Electronics is so much a part of our daily lives that it is difficult to think of a world without it, thanks to the great efforts in R&D and innovation. The spread of the Covid-19 pandemic has further accelerated the digital transformation of global economy as the world tried to shift from office to home. This trend has pushed demand for electronic devices such as laptops and mobile phones. The lifting of lockdowns and reopening of markets led to a rebound in demand for consumer electronics. As per a survey conducted by Japan Electronics and IT industries Association, the global electronics manufacturing sector which was at around $2.97 trillion in 2020 is expected to reach $3.17 trillion in 2021 and $7.3 trillion in 2025.

Over the years, electronics manufacturing has seen a geographical shift in production bases from the US and Europe to Asia. This trend saw Asia’s share in global production increasing to over 60%. However, South Asian countries including India could not derive much benefit from the global shift of electronics manufacturing. In 2020, India only represented 3.6% of the world’s electronics manufacturing accounting for less than 3% of India’s GDP. The countries in East Asia that started from insignificant positions have established themselves as new global players in electronics manufacturing. For example, the contribution of the sector in the GDP of Taiwan, South Korea, and China are 15.5%, 15.1%, and 12.7%, respectively.

READ I Targeted incentives can boost manufacturing sector, revive MSMEs

Govt support for electronics manufacturing sector

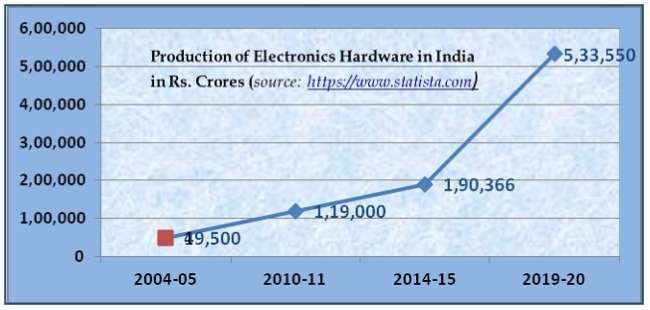

The National Policy on Electronics (NPE 2019), launched by the Narendra Modi government, targets $400 billion turnover by 2025. The three new schemes under NPE 2019 — the Scheme for Promotion of Manufacturing of Electronic Components and Semiconductors, the Production Linked Scheme (PLI), and Modified Electronics Manufacturing Clusters (EMC 2.0) Scheme — have enabled Indian electronics sector to increase the country’s share in global electronics manufacturing from 1.3% in 2012 to 3.6% in 2020. The value of locally produced electronic goods in the country rose from Rs 1,90,366 crore in 2014-15 to an estimated Rs 5,46,550 crore in 2019-20, a growth of 187% in five years.

The corresponding statistics for electronics products imported into India during the year 2014-15 and 2019-20 were Rs 2,25,444 crore and Rs 3,71,840 crore respectively (source: https://www.statista.com), a growth of 65%. Thus, the value of locally made electronics products in the five years exceeded the value of electronics items imported. The recent surge in electronics manufacturing sector can be attributed to rising demand for consumer electronics products including mobile phones. The domestic demand for electronics products is being met almost equally by local production and imports.

The story of made in India phones

Even though mobile phones being made in India are largely being assembled with imported components, it is a success story considering that only a few years ago, most of the phones sold in India were imported as completely built-up units (CBU). A series of government initiatives like reduction in the import duty on components of mobiles, increase of import duty on fully assembled phones, and rationalisation of excise duty led to fast growth of local assembly units from 2 in 2014 to 268 in 2019.

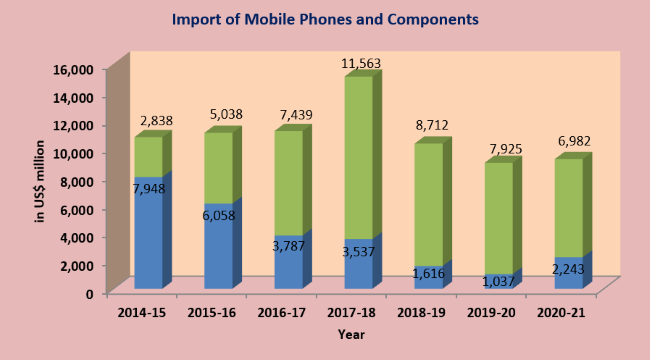

The above graphs demonstrate:

(i) The value of CBU mobile phones imported into India had fallen from around $8 billion in 2014-15 to $1 billion in 2019-20, though it rose slightly in 2020-21 to $2.2 billion, possibly due to disruptions in local manufacturing.

