The telecom sector lies at the heart of the ongoing digital revolution in India. Recognising its pivotal role in shaping the future, the government is championing the industry. Minister of State for Electronics and IT, Rajeev Chandrasekhar, emphasised that substantial investments have been directed towards nurturing the telecom sector and enhancing its market capitalisation, all in the context of its vital contribution to expanding the dimensions of the digital economy.

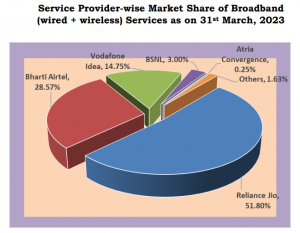

Despite the government’s efforts to make the telecom landscape attractive for investors and to ensure robust competition, indications are emerging that the Indian telecom industry might evolve into a duopoly. Jefferies, a renowned American multinational independent investment bank, has projected that the sector could transition into a duopoly sooner than anticipated. Recent data from the Telecom Regulatory Authority of India (TRAI) highlights the ascent of Reliance Jio and Bharti Airtel in terms of wireless subscribers, while Vodafone Idea faces a decline.

READ | Sustainability: Need a blueprint for gauging corporate commitment

Reliance Jio has a net subscriber base of 44 crore, and Bharti Airtel has 37 crore subscribers. Meanwhile, other contenders like BSNL and Vodafone-Idea find themselves sidelined due to capital constraints that hinder investments in forward-looking technologies such as 5G.

Ever since Mukesh Ambani’s Reliance Jio entered the arena, a fierce competitive landscape has taken root, with other telecom entities grappling with significant challenges. Vodafone-Idea, in particular, has continued to experience a worrisome loss of subscribers. Jefferies says that Jio’s recent Jio Bharat launch could accelerate Vodafone-Idea’s subscriber losses, effectively ushering in the duopoly scenario sooner than anticipated.

The sector’s woes have been exacerbated by favourable policies for specific operators and the concentration of crucial spectrum allocations with one operator. An earlier Supreme Court ruling, demanding significant payments from legacy telecom firms like Bharti Airtel and Vodafone Idea, further deepened the industry’s predicament, compounded by Reliance’s entry.

Amidst these challenges, the telecommunications sector in India has weathered significant turbulence, witnessed the entry and exit of numerous players. Capital outflows and the departure of foreign investors have been noticeable trends. Many international telecom brands that once invested in India were forced to exit due to factors such as corruption and crony capitalism, as pointed out by Chandrasekhar. Yet, the government’s focus has now shifted towards bolstering technology infrastructure across the nation and reshaping key legislations in the technology and telecom sectors to drive growth. With over 700 districts already under 5G coverage, the country is in the midst of a comprehensive 5G deployment.

In an optimistic vein, the government envisions that the ongoing investments in the sector will eventually give rise to more players in the market. As the landscape of telecommunication-related technologies undergoes transformative shifts in the coming years, new opportunities are poised to emerge for other contenders, Chandrasekhar noted.

With around 83 crore internet users, India’s telecom industry stands among the global leaders, and projections indicate that the number of internet subscribers could exceed 120 crore by 2025-26. Driven by initiatives like PLI (Production-Linked Incentive) to curtail reliance on imported equipment, the sector is experiencing a more promising era. The government’s assertion that virtually all telecom gear is now manufactured in India, and the surge in Indian smartphone exports following the introduction of PLI, underscore the positive impact of these measures.

In realising its potential to significantly benefit stakeholders, the telecom sector warrants strategic investments and incentives. However, this support must be broad-based, aiming to create a level playing field for all participants, rather than favouring a single player. A progressive step in this direction could involve reducing the license fee of 8% of the Adjusted Gross Revenue (AGR), which includes 5% for the Universal Service Levy (USL), which currently ranks among the highest globally. Furthermore, concerted efforts are needed to bolster state-run players like BSNL to foster a robust competitive environment within the segment.

Industry leaders are urging the government to address structural and policy-related challenges to rejuvenate the telecom sector. It’s a timely call for the government to build on its past achievements and ensure that telecom flourishes as a profitable venture for all stakeholders.