We have to contextualise multiple perspectives. India has pioneered the digital economy with JAM (Jan Dhan, Aadhaar, Mobile trinity), jiofication, and most importantly, its globally acclaimed payments system, all accessible at the consumers’ fingertips. As the economy grows and cash-in-circulation increases, the costs and logistics involved in currency printing, storage, currency movement, and cash management operations become complicated and expensive for the RBI.

Usually, only the direct costs of these operations are reflected in the P&L of central banks, while sunk costs such as real estate, staff costs, and operational costs are not. Currently, 115 countries, representing 95% of the global GDP are exploring digital currency, with 60 countries in the advanced phase of development, pilot, or launch stage. It is a natural progression in India’s economic growth story for the RBI to move towards digital currencies.

A decade ago, the idea of net and mobile banking as a daily way of life would have seemed far-fetched. Even as recently as seven years ago, imagining using our phones as wallets for all our payments, from the Rs 10 chaat on the street to transactions worth thousands of rupees would have sounded like science fiction. If someone were to say that within the next five years, we could have digital cash equivalents and no paper currencies, we might be skeptical. So, what will we see next?

READ I Digital literacy: From skill gaps to employment crisis

RBI sees CBDC as payments and policy tool

In recent months, the RBI has been piloting its Central Bank Digital Currency (CBDC) to assess its potential benefits and challenges. CBDCs are digital forms of traditional currency issued and regulated by central banks. They can be used to settle debts, taxes, and other financial obligations. On the other hand, UPI is a payment system that facilitates fund transfers between bank accounts but does not have legal tender status.

Central banks use monetary policy tools such as interest rates and open market operations to manage inflation and stabilise the economy. CBDCs can provide central banks with additional policy levers, allowing them to implement monetary policy more effectively. With a digital currency, central banks can introduce tiered interest rates, varying rates for different types of transactions or accounts, or even negative interest rates. CBDCs enable central banks to directly transmit changes in interest rates to the financial system and households, influencing borrowing costs and incentivizing desired economic behavior.

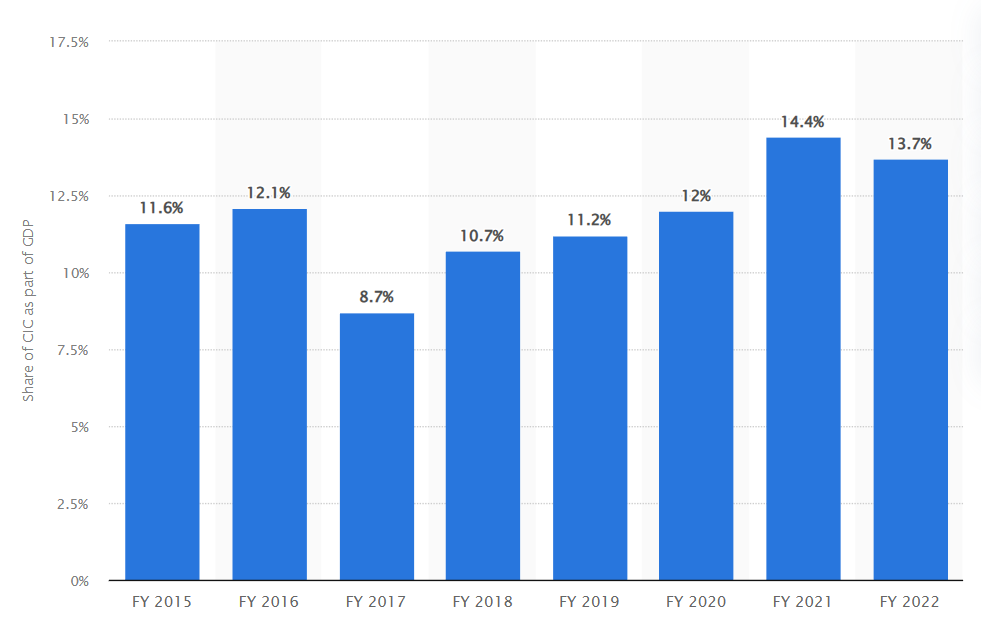

Currency in circulation as share of GDP (2015-2022)

Change and privacy concerns

However, the ubiquitous problem of change or the availability of exact denominations is yet to be solved with CBDCs. For example, in UPI, one can remit the exact amount without worrying about receiving change. But with CBDCs, one needs to load various denominations, and any excess payment would require the recipient to have the exact denomination to return the excess amount.

CBDCs offer greater transparency and traceability compared to physical cash. With digital transactions, a trail is left forever. Every transaction can be recorded and audited, mitigating the risk of illicit activities such as money laundering. Additionally, robust encryption and security measures can help safeguard against fraud and cyber threats. However, these factors raise concerns about the loss of anonymity for CBDC users, unlike paper currency. There are also worries about potential privacy overreach and covert surveillance on citizens.

Real-time M1 indicator

To monitor and assess the overall health of the economy, central bankers rely on various money aggregates, such as M1, M2, and M3. M1 represents the most liquid form of money, including physical currency (coins and notes) in circulation and demand deposits held in commercial banks. With CBDCs, real-time information on M1 can be made available to central bankers.

By utilising digital currencies, central banks can monitor transactions in real-time, analyze spending patterns, and make data-driven policy decisions. CBDCs can streamline payment processes, reducing transaction costs and settlement times. The use of digital currencies eliminates the need for intermediaries, simplifies cross-border transactions, and enhances overall efficiency in the financial system. CBDCs can democratize I2I (Institution-to-Institution) payments, bringing speed of exchange, reducing transaction costs, and providing better transparency through immutable records for inter-bank borrowing, B2G, G2G balance of trade payments, etc. This can even improve the ease of settlements.

Upcoming FATF review

The upcoming FATF review for India is scheduled for November 2023. India’s previous commitments to FATF have been reflected in recent regulations, which bring Designated Non-Financial Businesses and Professions (DNFBPs) (such as auditors) within the scope of its preventive anti-money laundering (AML) measures. Showcasing the ability to enhance the digital economy with improved policy capabilities (using CBDC for M1), enhancing traceability of currency ownership and movement, will position India favorably.

From a national perspective, ensuring a less-cash economy and reducing corruption, the transition to digital currencies must also be considered in a political context. Political analysts have always referred to the Election economics of ABC – distribution of alcohol, biryani, and cash. While we can argue that electoral bonds have replaced conventional campaign funding, cynicism and skepticism can only be dispelled if ground realities actually change. The decision to remove Rs 2000 from circulation in a year when campaigning would begin for national elections is also fuel for political gossip.

The removal of Rs 2000 from circulation could mark the beginning of an accelerated transition to a digital economy. Replacing paper currencies with digital currencies and reducing the denomination of available currencies to smaller units, while utilizing them in conjunction with UPI, could address the daily usage needs of individuals and institutions alike.

Srinath Sridharan is a strategic counsel with 25 years experience with leading corporates across diverse sectors including automobiles, e-commerce, advertising and financial services. He understands and ideates on intersection of finance, digital, contextual-finance, consumer, mobility, Urban transformation, and ESG. Actively engaged across growth policy conversations and public policy issues.