India’s services exports have contributed greatly to its economic success, but a recent deceleration has raised concerns. The financial year ended March 2024 witnessed a modest 4.9% increase in services exports to $341.1 billion, a three-year low, after two years of double-digit growth. However, net services exports surged by 13.6% reaching $162.8 billion, buoyed by a double-digit contraction in services imports.

The trend can be attributed the slower growth to a base effect and subdued demand in developed economies. This trend is expected to persist into FY25 due to stable but uninspiring growth in major markets like the US and Europe, constrained further by high interest rates curbing consumer demand.

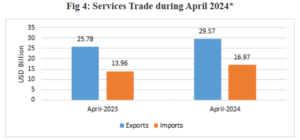

India’s services exports declined by 1.3% in March to $30 billion, while imports fell by 2.1% to $16.61 billion, according to a report by the Reserve Bank of India. The trade surplus during March 2024 was $13.4 billion. Both exports and imports of services were in the positive zone in the preceding two months.

READ I Gold rush: Can the yellow metal sustain its sheen

India’s services export surplus

The slowdown in services exports growth in FY24 was counterbalanced by a decline in services imports, particularly in transport services, software services, and professional services. One can expect continued strength in services surplus, supported by the rise of global capability centres (GCCs). However, challenges loom, especially concerning software services exports, which may face headwinds due to weaker growth in developed markets.

India’s services export market is evolving. While software exports traditionally dominated, other business services, including those by GCCs, have gained momentum, accounting for a significant share of total services exports. This diversification is crucial for resilience in the face of market fluctuations.

Despite persistent global challenges, overall exports (merchandise and services) are estimated to reach $776.68 billion in 2023-24 compared with $776.40 billion in 2022-23. India’s services export receipts rose from $95.8 billion in the post-crisis year of 2009-10 to $341.1 billion in 2023-24. Despite India’s significant 20% share in global IT exports, its share in other crucial services sectors is limited.

India’s services export story extends beyond traditional sectors like IT services. The country has made significant strides in diversifying its services portfolio, including sectors such as healthcare, education, finance, and legal services. This diversification not only reduces dependence on specific sectors but also opens up new avenues for growth and innovation.

A Goldman Sachs report projects India’s services exports to reach $800 billion by 2030, representing 11% of the country’s GDP. This ambitious target, however, requires addressing critical issues. The report warns against complacency, highlighting challenges such as talent shortages and resource stress in key hubs like Bengaluru. The need for a skilled workforce and sustainable resource management cannot be overstated if India aims to maintain its growth trajectory.

The sustained growth of services exports hinges on robust policy support and infrastructure development. Initiatives such as the National Digital Health Mission, reforms in the education sector, and investments in digital infrastructure are pivotal in enhancing the competitiveness of India’s services sector.

According to commerce ministry data, the services export during fiscal 2023-24 is estimated at $339.62 billion and imports at $177.56 billion. The trade surplus or difference between exports and imports works out to be $162 billion during the year. Interest in India’s almost unique success as a services exporter in global markets persists.

India’s services export growth, outpacing the global average, showcases its potential as a global services powerhouse. However, challenges, both domestic and global, demand proactive strategies. Enhancing skill development, fostering innovation, and diversifying export destinations are essential steps. Moreover, navigating geopolitical tensions and rising protectionism requires diplomatic finesse to safeguard export prospects.

Collaboration with global partners and access to international markets are crucial for expanding India’s services exports. Bilateral and multilateral agreements, coupled with initiatives to ease trade barriers, can enhance market access for Indian service providers.

India’s services exports face challenges amid global economic uncertainties. Strategic investments in human capital, infrastructure, and regulatory frameworks are imperative to sustain growth and solidify India’s position as a services export leader in the coming decade. As India targets robust services export growth, it must prioritise sustainable development and climate resilience. Investments in green technologies, renewable energy, and eco-friendly infrastructure not only align with global sustainability goals but also enhance India’s competitiveness in the international market.