Indian policymakers are facing a peculiar situation that will require conflicting policy actions. The retail inflation rate touched a five-month high in September, while factory output contracted after a gap of 17 months in August. The challenge is to curb inflation while giving a fillip to growth. In the view of present circumstances, the Reserve Bank of India (RBI) may be forced into raising the policy repo rate yet again in December, a course of action that will have repercussions for the economy’s growth prospects.

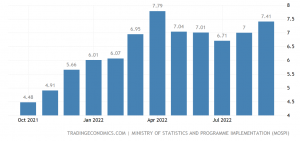

The latest data released by the National Statistical Office showed that consumer price index (CPI)-based retail inflation accelerated to 7.41% in September, up from 7% in the previous month. This spike can be attributed to a 22-month high food inflation rate of 8.6%. What is worrying the government even more is the fact that inflation has now stayed above 6%, the upper threshold of RBI’s target band for three consecutive quarters.

Retail inflation soars to 5-month high level

According to the RBI Act, the monetary policy committee (MPC) of the RBI has set an inflation target of 4%, with a variation of 2 percentage points on either side. It is perceived as a failure if the average inflation stays beyond the 2-6% range for three consecutive quarters. RBI will now be required to write a letter to the government explaining the reasons for its failure and the steps it will take to correct this.

READ ALSO | Cryptocurrencies: India may firm up rules around OECD framework

There is also the issue of the shrinking index of industrial production (IIP) which fell 0.8% in August, after growing 2.2% in July. The main reason for this fall is a contraction in mining (3.9%) and manufacturing (0.7%).

What is retail inflation sticky

The year 2022 is a forgettable one for the world economy which is struggling to recover from the damage caused by the coronavirus pandemic. To make matters worse, Russian invasion of Ukraine has caused supply chain disruptions, triggering a jump in commodity prices. The Ukraine conflict led to a rise in energy prices and supplies were hit, leading to high inflation across all major economies. Inflation as such is not just an Indian headache, it is plaguing all major economies too. Inflation is expected to haunt policymakers in such circumstances.

Recently, major oil-producing countries led by Saudi Arabia have decided to cut oil production. The laws of supply and demand suggest that it can only mean one thing — higher prices are on the way for crude, and for diesel, petrol and heating oil. This is causing worries for policymakers across the world.

As discussed above, inflation is not an Indian problem and signs of trouble are also coming from other countries. A key gauge of US consumer prices advanced to a 40-year high in September, underscoring persistent, elevated inflation. This is squeezing households and pushing the Federal Reserve towards another aggressive rate hike. The inflation data can force the Fed to continue with its policy-tightening cycle. Also, any sign that price pressures remain elevated may send markets into sell mode.

In Europe, shares are tumbling as worries about soaring prices and rising interest rates were aggravated by inflation data from the United States. Mixed earnings reports also kept investors on edge about the outlook for corporate profits. The pan-European STOXX 600 index closed down 0.5%, falling for a sixth straight session.

The current food inflation situation

In September, prices of cereals rose by 11.53%, vegetables are costlier by 18.05%, spices by 16.88%, footwear by 12.3% and fuel has risen by 10.39%. The double digit rise in daily use items is driving food inflation. To aggravate the situation, excessive rainfall in early October may adversely impact the kharif harvest and delay rabi sowing. Analysts are of the opinion that there is a material risk to the food inflation outlook due to the present circumstances.

ALSO READ | National Logistics Policy a step towards foolproof food security

Other than food and fuel components, core inflation is causing equal worries as it continues to remain elevated, driven by clothing and footwear, household goods and services, personal care and effects and recreation and amusement. Costlier everything means lighter pockets of the common man and a slip in consumer confidence which then snowballs into weak economic growth.

Meanwhile, the World Bank and the International Monetary Fund have pared their growth projections for India to 6.5% and 6.8%, respectively, for the current fiscal. In its recent policy, the RBI, too, had reduced its FY23 growth forecast to 7% from 7.2% estimated earlier.

RBI had raised policy repo rates by 50 basis points each in the last three meetings of the monetary policy committee. Most economists say that the retail inflation has peaked in India. The signs of weak economic activity as reflected in the index of industrial production the purchasing managers index may make RBI rethink its monetary policy direction.