India has 6.3 crore MSMEs that employ 40% of India’s non-farm workforce, contributing to nearly 25% of India’s services output and 33% of its manufacturing output. What works to India’s advantage is that it has had historical experience of traditional trade guilds. Prior to independence, Indian experience in the realm of Small-Scale industries (SSI) were of composite groups of village and small industries that consisted of varieties of industries like beekeeping, ivory carving, locks, iron safes, textile works, leather goods, processing of food, forest industries, dairy farming, toy making, perfumery and other miscellaneous groups.

This has expanded substantially after independence, providing employment to over 11 crore Indians and contributing over 29% to the GDP. There are 6.30 crore (99.4%) micro, 3.31 lakh (0.52%) small and 0.05 lakh (0.01%) medium enterprises in the country. Around 3.24 crore MSMEs (51%) are in the rural areas and 3.09 crore MSMEs (49%) are in urban centres.

The Micro, Small and Medium Enterprises (MSME) sector is critically important for the economic and social development of India, as it not only fosters entrepreneurship and nation building, but correspondingly generates large employment opportunities at a comparatively lower capital cost. The lower end of the industry has single-person entrepreneurs like grocers and everything in between from commercial vehicle owners to village craftswomen. Thus, it is a vast spectrum of businesses and employability both.

READ I Retirement planning: Indians, Americans stare at uncertain future

Impact of Covid-19 pandemic on MSME sector

In a pandemic situation, the impact across most sectors is uncertain. It could probably be worse than one-in-a hundred-year mega-crisis impacting the lower end of businesses, while it could also generate new avenues of growth once the geopolitical dynamics related to the Chinese manufacturing settles down, perhaps adversely for the Chinese economy.

While much speculation, wider range of ideas and expectations have been made on the governments globally, India has been no different. With our large population, and especially with our diverse socio-economic strata, there is no Playbook for dealing with sudden economic volatility and stoppage of livelihood sources. India’s GDP contraction in April to June (Q1 FY20-21) quarter reflects the impact of the Covid-19 pandemic. The first quarter of FY 2020-21 witnessed the rapid spread of the virus, an unparalleled lockdown and a sharp recovery as India partially unlocked in June 2020.

With the economy brought to a standstill for two complete months, the inevitable effect was a 23.9% contraction in GDP compared with the same quarter previous year. MSMEs were no exception and indeed it is feared that the impact on them would be even more severe as they lack on two accounts — deep pockets to withstand disruption and the capacity to restructure their debt.

READ I Towards a robust public health system based on universal healthcare

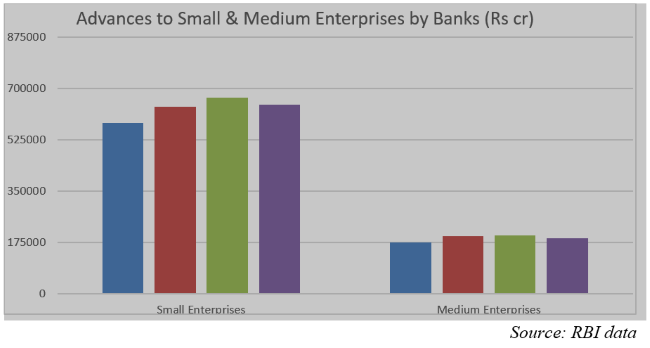

So far, fueling the optimism in the MSME sector driven by a large basket of reforms initiated by the government, credit flow to the sector has been restored. Prior to the pandemic, on a yearly basis, overall outstanding advances to MSMEs from Scheduled Commercial Banks (SCBs) and Non-Banking Financial Companies (NBFCs), was exhibiting a steady rising trend i.e up to March, 2020. Post the first wave of the pandemic, during the first quarter of FY 2020-21, the adverse trend could be observed. Figure 1 depicts the outstanding advances to small and medium enterprises by scheduled commercial banks, the primary lenders to the sector over a four year period up to 30.06.2020.

