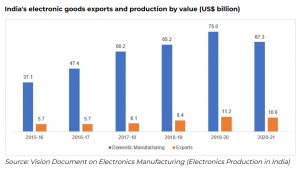

PLI for electronics industry: Exports in high growth sectors such as electronics are picking up, benefiting from government initiatives such as production-linked incentive scheme. Recent trade data show that exports of electronics and electrical machinery stood at an estimated $27.4 billion in FY2023. This marks an export growth of 36% in FY23, compared with the figures for the last financial year. Mobile phones alone accounted for $7.2 billion in exports.

Global Trade Research Initiative’s latest report on India’s foreign trade says that India was able to register a boom in smartphone export bears testimony to the success of the PLI scheme. The Economic Survey 2022-23 has also emphasised on the role played by PLI scheme in boosting exports. During the first 8 months of FY2020, India’s electronic exports stood at around Rs 60,000 crore. The Economic Survey says the government initiatives after the Covid-19 pandemic disrupted the economy and boosted India’s fortunes on the exports front. The government must now look to emulate PLI success in smartphones to other electronics segments as well, says the GTRI report.

READ | Monetary policy coordination among central banks desirable during crises

Smartphone exports from India topped the $2 billion mark in the first two months of 2023, indicating the growth of the local industrial ecosystem. The world’s largest mobile phone manufacturers such as Apple and Samsung have expanded in India via contract manufacturers. These two companies together account for nearly 90% of Indian smartphone exports since April 2022.

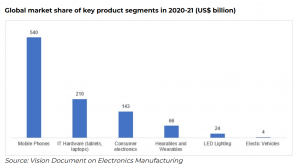

Global market share of key product segments in 2020-21 ($ billion)

According to India Cellular and Electronics Association, Indian-origin devices are sold in the UK, Netherlands, Austria, and Italy besides the middle eastern and South American markets. Every one in four smartphones made in India is exported out of the total mobile device production in India in FY 2023.

India’s electronic goods exports and production by value ($ billion)

PLI and India’s electronic industry

The PLI scheme looks to attract large investments into mobile phone manufacturing and specified electronic components, including assembly, testing, marking and packaging (ATMP) units. Under it, 4% to 6% incentive is provided on incremental sales of goods manufactured in India. These incentives are offered for a period of 5 years subsequent to the base year (FY 2019-20). The applicant companies are expected to meet minimum thresholds of investment and production and meet the eligibility criteria to receive incentives under the scheme which has an outlay of about $5.5 billion.

The recent surge in export-oriented production followed PLI schemes. Even Apple’s contract manufacturers and Samsung have applied for PLI scheme benefits. The success of the first round of the PLI Scheme, which attracted investments in mobile phone and electronic components manufacturing, also led to the second round of the PLI Scheme for large-scale electronics manufacturing. The same was launched on March 11, 2021, targeting electronic components. Sixteen companies have been approved under the second round.

Developing a domestic electronics manufacturing ecosystem has been on the government’s agenda since the last decade. The country is endowed with a vast labour market and a thriving IT services sector which India has been able to leverage in the last few years. India has now become the second largest mobile phone manufacturer globally. According to the recent Economic Survey, participation in the PLI scheme will also help domestic players to attain economies of scale in production through localising. This in turn will translate into better export competitiveness and increased participation in the global value chain.

India’s efforts to attract greater foreign investment also align with the idea that the country must reduce the reliance on China for production and sourcing. The Indian market has also been helped by the growing US-China tensions and trends towards decoupling in the technology sector. Due to this, many companies look to diversify their China manufacturing footprint or spread out their supply chains across multiple locations.

The success of India’s smartphone exports has boosted the confidence of the government which believes that India is on its way to become global leader in the mobile devices segment and smartphone exports will also play a major role in India’s electronic exports.

The government has set a target of $10 billion worth of mobile phone exports from the country. It also eyes $300 billion worth of electronics manufacturing by 2025-26, with $120 billion expected to come from exports. Mobile phones are anticipated to contribute more than $50 billion worth of exports by 2025-26. According to ICEA, mobile phone exports now account for 46% of the overall electronic goods exports.