As the world stares at the prospect of a recession, the need for monetary policy coordination among central banks is a hotly debated topic. It has been proven that monetary policy coordination among nations helps reduce volatility in financial markets, improve global economic stability, increase the efficiency of global financial markets, and reduce the cost of international transactions.

Nations, however, show reluctance to cede control over their monetary policy, especially in times of crises. Policy think tank EGROW Foundation brought together some of the foremost experts on monetary policy to discuss the pros and cons of monetary policy coordination among central banks.

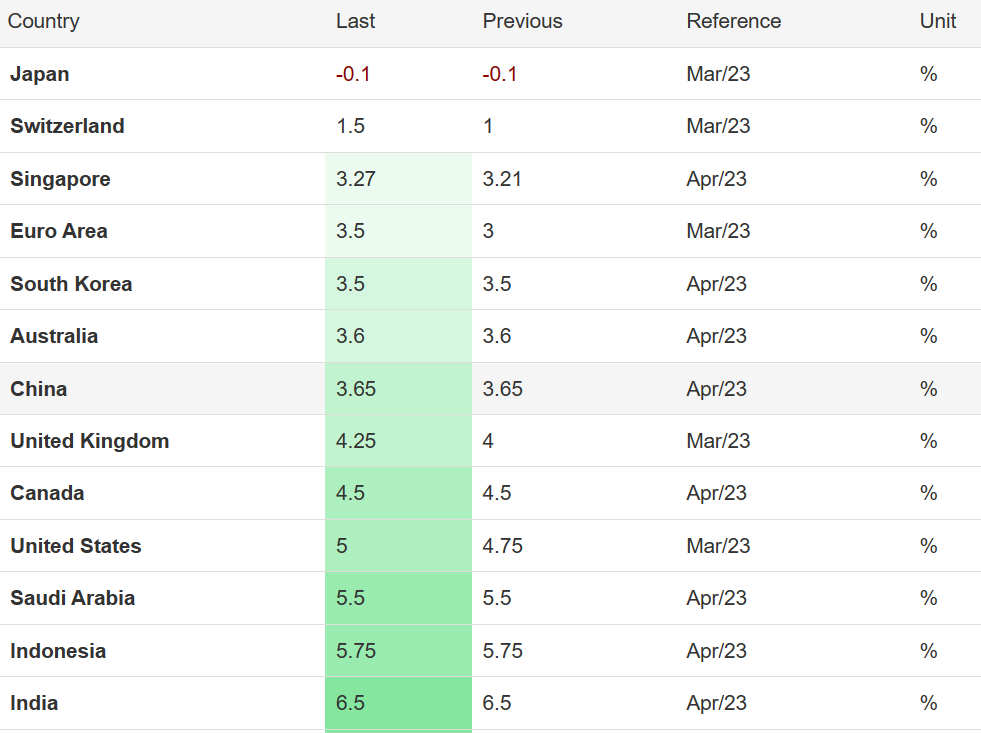

Policy interest rates in major economies

READ I Ghosts of the past continue to haunt world economy

Is monetary policy coordination desirable?

Benjamin M. Friedman: William Joseph Maier Professor of Political Economy, Harvard University

The implications of central banks’ current battle against inflation need to be revisited. In the past two decades, the primary concern of the central banks of developed economies was low inflation. Their primary challenge right now is high inflation. The flat Phillips curve suggests that the current inflation has origins outside of the standard aggregate demand story.

Consequently, the attempts to control inflation by raising interest rates and reducing aggregate demand may not be effective if the Phillips curve is flat. As a result, the slope of the Phillips curve is expected to become a primary focus of macroeconomic research for central banks and individuals interested in monetary policy.

There is a need to examine various aspects of inflation expectations in economic research. Certain studies express doubt about previous studies that suggest a flattening of the slope. Laurence Ball (2014) examined the effectiveness of surveys on inflation expectations in anticipating inflation which suggest that there is a lack of evidence to support the notion that central bank commitments are crucial in anchoring inflation expectations. This emphasises the need for more research in this field.

