RBI monetary policy committee meeting: The Reserve Bank of India has decided to maintain the policy repo rate at 6.5%, opting for continuity in its monetary stance for the fifth consecutive time. This decision, reflecting a deep vigilance over inflation trends, comes at a critical juncture where India, like much of the world, is facing uncertainly in post-pandemic recovery and global economic upheavals.

After a series of six consecutive rate hikes, aggregating to 250 basis points since May 2022, the RBI paused its rate increase cycle in April 2023. The continued pause, announced by RBI Governor Shaktikanta Das during the bi-monthly monetary policy, is a testament to the central bank’s strategic approach in balancing growth and inflation. The RBI Monetary Policy Committee (MPC), in a unanimous decision, emphasised its commitment to an “actively disinflationary” stance, underlining a focus on curbing inflation while supporting economic recovery.

READ I Chinese economy faces uncertainty amid shifting global dynamics

Growth and inflation projections

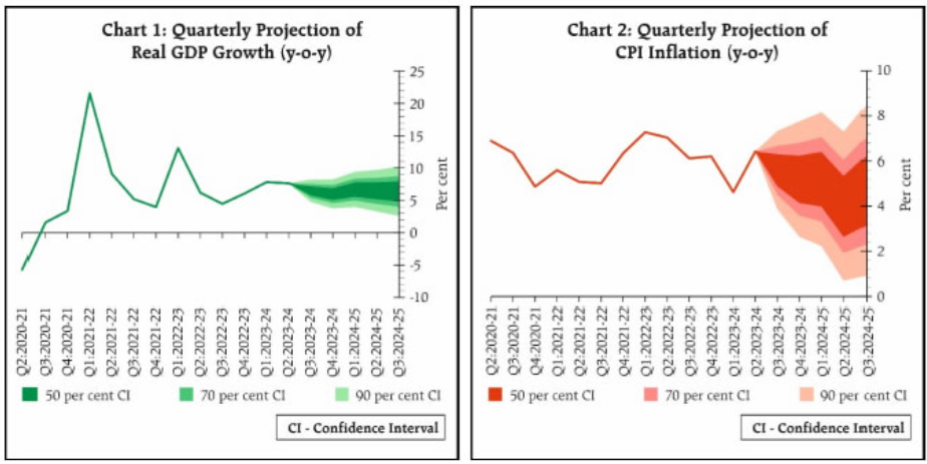

In a significant update, the RBI raised its growth projection for the current financial year to 7%, up from the earlier estimate of 6.5%. This upward revision indicates a recognition of the economy’s resilience and the potential for sustained growth. Concurrently, the central bank projected the Consumer Price Inflation (CPI) based retail inflation at 5.4% for the current fiscal. This projection comes against the backdrop of a decline in inflation to 4.87% in October, signalling a cooling trend from the previously high rates.

The recent moderation in CPI inflation, particularly the notable decrease in essential commodities like vegetables, paints a picture of an economy making significant adjustments. From a peak of 7.44% , inflation has eased to 4.87% in October 2023. This cooling trend, especially in the context of vegetable prices, is not merely transient but indicative of deeper economic realignments. However, this positive trajectory is clouded by the uncertainties of climate change and global economic dynamics. The unpredictability of food prices due to weather anomalies, coupled with the FAO’s food price index remaining above pre-COVID levels, underscores the need for a proactive and adaptable monetary policy.

The agricultural sector, a critical component of India’s economy, presents a complex scenario. Slight increases in cereal and pulse prices, coupled with concerns over potential crop damage due to recent rains in Maharashtra, point to possible inflationary pressures in the future. Additionally, lower sowing areas for key rabi crops, along with weaker reservoir levels, could pose challenges for crop yields, impacting food prices and, by extension, inflation.

RBI’s balancing act

The RBI’s current monetary policy stance reflects a nuanced understanding of these dynamics. By maintaining the repo rate at 6.5% and projecting a positive real interest gap, albeit lower than pre-Covid levels, the RBI is navigating a path of cautious optimism. The focus remains on containing inflationary pressures while fostering conditions for sustainable economic growth.

Looking ahead, the RBI’s approach suggests a continuation of its holding pattern on rate adjustments. This stance is influenced by both domestic economic indicators and global trends, particularly the policies of central banks like the US Federal Reserve. The RBI’s decisions, therefore, are not in isolation but in response to a complex interplay of global and local economic factors.

The RBI’s decision to hold the policy rate steady at 6.5 percent is a strategic move in India’s economic narrative. It reflects a commitment to steering the economy towards stability and growth amidst global uncertainties and domestic challenges. As India navigates this intricate economic landscape, the RBI’s role as a cautious yet proactive arbiter of monetary policy becomes increasingly pivotal. The path ahead may be fraught with complexities, but with a steady hand at the monetary helm, the journey towards sustained economic health and stability looks promising.

Global interest rate outlook

The global interest rate outlook is characterised by a divergence between major central banks, reflecting varying economic conditions and priorities. The US Federal Reserve (Fed) has been at the forefront of tightening, raising rates aggressively to combat persistent inflation. With inflation showing early signs of moderation, the Fed is expected to slow down the pace of rate hikes in the coming months, but further increases are likely until inflation is firmly under control.

In contrast, the European Central Bank (ECB) has been more cautious in its approach, reflecting concerns about the potential impact of tighter monetary policy on the fragile European economy. The ECB has only recently begun raising rates, and the pace of hikes is expected to remain gradual in the coming months. The Bank of England (BoE) finds itself caught in a similar bind, balancing the need to control inflation with concerns about economic growth. The BoE has raised rates more aggressively than the ECB, but it is also expected to slow down the pace of hikes in the coming months.

The divergent outlook for interest rates is likely to have a significant impact on financial markets and economic growth. Investors will need to tread carefully, while policymakers will need to balance the need to control inflation with the risk of triggering a global recession.