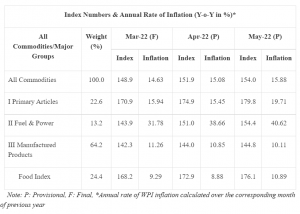

More interest rate hikes: Annual inflation measured in terms of the wholesale price index rose to a 31-year record of 15.88% in May, posting double-digit figures for the 14th month running. WPI inflation stood at 15.08% in April. Analysts blame supply chain disruptions and high global commodity prices caused by the Russia-Ukraine conflict for persistently high prices. The most worrying trend is an unabated increase in wholesale food prices which threatens to seep into consumer prices, spelling trouble for the government.

The WPI inflation is driven by prices of mineral oils, crude petroleum and natural gas, food articles, basic metals, non-food articles, chemicals and chemical products, and food products, according to government data. Prices of manufactured products that have a combined weight of 64% in WPI rose 10.11% and fuel and power rose 40.62%, compared with May last year.

READ I Timely action on inflation needed to avert hard landing

Inflation may force more interest rate hikes

The retail inflation measured by the consumer price index, however, slowed to 7.04% in May compared with 7.79% in April, helped by a marginal fall in retail food prices. It is still way above the RBI’s tolerance limit of 4 (+/-2)%. Retail inflation averaged 6.7% since April. Rising consumer prices have forced the RBI to hike the repo rate by 90 basis points within the span of a month. The fall in CPI inflation is in line with the RBI forecasts.

The rupee slipped to below the 78-mark against the US dollar. The yield on the benchmark 10-year government bond rose to 7.60%, which will make funds costlier for consumers and businesses. Heavy selling by foreign portfolio investors saw technology, banking, metal, and realty stocks falling steeply. Newly listed LIC shares fell as investors began to sell shares after the lock-in period.

READ I Indian economy: War on inflation will warrant sacrifices

Global inflation may lead to a larger crisis

In the United States, annual consumer inflation rate soared to another 40-year record in May which may force the Federal Reserve to aggressively pursue rate hikes. The benchmark consumer price index rose 8.6% from the same month last year, beating all forecasts.

Supply chain disruptions caused by the Ukraine-Russia war and the Covid-19 pandemic have been driving up prices all over the world. But the massive $5 trillion stimulus spending by the US government has created huge demand for goods at a time when the economy was facing supply shortages drove up inflation to levels unseen in several decades. And the Fed response has been very slow with the regulator classifying the price rises as transitory and would end when supply chain issues are resolved.

In Europe, the annual inflation rate hit 8.1% in May due to high energy prices. In UK (7.8%), Japan (2.5%) and other OECD countries (8.5%) also, inflation is on the rise. The massive rise in inflation may force central banks to raise rates dramatically, pushing the world economy into a recession.