There are two major points. First, not all inflation can be categorised in the same manner. Thus, it is important to recognise different causes of inflation. While aggregate supply has always been relevant in economics, it was only in the 1970s that the notion of supply shocks was introduced into macroeconomics after the oil crisis triggered by OPEC. Today there exists a similar phase where supply-side factors have a significant influence on inflation, and monetary policy needs to consider demand and supply-side forces equally.

Second, there is a need for a more detailed approach to addressing inflation. In the United States, the inflation conversation is mostly focused on aggregate demand, while in Europe, there is more emphasis on supply-side shocks such as natural gas prices. A nuanced approach to inflation is necessary, and central banks need to pay close attention to the various causes of inflation, especially the challenges posed by supply-side shocks.

Two major aspects remain important here. First, a comparison between the economic ramifications of the COVID-19 pandemic and those of a war. There could be a rise in the need for specific goods and services during the pandemic, similar to the rise in demand for weapons during wartime. This is a potential area for exploration. Second, there are doubts regarding forward guidance in monetary policy, contending that it can limit policy choices and potentially result in errors.

The Federal Reserve’s tightening policy resulted in a mistake. In the current scenario, Fed’s inflation averaging objective is no longer viable, and that a 2% target is insufficient. The central banks might leverage the current scenario to raise the inflation target to a higher level.

Jeffrey A. Frankel: James W. Harpel Professor of Capital Formation and Growth, Kennedy School, Harvard University

Inflation targeting and global monetary coordination are only necessary when there are spillover effects — where one country’s actions have an impact on others. For example, the taper tantrum of May 2013 where Fed Chairman Ben Bernanke’s remarks on tapering quantitative easing resulted in a reversal of capital flows from emerging market countries.

This situation prompted appeals for international monetary coordination, with Governor Raghuram Rajan of the RBI expressing worries about the failure of international monetary cooperation. Moreover, the Brisbane Action Plan urged greater collaboration to enhance the global economy and generate employment opportunities.

The concept of coordination can be designed in a Game Theory model which refers to a collaborative effort among participating countries to establish policies that mutually benefit all players. The concept can be applied to recent macroeconomic events, specifically focusing on three games: the exporting unemployment game, the currency war game, and the competitive appreciation game.

The exporting unemployment game requires coordinated fiscal expansion to address deficiencies in global demand, caused by each country holding back on stimulus in an effort to improve their trade balance. There is a need for coordination to pull the world out of recession with the United States, Germany, and Japan serving as leaders in this effort.

There are potential advantages and disadvantages of implementing fiscal and monetary policies for encouraging global economic growth and collaboration. Two potential scenarios, the exporting unemployment game and the locomotive game. In the former, nations adopt independent policies that result in economic recession, whereas in the latter, nations agree to coordinated fiscal expansion that leads to increased output, employment, and trade surplus.

Cooperative monetary expansion could foster global economic growth, it affects trade differently than fiscal policy. For example, the US monetary expansion could stimulate other economies by increasing imports, but it could also lead to a depreciating dollar that impedes foreign producers from competing with US producers.

The concept of competitive depreciation which is also known as currency war shows how countries have levelled accusations against one another for unfairly undervaluing their currency in order to gain an advantage in trade. Examples abound such as the US accusing China of undervaluing the yuan, and Brazil accusing the US, Japan, and the European Central Bank (ECB) of excessively quantitative easing to devalue their currency.

This kind of game can have detrimental consequences for all parties involved and puts forth fixed exchange rates as a potential solution. Japan’s pursuit of expansionary monetary policy to depreciate the yen as part of their economic policy known as Abenomics.

Three concepts related to monetary policies and their effect on the global economy need to be studied. The first concept, known as “currency wars,” occurs when countries implement expansionary monetary policies to stimulate their economies by devaluing their currencies and improving their trade balances. However, this approach can result in a non-cooperative equilibrium where no country achieves the desired outcome, but instead there is an overall expansionary monetary policy worldwide.

The second concept revolves around cooperation and coordination among countries to achieve a more favourable equilibrium, where all countries agree to abstain from engaging in currency warfare. An example provided is the G7 countries’ agreement in 2014 or 2015 to avoid intervening to devalue their currencies which has been profitable thus far.

