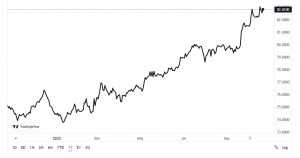

The rupee touched a historic low of 83.06 against the dollar last week. It has clawed back a bit since then, but the forex market is expected to remain volatile in the months to come. Going by the global trend, the rupee may test 84 levels in the near future. Forex traders expect resistance at 83.50 and 84 levels.

The strong dollar has become a global problem. Most global currencies depreciated against the US currency this year, leading to debt sustainability problems for low- and middle-income countries. Most of the international borrowing by governments and corporates are denominated in dollars. When the dollar rises, this debt becomes more expensive to service.

Rupee vs US dollar

The US dollar has reached its highest levels in two decades. The strength of the US economy compared with that of other nations and jumbo interest rate hikes by the Federal Reserve led to flight to safety from capital markets across the world. High interest rates in the US and the strong dollar translates into rising costs of imports and higher inflation for developing countries.

READ I Push to gig economy can solve India’s jobless growth riddle

Dollar denominated trade

A large chunk of international trade is also settled in dollar. The impact of the rising prices of crude oil and other commodities will pinch more as oil importers have to make the payments in dollars. The dominant position of the dollar in international trade and finance leads to higher inflation at a time when the world is facing a demand crunch.

The central banks address this issue by intervening in the foreign exchange market, selling dollars to shore up the domestic currency. The Reserve Bank of India has spent more than $100 billion in the last one year to support the rupee. However, foreign exchange market interventions by central banks are seen as a sign of weakness which will lead to more volatility.

US annual inflation rate

US Fed funds rate

The Federal Reserve is expected to continue with monetary tightening as consumer inflation in the US is showing no signs of abating. Interest rate hikes by the Fed often mean trouble for the rest of the world. This problem can only be solved by a coordinated sale of dollars by the US and other governments to depreciate the dollar. But no such action seems to be in the offing, with most central banks other than the Fed selling dollars.

The only viable short-term solution for emerging market central banks seems to be hiking interest rates to strengthen their currencies against the dollar. This way, they can ensure higher dollar flows into the economy. But this policy will have repercussions for economic growth. Rising interest rates will affect the fragile economic recovery from the pandemic crisis. The long-term solution is the diversification of forex reserves with other global currencies. This will make currencies less vulnerable to policy changes by the Fed.

Going by the hints from the Fed announcement at the end of its FOMC meeting last month, the US central bank will continue to raise policy interest rate to 4.25-4.4% this calendar year. The rate hikes are expected well into the first half of 2023, leading to an adverse impact on emerging markets that are already battling low growth, high inflation, and high unemployment.

Major rating agencies are scaling down growth projections for developing countries which will also face huge capital outflows, weakening exchange rates, and a further weakening of their financial conditions. They will face an uphill task to fuel economic recovery and achieve sustainable economic growth.