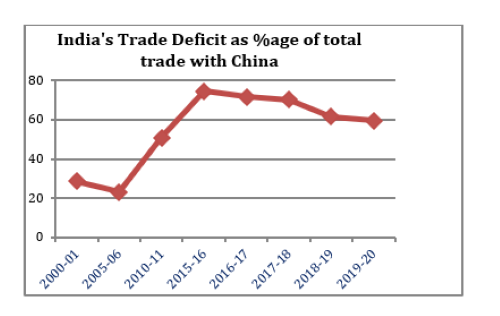

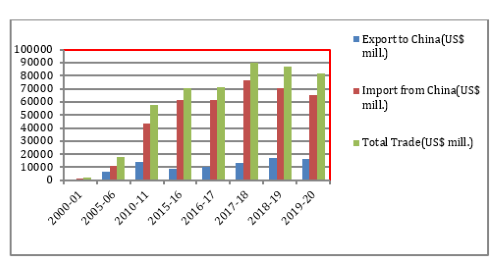

After the recent Indo-China conflict in the Galwan Valley, there is a call in India for boycotting Chinese products to hit China economically. The push for Atmanirbhar Bharat and the “vocal for local” outcry are also in sync with the boycott call to promote Indian products. However, the challenges for India in inflicting damage to the Chinese economy through a boycott are enormous. Since the beginning of the millennium, the rapid expansion of India-China trade saw China emerging as India’s largest partner in goods trade by 2008, a position that China held till last year. Bilateral trade rose from $2.33 billion in 2000-01 to around $89.71 billion in 2017-18, though the trade balance tilted heavily in favour of China. China’s share in India’s total export and import were 9% and 18%, respectively in 2019-20, whereas India’s share in China’s total export and import were just 4% and 0.76%, respectively.

Chinese products like needle, toys, electronic gadgets, cell phones, televisions, crackers, gift items, car components, textiles and garments have become inevitable in our day to day life. Indian industries also import several inputs/intermediates from China for their production lines. There are Chinese made products available here at 10-70% cheaper than India made goods, weakening the Indian industry and the economy.

READ I Atmanirbhar Bharat: Reducing dependence on China for pharmaceutical ingredients

An unusual sharp increase in imports from China between 2005 and 2015 led to several anti-dumping investigations, and anti-dumping duty is in force on around 100 products from China. These products include chemicals & petrochemicals, steel & other metals, fibres & yarn, machinery items, rubber or plastic products, electric and electronic items and consumer goods. These measures helped India flatten the import curve after 2018. However, the trade deficit remains large, and is a cause of concern.

Top 10 categories of imports from China

An analysis of India’s imports from China would help reveal the extent of dependency on China. The data may also offer clues to assess which of these products could be produced viably by local manufacturers, or if India needs to look for alternate sources for domestic needs. Based on ITC-HS -2-digit level (Chapter wise) classification, the top 10 categories of import from China have been analysed to identify products, the extent of their penetration into the Indian economy, and their importance to the industry or for public consumption.

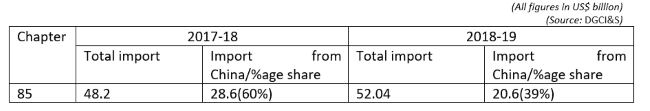

Chapter 85: Electrical machinery and equipment

Out of 45 commodities imported by India under 4-digit HS code, telephone sets of different types and their parts covered under code 8517 has a major share amounting to $15.3 billion in 2017-18. However, the import from China fell by 50% in the next financial year. The share of China in total import by India also dipped to 42% in 2018-19 from 73% in 2017-18. Setting up assembly plants for mobile phones by Chinese manufacturers in India helped in reducing the foreign exchange outgo under the category, however, diversifying the supply chain of components based on in-house development and production and sub-assembly would be needed for real self-sufficiency.

READ I FDI from China: India must balance strategic and economic interests

The steps required are facilitating mass manufacturing, creation of a supply chain ecosystem, and development of manufacturing clusters in the country, all of which are objectives under the National Policy on Electronics 2019 (NPE 2019). One more commodity under the chapter needs mention which is Solar cells/PV cells covered under 8-digit code 85414011. This product was imported in bulk from China during the last three years, as much as 89% of India’s total imports of $3.8 billion in 2017-18. While the import of this product fell in 2018-19, the share of China remained close to 80%.

