The Reserve Bank of India bulletin dated August 18 makes an interesting reading. A paper published in the bulletin says a big bang approach to privatisation of public sector banks will do more harm than good. It goes on to explain the important role played by the PSU banks in the Indian economy.

The paper lists a number of reasons why the public sector banks are important to the country — they have a key role in improving financial inclusion and have a better credit system. It says the public sector banks are more efficient than private banks on several counts. The paper says India’s private sector banks have failed the customers in the rural and semi-urban areas where people are dependent on public sector banks for banking services.

The paper clearly goes against the grain of the current thinking in the government that favours privatisation of all public sector units, irrespective of the sector they are in. This thinking was evident in a recent policy paper authored by former Niti Aayog vice-chairman Arvind Panagariya and PMEAC member Poonam Gupta which called for the privatisation of all public sector banks except State Bank of India.

READ I PSU bank privatisation: Will the government bite the bullet?

Govt plans to privatise 2 banks

The global trend towards privatisation is clearly visible in the banking industry, says the paper authored by Snehal S. Herwadkar, Sonali Goel and Rishuka Bansal of the RBI’s banking research wing. The average equity stake of the governments in public sector banks of developing countries fell to 17% in 2008 from 40% in 1995. The global financial crisis saw a reversal of this trend when the government stakes rose by 10% in countries such as the United Kingdom, Iceland, Kazakhstan, and Venezuela, the paper says.

The paper identifies the influence of the idea of privatisation over the economic thinking in India. The Union Budget 2021-22 declared the intent of the government to privatise two public sector banks. The paper cites the policy paper by Panagariya and Gupta which says that the PSU banks “have underserved the economy and their stakeholders”.

The RBI article cites studies by some renowned economists to justify the role played by public sector banks. It says state-owned enterprises are created to address market failures, and their social benefits exceed the social costs in many cases. The state-owned banks contribute to macroeconomic stability in developing economies. There are some studies highlight the role of PSU banks in catalysing investments in low-carbon industries, supporting the green transition in several countries.

The RBI paper provides empirical evidence on the role of public sector banks in enhancing welfare compared with their private sector counterparts. It says private banks’ lending is more pro-cyclical in comparison with their PSU counterparts.

READ I Indian banks remain male bastions despite gender inclusion policies by govt, RBI

PSU banks and financial inclusion

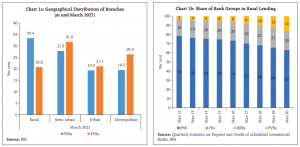

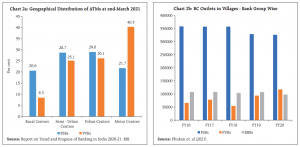

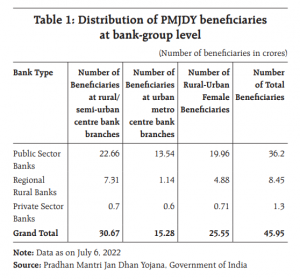

Public sector banks operate more rural branches than private banks, contributing to financial inclusion. They meet the lion’s share of credit demand in rural areas. Private banks have been timid in their attempt to make inroads into India’s villages, mainly because of profitability considerations. PSU banks have more than double the number of ATMs in rural India. They also account for more than 60% business correspondent outlets in villages. Also, more than three fourth zero balance accounts under Pradhan Mantri Jan Dhan Yojana are with public sector banks.

Public sector banks meet their priority sector lending target organically, while most private banks meet their targets by investing in priority sector lending certificates (PSLCs), especially in the cases of lending to agriculture and small and marginal farmers. Private sector players prefer to pay a premium to meet their lending targets than to develop expertise in such niche lending.

The main argument cited by supporters of privatisation is that PSU banks are inefficient and tend to underperform on key indicators. The paper uses various inputs to verify this claim. It says, in terms of profit maximisation, the private banks score over their PSU counterparts. But when the objective of financial inclusion comes into play — total branches, agricultural advances and priority lending.

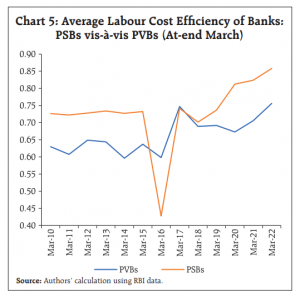

Gupta and Panagariya argue that the staff in public sector banks are inefficient. The paper employs cost minimisation DEA framework to evaluate this claim. Data on deposits, loans and advances, investments, non-interest income, total staff and fixed assets were studied and it was found that the labour cost efficiency of PSU banks was higher than that of private banks.

Public sector banks have shown better efficiency in monetary policy transmission, helping monetary policy actions gain traction. Their reduction in lending rates was much higher than that of private banks during the last easing cycle. Their deposit rates also were relatively stickier in comparison with those of private banks.

Anil Nair is Founder and Editor, Policy Circle.