(ii) While the value of mobile phones imported has fallen considerably since 2014-15, the total foreign exchange outgo on import of mobile phones and components has remained almost static during the past seven years. The import of components witnessed a sharp increase from $2.8 billion in 2014-15 to $7.9 billion in 2019-20.

(iii) The business of mobile phone assembly which is among the Make-in-India success stories has not achieved much in terms of localisation of components.

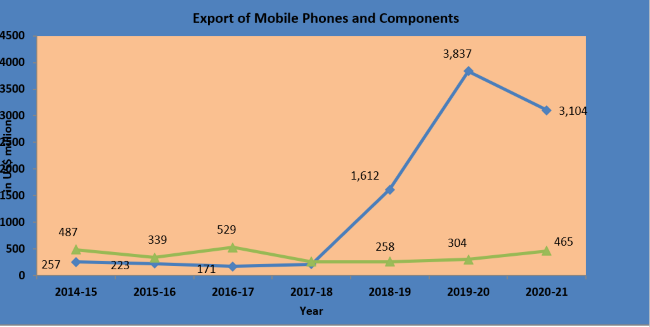

(iv) India has emerged as an exporter of mobile phones and the value of mobile exports increased substantially from $257 million in 2014-15 to $3,104 million in 2020-21. India became a net exporter with the export of mobile phones worth $3,837 million against the import of $1,037 million of CBU mobile sets in 2019-20.

(v) The export of mobile phone components has also been initiated, though in smaller volumes. The value of such exports has remained almost stagnant at around $500 million, corroborating the limited progress in the indigenisation of components.

Currently, the assembly process is at the stage of switching from semi knocked-down (SKD) to completely knocked-down (CKD) kits, resulting in value addition in the range of 15-20%. Important components such as printed circuit board (PCB) assembly, display, housing, battery, cameras, and charger contributing to almost 90% of the total mobile phone cost are being imported. Generally, achieving a value addition of 50% plus is considered good enough in mobile phones, yet, a country churning out the second-largest number of mobile phones and having the advantage of the world’s second-largest market is expected to go beyond the localisation level attained by smaller economies such as Vietnam or Thailand.

The annual domestic demand of 150 million mobile phones presents a model scenario for India to promote the manufacturing ecosystem for electronics products, somewhat similar to the growth of the automobile ancillary industry in the 80s and 90s as a result of the phenomenal growth of Maruti Suzuki. Through suitable policy interventions, the government can ensure that the advantage of a large market is not offset by higher costs of doing business compared to some South Asian countries.

READ I India’s mobile manufacturing sector charts a success story

Replicating mobile manufacturing success

Though the growth of mobile phone manufacturing in India could only be described as a partial success story due to low-value addition, it presents a good example to strategise the development of electronics manufacturing in India, and replicate across the electronics sector, to reduce the import bill, generate jobs, and attract investments. Keeping in view the absence of a large domestic market for many of the electronics products, due diligence on the selection of electronics parts /components for setting up local units is important.

In the case of mobile phones, India relied on import substitution with most of the local assembly units catering to the thriving domestic market. However, for other electronics components, Indian producers need to compete in the export market for growth which may pose tough challenges in terms of technology gap, cost and quality competitiveness for MSME (Micro, Small, and Medium Enterprises) companies. Thus, the policy to develop India’s electronics manufacturing sector needs to have an export-oriented and technology push at its core.

The Production Linked Scheme (PLI) is a good initiative, and a lot depends on its success. Under the scheme, several big global companies such as Apple, Samsung, and Vivo, in addition to contract manufacturers like Foxconn and Wistron, have shown interest in creating their manufacturing base in India. This has raised the hope of India getting integrated with their established global supply networks.

India could do well to learn lessons from the success achieved by Vietnam in electronics sector manufacturing and success in the export markets. A country with a GDP (at constant prices) of $260 billion has an export turnover of $250 billion in 2019, out of which $51.2 billion came exclusively from exports of mobile phones and components. Many relevant parameters show similarities between the two countries. Both nations have favourable demographics and offer the most competitive wages. While India has more than 50% of its population below the age of 25 and more than 65% below the age of 35, about half the population of Vietnam is below the age of 35.

India and Vietnam have closer rankings in the World Bank’s Ease of Doing Business index at 63 and 70 respectively. Both countries are having political stability and have emphasised good governance. However, Vietnam has moved ahead due to the faster pace of internal reforms, infrastructure creation, and human skills development. Further, Vietnam has improved its business environment for foreign companies at the ground level, making it easier for them to access finance. This has translated into foreign investment in areas of national priority such as the industrial sector, creating more direct jobs as well as in the allied activities which is reflected in the share of the industrial sector in GDP at 34% compared with 26% in India.