To meet India’s target of achieving 175 GW of renewable energy capacity by 2022, out of which 100 GW will be from solar energy, meeting solar cell requirements is critical. The requirement in the coming years is going to be huge as, by December 2019, less than 50% of the 2022 target of renewable energy has been achieved. Keeping in view huge domestic requirements of solar panels in the coming years, bids may be invited from foreign companies (100% FDI permitted) for setting up the plant to produce solar cells from the basic silicates stage.

READ I How India lost out to China, rest of Asia in development race

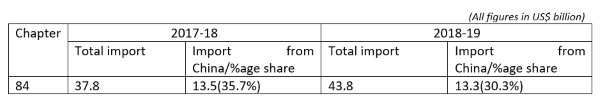

Chapter 84: Nuclear reactors, boilers, machinery and mechanical appliances

Automatic data processing machines, air-conditioning equipment, electronic printers, ball and roller bearings are the major items of import under the chapter. Laptops worth $2.2 billion were sourced from China accounting for a 75-90% of our total imports. These statistics along with import data of the previous chapter expose India’s status in electronic and computer hardware manufacturing. Another product namely compressors used in AC and refrigerating equipment has close linkage with Chinese suppliers as up to 75% of all compressors imported by Indian manufacturers were from China. It is more significant since the cost of a compressor is around 30 % of the cost of an AC or refrigerator. Unlike electronic hardware, Indian manufacturers have an existing design and manufacturing competence in the sector, the need is to reinvigorate the industry and encourage mass production to meet the domestic demand.

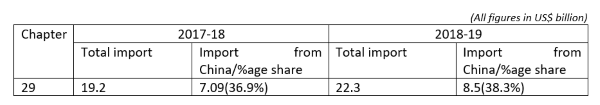

Chapter 29: Organic chemicals

Under the chapter, those chemicals which stand out due to large import value, and/or its critical application are antibiotics; cyclic hydrocarbons used as an industrial solvent; heterocyclic compounds with nitrogen, an important pharmaceutical input; and polycarboxylic acid; used in soap, food processing, and pharmaceutical industry. For a life saving drug Penicillin G, India’s dependency on China is as high as 90%. It is reported that the three of the four companies that produce the API for Penicillin G are in China.

This generic product offers small profit as demand is limited. Unfortunately, attempt to revive production of Penicillin G by public sector firm HAL has not succeeded so far, and it is up to the domestic pharmaceutical industry to take up the challenge. As regards other chemicals being imported in bulk quantity from China, used by FMCG, food processing and tyre industry, what is needed is back-end integration by existing producers. India’s chemical industry is fourth largest globally, and has the capability to take up the challenge; however, government support in terms of cost reducing measures for import substitution is needed.

READ I Covid-19 explainer: All you need to know about how coronavirus is transmitted

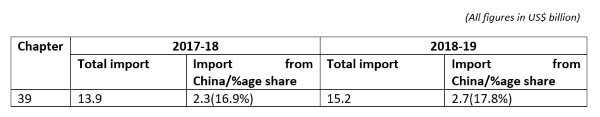

Chapter 39: Plastic and articles thereof

China has the largest share followed by South Korea, the US, Singapore, and Thailand. The import basket includes “parts made of plastics” for different applications, and in the category, China supplied 40% of our total import requirements. Flat plastic products and various polymers such as PVC are other high-value imports. PVC, a basic raw material for products used in the construction and agriculture sector, is being produced in India for the last 60 years. However, domestic production has not kept pace with the consumption, resulting in demand being met through imports. In the last five years, while import of PVC by India has gone up, the share of China has reduced. The anti-dumping duty on imports from China, and slowdown in the construction sector are the probable reasons. But the domestic industry has to ramp up production of PVC to meet the growing demand of the third most widely used plastic product. Given the strength of the Indian plastic industry, which exported products worth $10.98 billion including raw materials of value $4.53 billion in 2018-19, it is possible to reduce our dependency on imports.