The third concept is the “competitive appreciation game,” which is the opposite of the competitive depreciation game. Currently, the focus has shifted towards combating inflation, and higher interest rates in the United States make US assets more appealing, resulting in an influx of capital in the form of dollars, which in turn leads to the exportation of inflation to other countries. This phenomenon, known as “reverse currency wars,” occurs when the US exports inflation instead of devaluing its currency, resulting in higher commodity prices in other countries.

Overall, the speech underscores the interconnectedness of global monetary policies and their repercussions on inflation, trade balances, and commodity prices. It emphasises the significance of cooperation among countries to attain desirable outcomes.

There are effects of unilateral increases in interest rates by countries aiming to appreciate their currency and reduce inflation. This approach can result in excessively high global interest rates, which can have negative repercussions on emerging market economies with significant dollar-denominated debt. Cooperation among countries could be advantageous.

Developing countries, including India, are more susceptible to supply shocks such as natural disasters or productivity shocks. As an alternative, the nominal GDP targeting may be a better approach for countries like India, as it is not vulnerable to supply shocks.

Laurence M. Ball: Professor, John Hopkins University

Inflation targeting benefits central banks by having a specific numerical target for inflation and implementing policies aimed at keeping inflation close to that target. Thus, policymakers should establish an acceptable range for inflation and strive to maintain it around the midpoint of that range.

The significance of policy committees within central banks to reach a consensus on a common inflation target and publicly announce the target fosters clear expectations about inflation and promotes transparency in a democratic system. Thus, inflation targeting over undisclosed inflation targeting is always preferred. The significance of publicly announcing an inflation target for central banks e.g., the US and India can yield substantial benefits in terms of reducing confusion and enhancing the effectiveness of monetary policy.

Solely focusing on the inflation target is not sufficient for optimal monetary policy. Economic welfare is also influenced by output and unemployment, and therefore, policy should strive to stabilise the real economy in addition to managing inflation. Strict versions of inflation targeting that solely prioritising inflation may not be optimal for mitigating short-term fluctuations in output and employment, as this approach could result in long-term harm to the real economy.

Relying solely on a mandate to achieve an inflation target is thus deemed risky, as it may neglect the importance of stabilising the real economy and give rise to hysteresis which refers to prolonged periods of sluggish output and high unemployment stemming from an excessive focus on inflation that can cause lasting damage to the economy.

The European Central Bank has a single mandate for price stability. It has had negative effects, underlies the need for a broader approach to monetary policy that takes into consideration both inflation and the real economy for greater effectiveness.

ECB’s past approach of mandating maintaining 2% inflation despite high unemployment in the Euro area was a matter of concern and such narrow focus on inflation without considering the broader economy can be risky. Thus, flexibility in inflation targeting is required to allow policymakers to consider other objectives such as employment and output, in addition to inflation.

The RBI can be commended for its policy regime is based on a sound framework for flexible inflation targeting. The RBI’s official policy is to prioritise price stability as the primary objective, but also explicitly mentions growth. The RBI has a target of 4% inflation with a wide range around it, allowing for flexibility in managing inflation with greater consideration for output and employment.

A 4% inflation target is preferable than the commonly adopted 2% target in advanced economies as it avoids the problem of the zero bound and interest rates. It is still low enough to not have adverse effects of higher inflation on growth.

Incorporation of inflation targeting in the monetary policy of India is a sensible and rational approach, but not a guaranteed solution for automatic prosperity. There are differing opinions on the effectiveness of inflation targeting, but it has tangible benefits such as stabilising inflation expectations. India has been fortunate to experience inflation within the target range of two to six percent since implementing inflation targeting.

It is noted that there are operational details to be considered, such as choosing which inflation rate to target, whether it should be the headline inflation rate or a measure of core inflation etc. Generally, if core inflation is targeted, it allows for policy to account for temporary shocks and helps in anchoring inflation expectations.

Further, it is recommended to use the weighted median inflation rate as a measure of core inflation, as opposed to the traditional measure of excluding food and energy prices. Thus, inflation targeting remains a sound policy, but there is a need to carefully consider operational details and trade-offs during implementation.