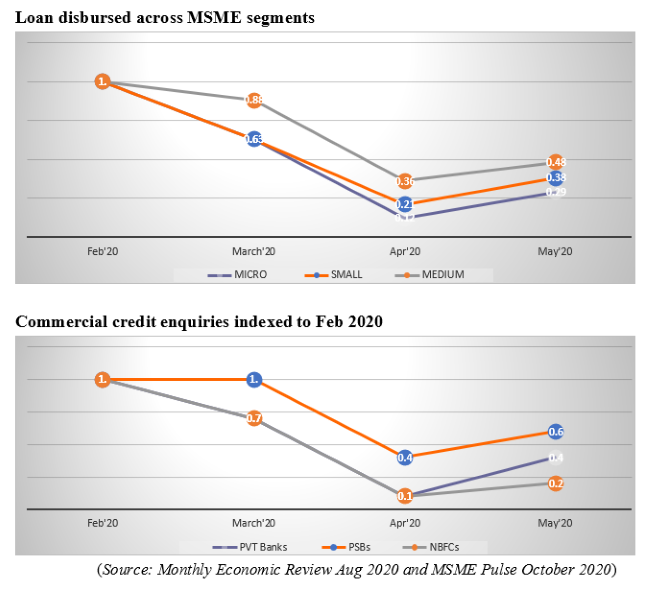

Data on fresh disbursements reported to CIBIL, the credit bureau, brought out a sharp drop in monthly disbursements of MSMEs (including Micro enterprises) from March 2020. The trend became pronounced in April 2020 once lockdown started. This was inevitable due to potential downslides in both demand and supply.

The drop was particularly sharp in the case of lending by NBFCs. Commercial credit enquiries also fell sharply in March-April 2020. The figures in May 2020 showed little improvement in comparison with April 2020 figures. MSME lending in Metro regions had the sharpest drop during lockdown. Micro loans segment showed the lowest decline in credit outstanding. Figures in 1 & 2 below bring out the extent of the decline.

At the end of April 2021, except sugar, shampoo, agro-chemicals, fertilisers, drugs and Pharma, all other manufacturing industries revealed a sharp decline. Consequent to the Covid-19 outbreak, both working capital impairment as well as demand-side issues cropped up. When business activity came to a halt, the MSME industry was weighed down by compulsory expenses such as loan-repayments, taxes, electricity bills, and other daily operating expenses. The lack of income flow had its deleterious impact. The second wave had a further negative impact though this time round, the supply side was kept more or less operational, albeit not fully so.

This was perhaps logical. For instance, a look at Chinese MSMEs through the Fitch Ratings in February 2021 showed that they experienced a plunge in business activity during 2020 due to the pandemic. Indices also revealed that SMEs underperformed larger enterprises, particularly in the retail sector. Hotel, catering, transport and logistics were the worst hit. Manufacturing, retail and real estate showed a speedy recovery from Q2 2020, but the indices for all sectors remained well below pre-pandemic levels.

Smaller retailers underperformed larger retailers, reversing the trend in 2013-2019. This was most likely due to small retailers being more financially strained and lacking the resources to sustain their operation amid the supply-chain disruption. National retail sales dropped by 3.9% yoy in 2020, lagging larger enterprises’ fall of only 1.9%.

READ I The Model Tenancy Act 2020: Towards a maintainable, inclusive rental market

Pre-pandemic efforts at boosting MSME sector

Recognising the strength of the MSME sector and perhaps, buoyed by the Chinese experience, the government had, in the past few years, introduced various schemes to provide support to the sector. In fact, in the SME sector, China had shown the way in the preceding decade.

The number of Chinese SMEs is over 38 million. The country led the pack in supply chain reforms. It has been pushing for structural reforms that could derisk its dependence on infrastructure & realty based investments. The reforms of the hukou system initiated in 2014 were targeted to boost labor and housing markets, speeding-up of investments in advanced technology to reduce dependence on the West, creation of mega-urban units, and new-age-infrastructure spending on the likes of ultra-high voltage grids and connectivity, using 4th IR tools. In the mid-2000s, China started to improve the operating environment of SMEs.

