The UK economy has shown clear signs of recovery in the early months of 2024, emerging from a technical recession with robust growth figures. In the first quarter, the GDP surged by 0.6%, marking the fastest growth in over two years according to the Office for National Statistics. This rebound was broad-based, with notable expansions in the services sector and improvements in manufacturing and retail sales. Despite a challenging construction sector, overall economic activities have instilled confidence among policymakers and economists that the UK is on a path to sustained recovery.

Despite overall strong economic performance, the construction sector continues to struggle under the weight of high borrowing costs. This sector’s sluggishness is a concern because it is a significant employer and a vital part of the economy that stimulates demand in numerous related industries. If construction continues to lag, it could potentially drag down other sectors and offset the gains seen in consumer-facing services and manufacturing.

READ I US-China tech rivalry: Can America maintain its lead in AI

UK economy – growth prospects

Chancellor Jeremy Hunt and Prime Minister Rishi Sunak have expressed optimism about the economic rebound, emphasising improvements in wages, falling energy prices, and beneficial tax cuts. This growth spurt is particularly significant as the government prepares for a general election later this year, with economic stability playing a crucial role in political campaigns.

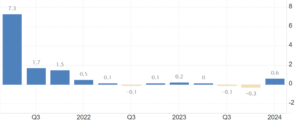

UK economy: GDP growth rate

Alongside the economic metrics, consumer sentiment has shown signs of improvement, buoyed by higher wages and the perception of a recovering economy. This is critical as consumer spending drives a significant portion of the GDP. However, there is a nuanced picture across different regions and demographics, with some households still feeling the pinch of previous economic hardships, which could temper the overall positive sentiment.

BoE’s interest rate dilemma

Despite the positive economic indicators, the Bank of England faces a challenging decision regarding interest rates. Currently, at 5.25%, the rates are at their highest in over a decade, primarily aimed at curbing inflation. While there was initial speculation about potential rate cuts to support economic growth and alleviate borrowing costs, particularly for homeowners facing refinancing challenges, the Bank’s monetary policy committee (MPC) appears cautious.

Recent strong growth figures suggest that the economy might be more resilient to high borrowing costs than previously thought. This resilience could delay rate cuts, as reducing rates too soon might reignite inflationary pressures. The Bank’s chief economist, Huw Pill, has emphasised the importance of ensuring that inflation stabilises at the target rate sustainably before considering rate adjustments.

UK economy: Annualised inflation rate

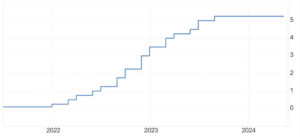

United Kingdom – BoE bank Rate

The UK’s economic performance must also be viewed in a global context. While the UK is showing signs of robust growth, it is competing in an international arena where other G7 countries, notably the US and parts of the Eurozone, are also making significant strides. The global economic environment, including trade relationships and external market forces, will influence the UK’s economic trajectory and, consequently, the decisions made by the Bank of England regarding interest rates.

While the pressure mounts for rate cuts to relieve mortgage payers and stimulate further economic growth, the risks associated with such moves cannot be understated. Premature rate cuts could lead to a rapid increase in inflation, erasing the hard-won gains achieved in stabilising prices. The delicate act of timing the rate cuts, therefore, remains a significant challenge for the Bank of England, which must balance short-term relief with long-term economic stability.

Economic forecasts and rate decisions

Forecasts by various economic institutes present a mixed picture. The National Institute of Economic and Social Research predicts continued growth in the current quarter, while the OECD has a more conservative outlook, downgrading its growth forecast for the UK. This uncertainty in growth projections adds to the complexity of the Bank of England’s rate decision.

Financial markets and some policymakers are advocating a rate cut by late summer, potentially in August. However, the actual decision will likely hinge on upcoming economic data, including wage growth and core inflation figures. These indicators will provide insights into whether the economy can maintain its growth trajectory without stoking inflation, a crucial balance for the MPC to strike in its upcoming meetings.

The Bank of England needs to balance fostering economic growth and controlling inflation. While the temptation to cut rates to support economic activity is strong, especially in an election year, the risks associated with prematurely easing monetary policy could outweigh the immediate economic benefits. As such, the MPC’s decisions in the coming months will be pivotal in shaping the UK’s economic trajectory amid recovering growth and the overarching goal of long-term financial stability.