Gender inclusion in India’s banks: The last two decades saw Indian women scaling new heights in almost every sphere of professional life including defence and space research. However, banking continued to remain the exclusive domain of men. Success of women in banking ends at manager level. Despite all the rhetoric about gender balance, top jobs in Indian banking sector remained elusive for women.

Things were promising a few years ago – largest bank in India, SBI, and the largest private sector bank, ICICI Bank, were headed by Arundhati Bhattacharya and Chanda Kochhar. Besides these two, the likes of Shikha Sharma (Axis Bank), Kalpana Morparia (JP Morgan), Ranjana Kumar (NABARD), Usha Thorat (RBI) and Usha Anathasubramanian (PNB) were dominating the banking space, prompting many to think that gender inclusion is here to stay and male domination was finally coming to an end.

READ I Women’s empowerment key to India’s transformation

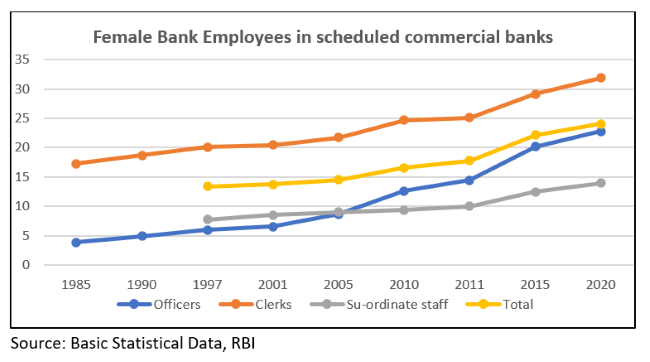

These women executives at the helm of important banks triggered expectations that they will inspire and empower more women to reach the top offices of Indian banks. Instead, when some of these women leaders left the office, the top banking jobs once again went to men. A spate of mergers in the banking sector further shrunk the space for women CEOs. However, the number of women in banking sector workforce is on the rise, both in the clerical and the officer cadre, since the year 2000. After 2005, the share saw another spurt, improving the gender inclusion in banks. This transformation is missing in both board rooms and corner offices. Many women bank leaders of the recent past belong to the few women officer recruits in the 1980s.

A study by Giovanni Cardillo and others has empirically proved that European banks with gender diverse boards are less likely to receive a public bailout than those with less gender diverse boards. The study also links gender diversity to profitability and lower non-performing assets (NPAs). The Khandelwal committee report has highlighted the need to have gender diversity and inclusion on bank boards and in executive positions. However, the Indian banking sector is way below the global standards of diversity, gender inclusion and parity. This needs conscious efforts and deliberations especially in the backdrop of the crisis faced by Indian banking industry.

READ I Empowerment of women: Achieving Sustainable Development Goal 5

Gender inclusion in Indian banks

An IMF study on gender parity in the financial sector argues that women are under-represented at all levels of global financial system — from depositors and borrowers to employees to bank board members and regulators. Many scholars have empirically proved that gender parity in bank management promotes financial inclusion in the economy and improves service quality. Studies also found that gender parity in bank management, especially at decision making roles, must improve to provide greater stability and efficiency in the banking system.

Countries across the globe have used financial inclusion as a strategy for women empowerment, poverty alleviation, micro-enterprise development and above all human development. The connection between female financial inclusion and socio-economic development is well recorded. Increased access to financial services to women indicates their increased interaction with the banking sector. Presence of more women at bank branches and counters improve the comfort level of female customers. The Indian banking sector is refusing to accept this reality.

This is the case also with the microfinance sector that mostly caters to women. The segment has only 12% women employees and 11% field staff. This indicates that those organisations with core inception goal is women empowerment don’t recognise the need to bring gender parity in its operations. The only exception is the SEWA Bank. The banks do not consider women eligible for top jobs at a time when a woman leads the Union finance ministry.

READ I Breaking the glass ceiling: Personal account of an Indian civil servant

Bank nationalisation in 1969 was instrumental in inclusion of women in banking business. Till 1990s, only around 10% of the bank employees were women, mainly representing clerical cadre. Only 5% of managers were women then. In the Indian scheduled commercial banks, their share in the clerical grade rose up to a fourth in 2015 and to nearly a third in 2020. The figure was 20.2% and 22.8% in 2015 and 2020 respectively in the case of managerial cadre. Rise in the number of professionally qualified women, especially graduates from management institutes, was instrumental in this shift. Many leading women bankers are also from this background.

Even though these numbers seem impressive, a global comparison shows that to reach the global standards of gender parity, Indian banks have a distance to cover. According to the Catalyst, a research organisation that focuses on women leadership, female employees constitute near 50% of the total workforce in banking sector in many countries.

READ I Cutting food waste key to achieving zero hunger by 2030

From branches to board – gender inclusion goes for a toss

While the number of women bank managers and clerical staff is on the rise since 2010, very few women made it to the level of senior managers, top executives and board members. Indian banking leadership is yet to understand the need for gender inclusion at the top level. The Khandelwal committee that studied the human resource issues with public sector banks in 2010 reported that female representation was only 2.7% in the executive cadre — 4.4% of general managers and just two executive directors. Appointment of Arundhati Bhattacharya as the SBI chairman and managing director followed the appointment of more women at the top of public sector banks.

A brief analysis of the annual reports (2019-20) of the Indian scheduled commercial banks shows that public sector banks had only one woman CMD (Corporation Bank) and just 15% women board members. Except for three banks, the rest had only one woman on the board. Indian private sector banks also show the same pattern — just 14% board members of 21 banks were women. If nominees of the government/ RBI are not counted, the private sector banks also have only one woman board member. Here too, Indian banks are far behind global gender inclusion standards, shows the Catalyst data.

Inclusion of one woman on the board is done to meet the legal requirements. Section 149 of the Companies Act, 2013 makes it mandatory to appoint at least one woman director in certain types of companies including banks.

The list of senior managers — vice presidents and senior managers – in both the public and private sector banks tells a similar story. Women constitute only 7% of the total senior management. Evidently, during the recruitment of executive jobs, a male candidate is preferred over women.

READ I Seven policy initiatives to revive Indian MSMEs, boost GDP growth

Missing women: Influence of social order, patriarchy

Poor representation of women in top banking jobs reveals the socio-cultural prejudices and the patriarchal mindset of selection committees dominated by men. It is a proven fact that talented, efficient and hardworking women fail to make it to the top jobs. Organic upward mobility of women in banks in the present scenario is a distant dream. Even if Indian banking sector achieves gender parity at the clerical, subordinate and even at managerial levels, their elevation into top jobs and the board room rarely happens.

Various gender inclusive policies implemented in the recent past including six months maternity leave and two years of child caring leave often affect the entry as well as the upward mobility of women in banking jobs. Besides, considering the rise in the share of women employees in the total workforce also emphasises the need to have women leaders in banks.

The government and the regulator should take steps to ensure the upward mobility of talented women and gender inclusion. Young women bank managers must receive equal treatment in terms of opportunities at the top of banking hierarchy.

(Dr Resmi P Bhaskaran is a Manipal-based economist. Views are personal)

Resmi Bhaskaran is a development economist based in Manipal, Karnataka.