The Chinese SMEs Promotion Law 2003, pegged the status of SMEs higher in the national economic order and the responsibility of the corresponding government departments. With this, governmental support to SMEs increased and created an environment where these enterprises could compete globally with help of financial and tax incentives.

In a nutshell, China has used SMEs strategically for growth and employment generation. As a result, these contribute to over 60% of the GDP and account for 80% of the jobs in China. According to data published by the United Nations Statistics Division, China accounted for 28.7% of global manufacturing output in 2019, ahead of the United States which had the world’s largest manufacturing sector until China overtook it in 2010.

Some key initiatives by India to boost the MSME sector

Prime Minister’s Employment Generation Programme

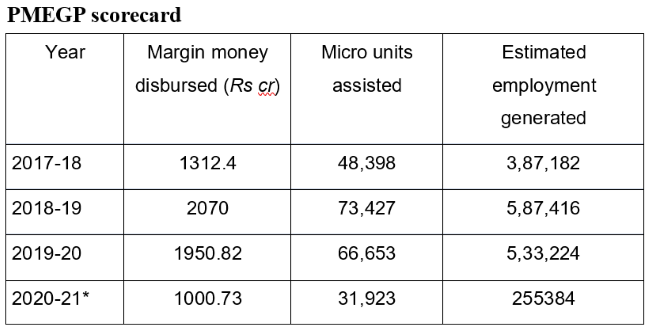

This is a bank-financed, credit-linked subsidy programme for generation of employment opportunities through establishment of non-farm micro enterprises for self-employment in rural as well as urban areas. KVIC is the nodal agency to implement the scheme across the country. Since inception in 2008-09 and up to 31.12.2020, a total of about 6.44 lakh micro enterprises have been assisted with a margin money subsidy of Rs 15,029.24 crore providing employment to an estimated 53 lakh persons.

Recently, the government introduced an online process, including a score card in co-ordination with the banks, for assessment of the proposal by the applicant, discontinuation of the role of District Level Task Force (DLTFC) which has led to 64% increase in sanctions under PMEGP in 2020-21, diversification of products by PMEGP units, and the designing of a geo-tagging portal namely www.geotag.kvic.gov. The performance of the scheme during last three years and the current financial year is given in the table below.

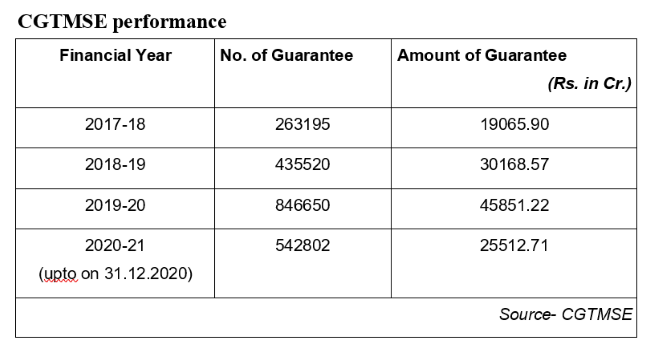

Credit Guarantee Trust Fund for Micro and Small Enterprises

CGTMSE was set up in 2000 by Ministry of Micro, Small and Medium Enterprises and the Small Industries Development Bank of India (SIDBI) to facilitate credit guarantee support for collateral free/ third-party guarantee-free loans to the Micro and Small Enterprises (MSEs). It facilitates access to finance for unserved and under-served segments of society and geographies, making available of finance from conventional lenders to new generation entrepreneurs and under privileged, who lack supporting their loan proposal with collateral security and/or third-party guarantee.

It has covered more than 48 lakh beneficiaries in last 20 years. The beneficiaries experienced a boost in their turnover as well as employment generation in the years following approval of CGTMSE. The scheme has been successful in spanning itself geographically across the country with a special focus in the North East.

