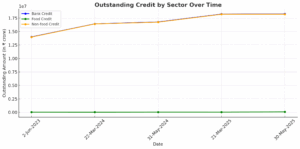

India’s financial sector finds itself in an unusual bind. On the one hand, credit demand from large corporations is slowing, while on the other, small and medium enterprises, as well as startups, struggle to access capital. Despite expectations that interest rate cuts would boost borrowing, bank credit growth has decelerated sharply. According to the Reserve Bank of India, credit growth fell to a three-year low of 8.97% in FY25, from 19.78% the previous year.

This points to a deeper malaise. Corporate capex is being held back by a combination of geopolitical uncertainties, including the threat of new US tariffs, and tepid domestic consumption. Companies with healthy balance sheets are choosing to repay existing debt rather than take on fresh loans. As a result, bank credit offtake in the wholesale segment has remained flat despite RBI efforts to ease liquidity—policy rates have been lowered by 100 basis points, and the cash reserve ratio by 50 basis points.

READ I US-India trade deal stalls over farm sector access

MSMEs, startups and bank credit

India’s bank credit cycle has long been back-loaded, with borrowing concentrated in the latter half of the fiscal year. But this seasonal trend does not explain the current stasis. What is more concerning is the credit freeze facing micro, small and medium enterprises (MSMEs) and startups—two segments that are vital to India’s growth aspirations.

According to the Parliamentary Standing Committee on Finance, there is a funding gap of ₹20-25 lakh crore in the MSME sector. Nearly half the sector’s bank credit demand remains unmet. India’s credit penetration in this space—just 14%—lags behind China’s 37% and the US’s 50%. Despite accounting for almost 30% of GDP and employing over 11 crore people, MSMEs continue to operate largely outside the formal credit ecosystem.

Scheduled commercial banks have directed only about 25% of their total credit to MSMEs as of March 2024. Many of these enterprises, particularly micro units which make up 99% of those registered under the Udyam portal (6.19 crore as of March 2025), lack collateral and credit histories. Banks, wary of non-performing assets, remain hesitant. Private banks are somewhat more willing but offset their risk through steep interest rates—effectively pricing out many borrowers.

Collateral damage of regulatory clampdowns

To compound matters, the RBI’s clampdown on unsecured personal loans and microfinance—initiated in November 2023—has dampened consumption among the urban lower middle class and rural segments. Data from CRIF High Mark shows a decline in active microfinance loans from 16.1 crore in March 2024 to 14 crore in March 2025.

This is significant. Consumption demand from these cohorts often feeds into the cash flows of MSMEs. Without sufficient liquidity on the demand side, supply-side credit expansion alone cannot revive the sector. Policymakers, therefore, face a twin challenge: spurring both credit offtake and consumption.

Policy responses in the pipeline

The RBI and the government have initiated corrective steps. Export credit insurance and currency hedging solutions are being developed to de-risk international trade. Tax incentives for the urban middle class, if implemented in the upcoming budget, could help revive consumption.

Meanwhile, plans are underway to establish venture debt funds with backing from RBI and SIDBI. These will provide startups with access to non-dilutive capital. Similarly, rural and semi-urban markets that were affected by microfinance curbs could benefit from an expansion of MUDRA loans and more rigorous enforcement of the priority sector lending mandate—which earmarks 7.5% of credit for micro-enterprises.

There are expectations that the festive season could lift corporate credit demand, especially in consumer-facing sectors. However, such a cyclical rebound would do little to address the structural challenges faced by small enterprises and startups.

Global models, local lessons

India is not the only country facing this dilemma, and there is value in looking at global best practices. Germany’s KfW Development Bank, for instance, disburses over €30 billion annually in low-interest loans, with up to 80% of the credit backed by government guarantees. These loans support MSMEs that generate 52% of Germany’s economic output.

In Singapore, the SME Working Capital Loan offers government-backed credit, while the Startup SG Founder scheme provides grants and mentorship. These measures have helped MSMEs contribute 44% to Singapore’s GDP. Similarly, the US Small Business Administration facilitates $40 billion in loans each year through 7(a) and 504 programs, with guarantees of up to 90%.

South Korea, too, offers instructive examples. The Korea Technology Finance Corporation (KOTEC) supports innovation by offering $10 billion annually in technology-based financing. Its Smart Factory Initiative has improved productivity by 30% for nearly 30,000 firms. Israel links funding with technology incubation and military R&D to help startups scale globally.

India’s opportunity to recalibrate

While India has introduced tools like the Unified Lending Interface (ULI), adoption remains limited. A Smart MSME Initiative—modelled on South Korea’s approach—could subsidise technology upgrades and formalisation. Expanding Startup India with dedicated R&D grants would help home-grown enterprises compete globally.

For startups, especially those exposed to slowing export markets, the creation of a specialised export promotion agency could help navigate tariff and compliance hurdles. Enhanced funding for the Market Access Initiative (MAI) and the creation of a unified compliance portal could significantly ease operational burdens. The National Apprenticeship Promotion Scheme (NAPS) can also be scaled up to train 10 million youth annually—providing the skilled labour force that MSMEs and startups urgently need.

India has made progress in improving bank credit access in recent years, but momentum has slowed. A coordinated push involving the RBI, government, banks, and fintechs is essential to revitalise the financial ecosystem for MSMEs and startups. These segments will be instrumental in realising the government’s ambition of a $5 trillion economy. Leaving them to navigate a bank credit-starved landscape alone would be both a strategic and economic misstep.