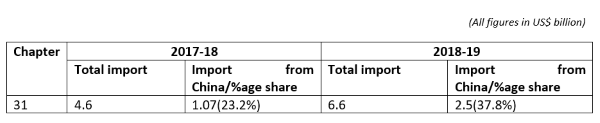

Chapter 31: Fertilisers

The role of fertilisers is critical for boosting the productivity of agriculture sector, the largest employment giver in the country. India’s dependency on imports of this crucial input is not desirable. Being the second-largest consumer of fertilisers in the world with an annual consumption of more than 55 million tonne, India is having an established production base for nitrogenous, phosphatic, and other fertilisers. However, the domestic production of fertilisers is inadequate due to raw material availability constraints in the country, resulting in a gap of 36% between demand and indigenous production being met through imports.

Although the share of China in India’s imports has fell from its peak of 49% in 2014-15, it is still significant at 37.8%. One input namely diammonium phosphate (DAP), used to increase the soil pH was imported for $1.5 billion, with China emerging as the largest supplier with a 50% share. Reducing our dependency on China is important as it is a key factor for food security in the country. As a replacement, suppliers such as UAE, Canada, Jordan, Belarus and Saudi Arabia can be further explored.

READ I Shadow pandemic: Tackling domestic violence amid Covid-19 outbreak

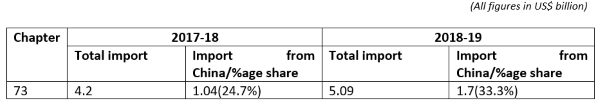

Chapter 73: Articles of iron or steel

Under the category, various types of steel tubes — seamless, welded, drill pipes, etc, and other finished articles (screws, bolts, nuts, etc.) made of steel are imported in bulk from China. The reasons for imports vary from price to the specialised nature of components developed for specific applications. India is home to a well-established industry for making welded or seamless pipes/tubes, and localisation of such imported semi-finished products should not be a tough task.

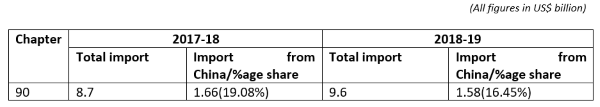

Chapter 90: Optical, photographic, surgical etc. instruments

Other than instruments for various end uses, optical fibre cable is a major product being imported. China is among the major suppliers along with the US, Germany, Japan, and South Korea. It needs to be examined why was there a surge in import of fibre cables from China during 2019-20, raising China’s share to 60% in this commodity. As regards medical instruments, it is an important segment of the healthcare industry, and the demand is expected to grow significantly in the coming years. By permitting 100% FDI in the sector, and setting up of Medical Devices Park like AMTZ in Andhra Pradesh, not only India can reduce its dependency on import, but has the potential to emerge as a cost-effective supplier to the whole world.

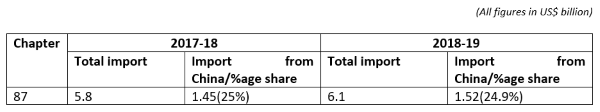

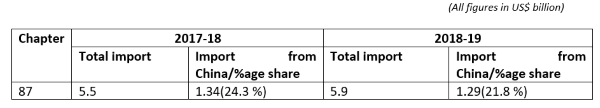

Chapter 87: Vehicles other than railway or tramway rolling stock

Under the chapter, imports from China equals the combined imports from Japan, Korea, and the US. With an import value of $1 billion, Germany is another major source. Overall, 71% of in value terms of goods imported under this category were parts/components/subassembly of passenger cars and other vehicles. Looking at the breakup of value country wise, it is seen that China accounted for 17% of total imports of parts/components/subassembly of passenger cars and other vehicles. This is alarming since Chinese vehicle manufacturers are still in the process of establishing in the Indian market. Boosting local design and development of critical auto components/subassembly is crucial for localisation of such components like Gearboxes, shock absorbers, drive axles and silencers, the government may insist on a phased indigenization program for localization of vehicles as was successfully done during the 1980s for Maruti vehicles with support from ACMA members.

READ I Gold smuggling: Faulty policies, corruption behind illegal trade

Bicycle parts and accessories also fall under the chapter, and Indian bicycle manufacturers seem to depend heavily on China for sourcing its components. Look at the statistics, out of total import of $696 million of bicycle parts in 2018-19, China accounted for $586 million, a whopping 84%. This drain of foreign exchange needs to be addressed as the Chinese appear to have outpriced Indian manufacturers of parts, not falling under high technology areas.

