The New Year is dawning on a gloomy note with economic forecasters and financial institutions using the dreaded R word without hesitation. In a recent report, the International Monetary Fund emphasised that the worst is not over for the global economy. The report says several large economies will come under the grip of a recession in the new year. The IMF expects the global growth to slow down to 2.7%. While India is one of the outliers that may withstand a global crisis, the impact will also be felt in the world’s fastest growing economy.

The global GDP surpassed $100 trillion in 2022 for the first time despite various headwinds slowing down growth. However, the growth momentum may not sustain in 2023. More than a third of the world economy is expected to contract if various reports are to be believed. There is a 25% likelihood of global GDP growing by less than 2% in 2023.

Global GDP growth trend from 1960

Here are some major trends signalling towards a global recession:

High inflation and recession connection

The prices of daily commodities are ruling sky high and most economies are being forced to raise lending rates to slow down growth. Inflation is riding high on soaring food and energy prices and the current level of inflation in many countries is highest in more than four decades. Inflation is the biggest macroeconomic challenge for most central banks.

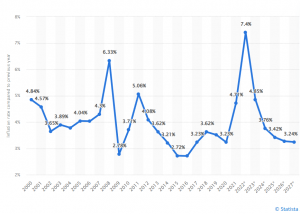

Global inflation rate from 2000 (%)

Central banks around the world have been raising policy rates this year with a degree of synchronicity not seen in the last five decades. Higher borrowing costs aimed at tackling inflation cause a number of economies to contract, according to a report by the Centre for Economics and Business Research, a London-based think tank. The central banks are likely to stay on guard despite the economic costs. The cost of bringing inflation down is slower economic growth for a number of years to come, says the CEBR report.

The China crisis looms large

The global powerhouse China was earlier set to overtake the US as the world’s largest economy by 2036, but the same may not materialise thanks to its disastrous zero covid policy. Not only did the lockdown derail the nation’s economy, but it also led to massive disruptions in the global economy as well. China’s slowdown means a slowdown in the global economy.

On top of the zero covid policy, the country is now facing a fresh coronavirus outbreak. Moreover, there are rising trade tensions with the West that further threatens global growth. As if China was not already juggling more plates than it can handle, Beijing has been trying to take control of Taiwan and faces retaliatory trade sanctions. The West is not likely to go easy on the China. According to CEBR, consequences of economic warfare between China and the west would be several times more severe than what the world witnessed due to Russia’s attack on Ukraine. All this point to higher chances of a world recession.

READ | Budget 2023 must focus on agriculture, rural income

Dipping consumer confidence

Other than inflation, several other historical indicators of recession are also flashing warnings signals. These include global consumer confidence which has already suffered a much sharper decline than in the run-up to previous global recessions. The world’s three largest economies — the United States, China, and the Euro area have been slowing alarmingly. Keeping this in mind, even a slightest hit to the global economy over the next year could tip it into a recession.

Russia-Ukraine war

The Russia-Ukraine war is casting a long shadow over the recovery chances of the global economy this year. But the upcoming year will not see any relief either. Ukraine is the leading producer of wheat, maize and sunflower which means importing countries such as Egypt will suffer shortages. As Russia has deployed its gas-supply as a strategic weapon in the war, Europeans are bracing for a bitter winter.

Slashing of forecasts

Considering past experiences with recessions, it is easier to gauge the possibility of a future recession. One such factor is the slashing of growth forecasts for major economies. Other than a significant weakening of global growth in the previous year, global asset prices and confidence, this is a major indicator of the looming recession. Growth forecasts for the United States, Euro area, and China have recently been lowered significantly. However, India is an outlier with global financial corporations rooting for the Indian economy.

Several large economies such as the UK may already be experiencing a recession. The way central banks are raising interest rates in tandem; the global economy is sure to slip into a recession. The severity of the crisis will depend on several factors such as the covid situation in China and the economic performance of economies like India which are expected to survive a global recession.