involved in such practices and suggested a legislation to ban unregulated lending activity. The norms announced by the RBI do not tackle fake loan apps as they are for regulated entities. Even if norms are brought in for lending scamsters, they may fail as it is virtually impossible to track such entities.

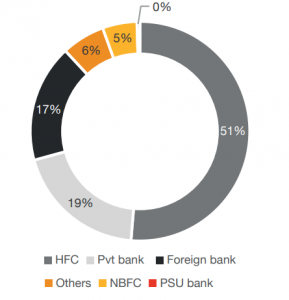

India’s home loan market

RBI has set up a working group last year on digital lending by online platforms and mobile apps. The guidelines are in line with the principle that lending can be carried out only by those entities regulated by the central bank or licenced to do so.

Digital lending norms empower customers

The guidelines will protect the interests of the borrowers by ensuring that the lending is done through a legitimate process. They will help borrowers make informed choices while borrowing money. The cooling off period and the appointment of a nodal grievance redressal officer will offer comfort to borrowers and improve the digital lending ecosystem in the country.

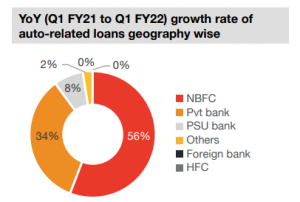

Business and personal loans market

The borrower will be empowered by the option to accept or deny consent for the use of data. He/she will be allowed to revoke already granted consent and will have the option to delete the data collected by the lenders.

The Working Group on digital lending submitted its report which was made public through the RBI website. Using the inputs from stakeholders, a regulatory framework has been created to ensure orderly growth of credit delivery by digital lending platforms. The working group has suggested several legislative and institutional interventions to curb illegitimate lending activity.

The RBI classified digital lenders into three categories — entities regulated by the RBI / permitted to carry out lending business; entities authorised to carry out lending as per other statutory provisions; entities lending outside the purview of regulatory provisions.

Anil Nair is Founder and Editor, Policy Circle.