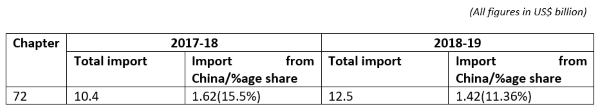

Chapter 72: Iron and steel

The rapid rise in domestic production has resulted in India becoming the second largest producer of crude steel with a total production of 102 million tonne in 2019. India is also a net exporter of steel with 8.36 million tonne export against an import of around 7.5 million tonnes in the last financial year. South Korea, Japan, China, and the US are major suppliers of primary steel to India. A gradual and sharp reduction in import from China has occurred since 2014-15, consequent to several technical and regulatory measures adopted after complaints received about the dumping of steel into India. However, the share of China is around 11% currently which is almost half of 2014-15. By and large, the current status is not alarming given the fact that China is the largest producer of steel, and has a share of 53% in global output. Indian steel producers, however, need to concentrate on the efficient production process to reduce cost, and production of special/alloy steels to reduce our dependency on other advanced countries.

Chapter 38- Miscellaneous chemical products

China is at the top of the list of supplier countries of products under the chapter. Insecticides, rodenticides, disinfectants, etc constitute 52% of our total imports of commodities under the chapter, and China supplies around 50% of our import requirements. Though India is a large producer and exporter of crop protection chemicals, the Indian pesticide industry is dependent on China, Germany, and the US for intermediates/ active ingredients for making final formulations. It is learnt that a disruption in supply from China due to the COVID-19 outbreak has led to a shortage of inventory stock of local producers and price increase. Dependency on China in this category of products has to be seen in the context of our partial dependency on fertilisers also, both being inputs for the agriculture sector, and an increase in inputs cost does not argue well for the small and marginal farmers in India. Backward integration by our industry will help reduce excessive reliance on China and other countries. Other chemicals like those used in the foundry or cement making process are also being imported from China; however, it would be easier to find suppliers in other countries for those chemicals.

READ I How India lost out to China, rest of Asia in development race

The way forward

Many people in India speak in favour of banning Chinese products as a measure to hit China economically. India imported around $70 billion worth of goods from China in 2019-20. Assume, if India brings this figure to zero, it would be a mere 0.5% of China’s GDP estimated at $13.5 trillion. The impact of such a move on China’s economy would hardly be significant. On the other hand, even a partial ban may lead to serious supply-chain disruptions for Indian manufacturers, which, in turn, would mean increasing costs of products made by domestic firms. The concept of Atmanirbhar Bharat does not mean bringing imports to zero. In the era of globalisation, integration of the national economy with the global economy through trade liberalisation brings about new dynamics which helps in lifting people above the poverty line and achieve a higher growth rate. India too was benefitted by following the approach. Nevertheless, the need for correcting the imbalance in India-China trade is acknowledged.

To reduce our dependency on China and to make a niche in global market, India requires drawing a calibrated approach in formulating medium-term and long-term policies for up-scaling local manufacturing nurtured by creating a healthy business environment, development of skills, R&D for creating labour-intensive technology, improved infrastructure, efficient use of energy, etc. Two mantras-matching the quality standards, and competitiveness, which means pursuing the strategy of mass production and mass consumption. The authorities at Central and State level need to show prudence in ensuring the reduced cost of production by judicious consideration of cost for land, power, water, financing, pollution control, etc as cost competitiveness is crucial in international trade, especially with China. However, the push need not be China-centric and rather aim at boosting our overall manufacturing sector as envisaged under the “Make in India” initiative.

The concept of Make in India was undoubtedly an inspiring initiative which is relevant in the context of the trade deficit with China. However, an honest review is called for as to what affected the progress of the initiative. An approach based on the review would not only enable India to give a befitting reply to China’s expansionist moves, but would also provide answers to India’s large trade deficits with other countries in Asia-Pacific such as Australia, Indonesia, Malaysia, Thailand, Vietnam, Japan, and Singapore.

(Krishna Kumar Sinha is an industrial policy expert based in New Delhi. He retired from Indian Engineering Services in 2017. The views expressed are personal.)

Krishna Kumar Sinha is an industrial policy and FDI expert based in New Delhi. His last assignment was as an industrial adviser in the department of industrial policy and promotion, DIPP, currently known as DPIIT, under the ministry of commerce and industry of the government of India.