By Aditi Sawant and Varun Bhomkar

The Mumbai real estate market may witness an upswing because of a fall in prices and several initiatives taken by the central and state governments, finds a survey. The Covid-19 pandemic and the lockdown measures have adversely affected almost all the sectors of economy. Real estate is among the hardest hit in terms of contribution to the GDP and job losses. India’s commercial capital always had a booming real estate market, but exorbitant unit prices pushed a large number of potential buyers out of the market.

The central and state governments have announced several relief measures such as a reduction in stamp duty, GST rate cut and lower interest rate on home loans. But Budget 2021 failed to enthuse the real estate industry that expected infrastructure status, GST waiver on under-construction projects, and tax breaks to help tide over the demand crunch. The Budget, however, offered some relief in the form of one-year extension of additional deduction of interest up to Rs 1.5 lakh for affordable housing units and tax holiday for companies building affordable units.

READ I RBI monetary policy: Rate cuts unlikely for the rest of 2021

The survey was conducted by the economics department of St Xavier’s College, Mumbai among potential home buyers in Mumbai, Navi Mumbai and Thane districts.

Price sensitivity in Mumbai real estate market

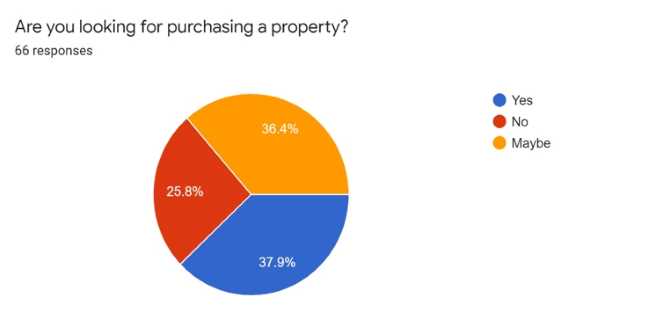

The survey found that more than a third (37.9%) of Mumbai residents surveyed are looking for a house to stay and 36.4% are thinking of buying a property. This shows a large part of the population is inclined towards an investment in Mumbai real estate. The market for homes in Mumbai, Navi Mumbai and Thane districts was affected badly by the economic crisis triggered by the Covid-19 pandemic.

Mumbai real estate market: Middle class by nature

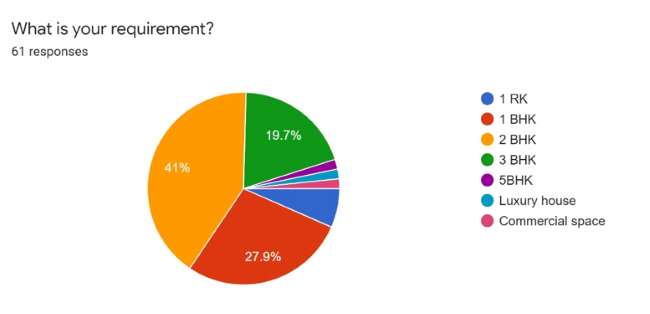

Around 41% of the home buyers are looking to buy two-bedroom properties (2BHK), 27% for one-bedroom apartments (1BHK) and 19.7% for 3BHK homes. There are just 1.6% who are interested for purchasing commercial space. This reflects the reluctance of people in taking risk in commercial space.

READ I Budget 2021 scorecard: What is on offer for different sectors of the economy

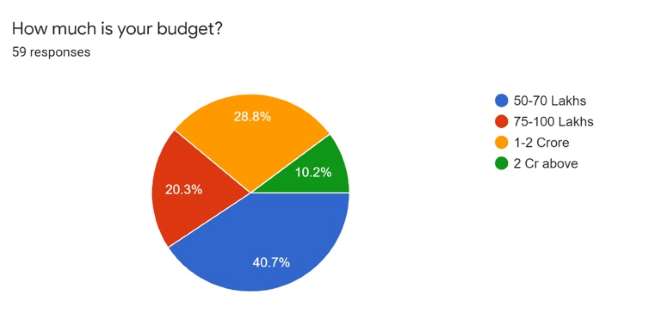

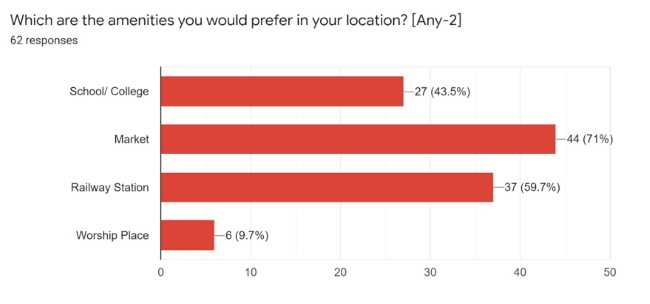

Around 40.7% of home buyers have a budget between Rs 50 lakh and Rs 70 lakh and their requirement is 2BHK. However, going by the average per square feet rate in Mumbai, 2 BHK apartments are beyond their capacity. This clearly shows a wide mismatch between paying capacity of majority of home buyers and costs of the homes. This also explains why a majority of people prefer to stay in rental residential apartments. For many home buyers, closeness to a market is an important factor, followed by railway station and other amenities such as schools and colleges.

