The influence of geopolitical uncertainties and shifting economic paradigms have a telling impact on the global foreign direct investment climate. Once regarded as a reliable engine for economic growth, FDI flows have faltered in recent years, weighed down by rising protectionism, supply chain disruptions, and subdued international project finance. The global FDI inflows now faces headwinds that threaten its role as a catalyst for sustainable development. For emerging economies like India, the situation is particularly challenging, as declining foreign inflows coincide with the pressing need for investment in key sectors such as manufacturing and infrastructure.

The UN Conference on Trade and Development (UNCTAD) World Investment Report 2024 says that the balance of Foreign Direct Investment (FDI) hangs precariously in a world grappling with global and regional crises. The report serves as a reminder that investment is the lifeblood of sustainable development. In this context, the 2024 report specifically focuses on the importance of investment facilitation and digital governance for the future growth of investment, particularly in the private sector.

READ I The mall effect: Consumerism widens inequality in India

Decline in global FDI

Foreign direct investment theoretically refers to investments made by a company or individual in a foreign country to protect their business interests by controlling the ownership and operation of a firm or venture. These inflows can take different forms, such as acquiring shares, establishing subsidiaries or joint ventures, providing loans, or facilitating technology transfers. The major components of foreign direct investment include equity capital, reinvested earnings, and intra-company loans. It is also expected to be a key driver in achieving the Sustainable Development Goals (SDGs) by 2030. However, data shows that FDI in 2023 declined marginally by 2%, amounting to $1.3 trillion.

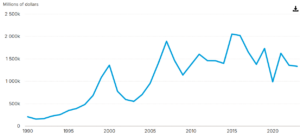

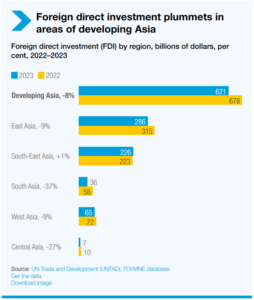

The decline in global FDI was driven by several factors, including economic uncertainty, economic fracturing trends in both developed and developing countries, cross-border mergers and acquisitions, and depressed international project finance. Global foreign direct investment flows were more than 10% lower in 2023 compared to previous years. FDI flows to developing countries fell by 7% to $867 billion, primarily due to an 8% decline in developing Asia, a 3% decrease in Africa, and a 1% drop in Latin America and the Caribbean. The overall stagnation in foreign direct investment growth was largely attributed to sluggish growth in the manufacturing sector. However, it is worth acknowledging the growth achieved in service-centric and asset-light investments during this period.

Global FDI inflows by region (1990-2023)

According to the World Investment Report 2024, the inward FDI stock for the U.S. was $2.78 trillion in 2000, rising to $3.42 trillion in 2010, $10.38 trillion in 2022, and $12.82 trillion in 2023. China’s FDI inflows were recorded at $193.3 billion in 2000, $586.8 billion in 2010, $3.49 trillion in 2022, and $3.65 trillion in 2023. As for India, FDI inflows stood at $16.3 billion in 2000, $205.5 billion in 2010, $510.7 billion in 2022, and $553.7 billion in 2023.

On the other hand, India’s foreign direct investment outflows, which were $1.7 billion in 2000, increased to $96.9 billion in 2010, $222.6 billion in 2022, and $23.5 billion in 2023. In comparison, China’s outward FDI flows were $27.7 billion in 2000, $317.2 billion in 2010, $2.75 trillion in 2022, and $2.93 trillion in 2023. The U.S. recorded FDI outflows of $2.69 trillion in 2000, $4.81 trillion in 2010, $7.98 trillion in 2022, and $9.43 trillion in 2023. It has been noted that India’s share in global FDI fell to 2.1% in 2023, down from 6.5% in 2000.

Similarly, India’s global ranking slipped to 16th in 2023, down from 8th in 2022. Foreign direct investment flows as a percentage of GDP have been steadily declining over the last three years, from 3.06% in FY 2020-21 to 1.9% in 2023-24. A study by Ind-Ra Research also indicated that FDI as a percentage of India’s Gross Fixed Capital Formation decreased from 11.22% in 2020-21 to 6.45% in 2023-24. Foreign fund inflows remain concentrated in a few states, primarily in southern and northern regions. Out of the total FDI inflows to India from October 2019 to March 2024, about half (49.5%) went to two states: Maharashtra and Gujarat.

Four southern states—Karnataka, Tamil Nadu, Andhra Pradesh, and Telangana—attracted 30.3% of the total inflows during this period. Surprisingly, despite being rich in mineral resources, Eastern India has failed to attract adequate FDI, except for Jharkhand (11%) and West Bengal (0.7%). Additionally, FDI inflows in India are sectorally skewed, with the services sector dominating at 40.9% during FY 2014-2015 to 2023-2024. FDI has primarily flowed into sectors like trading, telecommunications, banking, insurance, IT, business outsourcing, hotels, and tourism, partly through Global Capability Centres (GCCs). In contrast, the manufacturing sector accounted for only 25% of total FDI inflows during the same period, despite incentives like the Production Linked Incentive (PLI) scheme.

Digital business and investment facilitation tools are being established as crucial stepping stones towards broader digital governance. These tools are expected to significantly support inclusive and sustainable development. Reports indicate that investment facilitation plays an increasingly important role in both national and international investment landscapes. Studies show that investment facilitation measures led to a global investment growth of 39% in 2023, including 45% in developed economies and 38% in developing economies.

These measures can be divided into three categories: 1) Transparency, aimed at improving the clarity and accessibility of laws and procedures related to investment; 2) Facilitation measures; and 3) Facilitation services. Transparency measures also include the introduction of information portals for foreign investors. Streamlining measures, such as single-window operations (e.g., in Egypt) and information portals for investors (e.g., in Jordan and Mexico), aim to enhance procedural efficiency.

The World Investment Report 2024 suggests that the short-term prospects for increased foreign direct investment remain bleak, particularly under the prevailing geopolitical and global uncertainties. Challenges affecting FDI include both weakened global demand and potential disruptions to global supply chains.

Nonetheless, the report highlights that developing digital business, investment facilitation, and digital governance measures are positive steps towards enhancing procedural efficiency, transparency, and facilitation services. In countries like India, where a large stock of unemployed individuals exists, facilitating FDI may accelerate private-sector investments. However, while GDP may grow, these investments are unlikely to generate significant employment opportunities for the unemployed.

Dr Ravindran AM is an economist based in Kochi. He has more than three decades of academic and research experience with institutions such as CUSAT, Central University of Kerala, Cabinet Secretariat - New Delhi, and Directorate of Higher Education Pondicherry.