While Vietnam’s FDI inflows in 2019 amounted to only $16.1 billion, substantially lower than India’s receipt of $74.3 billion in 2019-20, their target to attract investors to set up factories in the country have resulted in the processing and manufacturing sector accounting for 47.7% of total investment capital in 2019 (Source: UNCTAD’s 2020 World Investment Report). Samsung has so far invested about $17 billion in Vietnam, making it the country’s largest overseas investor. In the light of global corporations showing signs of wariness with China, intense competition to capitalise on the opportunity has begun among emerging economies. In the race for capturing reallocation of manufacturing activities out of China, at the moment, Vietnam, Thailand, and Malaysia look to be ahead in the race.

READ I Why ease of doing business rankings are important

Fostering business-friendly investment climate

India’s large market is a big attraction for investors and the FDI policy is quite liberal. However, foreign investors often talk about lack of stability in policy environment which is not helpful in attracting investors in capital-intensive areas such as manufacturing. Another reason for the dissatisfaction among foreign investors is a delay in procedures, compliance measures, and various clearances to be obtained in spite of a quantum jump in India’s ease of doing business ranking. These hassles add up to considerable business costs. Last, but equally important is the assurance of National Treatment to all projects irrespective of ownership whether foreign or resident, except in strategic areas.

In simple terms, a foreign-owned entity in India should not feel discriminated by imposition of additional requirements for doing business over and above those applicable to domestic units. India has seen impressive growth in FDI inflows over the years with annual FDI reaching $81 billion in 2020-21. However, non-manufacturing sectors like services, software, construction, telecom, and trading received around 47% of the cumulative inflows till March 2021. The electronics sector is listed at rank 28 in the sector-wise ranking of cumulative FDI inflows into India. This demonstrates modest interest shown so far by foreign investors in India’s electronics manufacturing activities.

Future of electronics manufacturing

The focus has to be on local development and manufacturing of components, beginning with the less critical parts that could be supplied by the existing vendors. For critical electronics components/sub-assembly like PCB, steps need to be taken to get it designed locally and then move to the assembly of PCB. Any semiconductor-based sub-assembly may be taken up at the final phase as it would require semiconductor foundry and strong electronics components supplier ecosystem which India lacks currently.

Once the components supplier base for mobile phones is established, it would encourage and accelerate the manufacturing activities of other electronics products and devices used in industrial or defence products. This is an opportunity for all stakeholders including the government to join together for creating infrastructure, logistics, and manufacturing services to make India an electronics manufacturing hub and to upgrade mobile manufacturing from a low value addition assembly to a high value addition activity. The following strategies may be helpful in moving faster on indigenisation:

(i) A robust phased manufacturing programme (PMP) with specific yearly targets to localise components of battery, chargers, cables, headphones, with a high possibility for indigenisation is to be adhered to and monitored.

(ii) Import duty needs to be raised on those sub-assemblies based on a timeline to push the manufacturers to get the components developed locally.

(iii) Incentives may be offered to attract foreign sub-assembly/components manufacturers to set up greenfield manufacturing facilities, and such incentives may be linked with adherence to localisation plan as proposed in the agreed PMP.

(iv) The biggest stumbling block which an Indian component manufacturer faces in integrating with the global supply chain is the cost disadvantage. The government has a bigger role in controlling the cost influenced by external factors in terms of tax sops, subsidies, and a well-structured logistics framework.

(v) To make the local producers more cost-competitive, a review for rationalisation of import duties on raw materials not available in the country needs to be taken up.

(vi) Concerted efforts may be aimed at promoting exports from India. A larger export market will help in upscaling the volume of production and raise the quality consciousness among the domestic units.

Only a robust domestic capability in electronics manufacturing can halt a ballooning import bill for electronics products that seems all set to surpass the import value of petroleum, and putting pressure on foreign exchange reserves. However, the need for the development of the electronics manufacturing sector in India goes beyond the need to curb soaring trade deficit, generate jobs, raise incomes, or sustaining high GDP growth rates.

The electronics manufacturing sector has high strategic importance as end uses go beyond consumer products to communication, defence, aerospace, cyber security products, and data storage equipment. Accordingly, achieving self-reliance in the sector should be a national priority. The dependence on China which is the source of around 40% of all electronics imports is a matter of concern for India due to obvious geopolitical reasons.

(Krishna Kumar Sinha is an industrial policy and FDI expert based in New Delhi. His last assignment was as an industrial adviser in the department of industrial policy and promotion, DIPP, currently known as DPIIT, under the ministry of commerce and industry of the government of India.)

Krishna Kumar Sinha is an industrial policy and FDI expert based in New Delhi. His last assignment was as an industrial adviser in the department of industrial policy and promotion, DIPP, currently known as DPIIT, under the ministry of commerce and industry of the government of India.