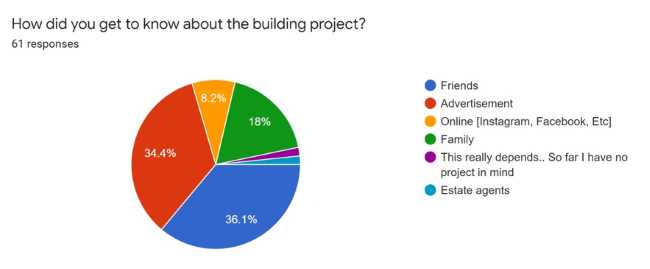

Around 36.1% of the home buyers would prefer to buy homes through references from friends or relatives. Around 34.4% of the home buyers get information via hoardings, cut-outs, and banners. On the contrary, 8.2% of the potential home buyers got information via social media channels such as Facebook and Instagram. This shows a majority of the potential home buyers do not trust information through social media.

READ I Budget 2021: A bagful of surprises from finance minister

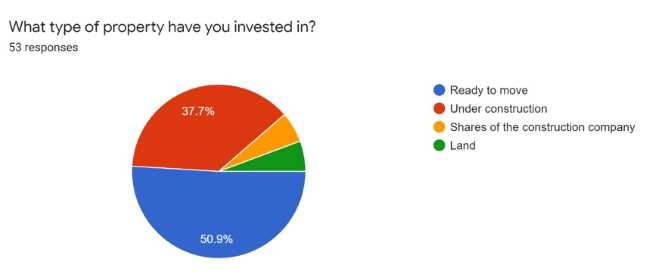

Home buyers prefer ready-to-move-in homes

Around 50.9% of the home buyers prefer ready-to-move-in homes to under-construction apartments or shares of construction companies. This also highlights the significance of zero GST policy on ready-to-move-in flats. However, 37.7% of potential homebuyers are looking for under construction properties because of budget constraints.

A majority of home buyers in Mumbai looking for 2 BHK flats have relatively smaller budgets. There is an urgent need for policy support to low- and medium-budget home buyers. The policy of 5% GST on under construction houses needs to be amended to take care of low budget home buyers who are in majority in Mumbai.

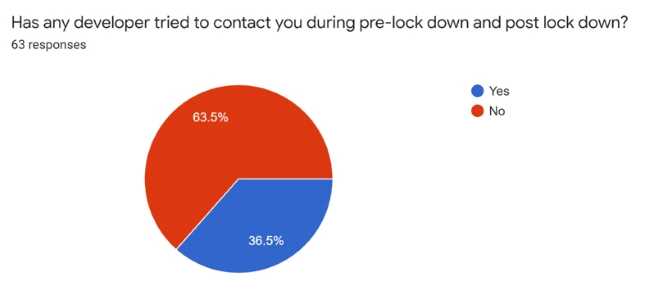

During the lockdown and post-lockdown periods, only 36.5% of the home buyers were contacted by the developers. This means that the real estate sector has been affected badly during this period and developers were severely affected by the slowdown.

READ I Budget 2021: Government borrowing and its implications for economy

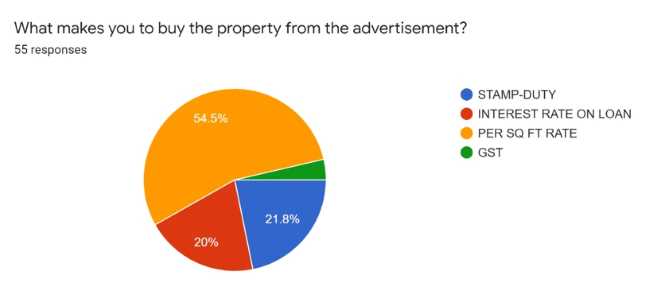

The study explains the important parameters used by home buyers while making decisions. It shows that 54.5% of the home buyers are concerned about the per sq ft rate as evident from chart 3. A majority of the home buyers with low budget fall outside the bracket of potential buyers due to low budget. There is an urgent need to bring down the ready reckoner rate in Mumbai.

The recent decision by the Maharashtra government to give 100% exemption on stamp duty till 31 January 2021 might bring some relief to around 21.8% home buyers who are looking for some concession. While 20% of the people responded positively for cuts in home loan interest rates. The home loan interest rate has come down to 7% from 9% earlier, which could result in higher real estate sales.

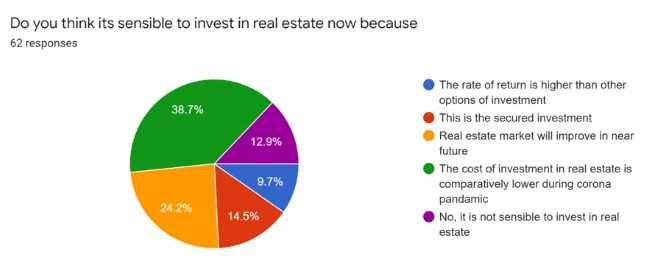

Around 38.7% of home buyers responded positively to investment in real estate as the cost has come down during lockdown. While 24.2% of the home buyers said the real estate sector will pick up in near future, 14.5% of the respondents believe that real estate is a secure investment. The results of the survey should give confidence to real estate players as just 12.9% of the respondents thought real estate investment is not a sensible decision.

(Dr. Aditi Sawant is Associate Professor and head of department of economics, St Xavier’s College, Mumbai. Varun Bhomkar is a research student at department of commerce, St Xavier’s College.)