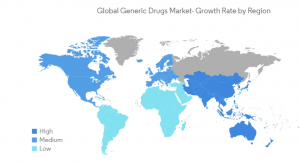

India’s pharmaceutical industry has achieved global success in the last fifty years. The contribution of the sector has not been limited to the country. It is the top producer of generic drugs globally, earning the country the title ‘pharmacy of the world’. The country is also the largest producer of vaccines by volume, accounting for 60% of the global vaccine production.

India is also the largest supplier of generic pharmaceuticals and has the greatest number of USFDA-approved factories outside the US. The nation’s pharmaceutical sector also accounts for more than 20% of the worldwide generics market and 62% of the global vaccine market.

The year 2020 ushered in a number of opportunities for the pharmaceutical industry. The Covid-19 pandemic may have brought many businesses to their knees, but the pharmaceutical sector stayed firm during the most severe healthcare emergency since the Spanish flu in 1918. Even the most well-known pharma firms were pushed to assess and enhance their digital capabilities by the pandemic-driven regulatory reforms and the emergence of new technologies.

READ I Budget 2022 must focus on demand, jobs, reforms

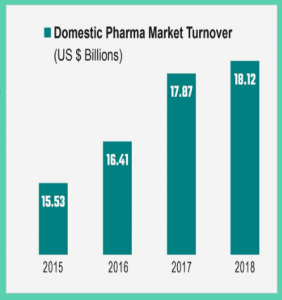

With the entire world waiting for an effective Covid-19 treatment, the field of research and development has received the maximum attention of the global pharmaceutical industry. The Indian pharmaceutical sector has grown at a steady rate of 7-10% over the last few years, and its prospects look very good. By 2030, the market might expand from $40 billion to around $80 billion in revenue at the current growth rate, and if it could notch up 11-12% growth, the industry will touch $120-130 billion by 2030.

Atmanirbhar Bharat and pharmaceutical industry

The Narendra Modi government’s ambitious Atmanirbhar Bharat scheme looks to position the country at the centre of the world’s pharma and healthcare industry. In keeping with the government’s goal of universal healthcare in India, the sector can contribute towards the goal of affordable access to high-quality medication. By 2025, India plans to increase public healthcare spending from 1.15% to 2.5% of the GDP. This is a step towards universal healthcare.

By introducing the Ayushman Bharat Yojana, the government has already created a solid base. It is critical that the private sector joins the government in delivering universal healthcare. The industry can provide India’s underprivileged with high-quality, affordable medication through the Ayushman Bharat Yojana, the world’s largest healthcare programme which will cover 50 crore citizens.

READ I Labour codes implementation to face delays as states struggle to frame rules

The pandemic did not transform the industry, it just helped enhance the pre-existing trends. One massive difference is the use of artificial intelligence (AI) and machine learning, speeding up the drug research and development process. Start-ups are experimenting with the use of these technologies to address numerous difficulties in the pharmaceutical sector such as manufacturing process automation and optimisation, as well as successful marketing and post-launch strategies.

India’s pharmaceutical industry is the third largest in the world by volumes, worth more than Rs 129,015 crore. India is the world’s largest producer of generic drugs, accounting for 20% of global exports by volume and 3.5% by value. Currently, most of the pharmaceutical products made in India are generic drugs. Patented medicines and APIs are imported. Most pharma inputs are imported from China (66%), Germany, and the US.

Today, the sector is valued at over $38 billion, with the potential to expand to $130 billion by 2030 if the huge opportunity is tapped. To attain 11-12% CAGR, all players such as the pharmaceutical industry, the government and regulatory bodies must work together. To restore its status as a world-class supplier of affordable high-quality medicines, Indian pharmaceutical businesses must foray into unexplored regions, products, and technology.

Government support in the form of investments, policies, as well as regulatory interventions is critical to accelerating innovation-driven growth. With such a strong focus on pharma, India appears to be on track to become the world’s leading pharma supplier, assuming that legislations are in place to meet the industry’s requirements.

(Arvind Sharma is Partner, Shardul Amarchand Mangaldas & Co.)