Credit Linked Capital Subsidy Scheme

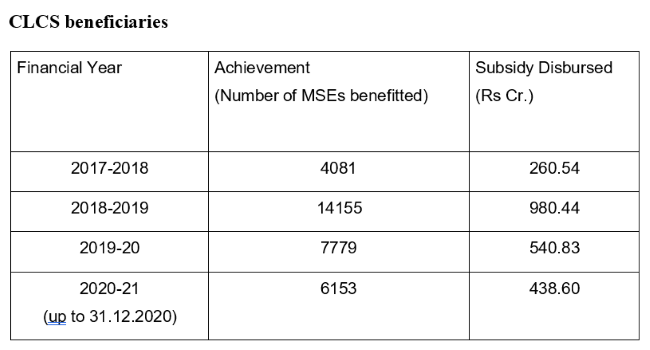

The objective of CLCS is to facilitate technology to MSEs through institutional finance for well-established and proven technologies in the specific sub-sector/products approved under the scheme. The scheme provides for the upfront subsidy of 15% on institutional credit up to Rs 1 crore (i.e., a subsidy cap of Rs. 15.00 lakh) for identified sectors/sub-sectors/technologies.

Since inception, the scheme has benefited 76,759 MSEs that availed a capital subsidy of Rs 4,867.58 crore. Progress of the scheme during last three years and the current financial year is given in the table below.

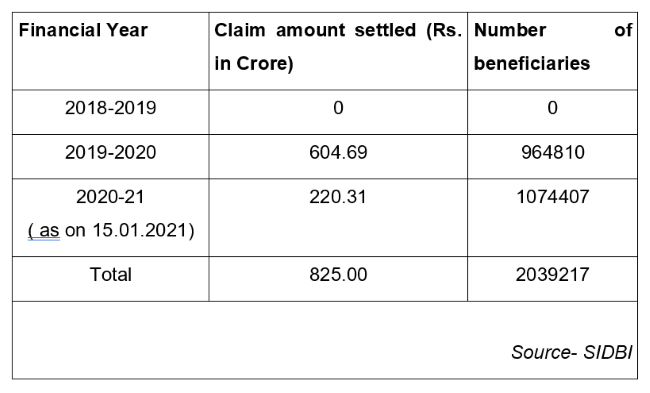

Interest subvention scheme for incremental credit to MSMEs-2018

The scheme offers 2% interest subvention for all Udyog Aadhar Number (UAN) and GST registered MSMEs on fresh or incremental loans to the extent of Rs 100 lakh. Progress of the scheme during last three years and the current financial year is given in the table below.

Other policy measures undertaken for improving credit flow to MSMEs

- MSME loans, including to service sector MSMEs, were classified as priority sector lending.

- The PSBloansin59minutes portal was launched on November 2, 2018 to facilitate in principle approval of loans of up to Rs 1 crore (enhanced subsequently to Rs 5 crore) to small and medium businesses without human intervention.

- RBI operationalised TReDS in 2017 to solve the problem of delayed payments to MSMEs.

- Restructuring of eligible MSME accounts without asset classification downgrade.

- Pradhan Mantri Mudra Yojana (PMMY) was launched in April 2015 to provide access to institutional finance to unfunded micro/small business units with collateral free loans up to Rs 10 lakh for manufacturing, processing, trading, services and activities allied to agriculture and to help in creating income generating activities and employment.

- For better transmission of monetary policy, RBI has advised banks to link all new floating rate loans to micro and small enterprises (MSEs) from October 2019.

- A target of 7.5% of Adjusted Net Bank Credit (ANBC) or Credit Equivalent Amount of Off-Balance Sheet Exposure, whichever is higher, was fixed for SCBs for lending to Micro Enterprises.

- The PLI scheme was announced in 2021 to boost domestic manufacturing under the Atmanirbhar Bharat initiative. It is expected to result in a minimum production worth more than $500 billion in five years. The scheme provides incentives to companies for enhancing their domestic manufacturing apart from focusing on reducing import bills and improving the cost competitiveness of local goods. PLI scheme offers incentives on incremental sales for products manufactured in India.

- The calculation of working capital requirement up to Rs 5 crore of MSEs simplified by defining it as 20% of projected annual turnover.

Measures undertaken after the pandemic

The likely impact of the pandemic and the lockdown on the MSME sector was recognised and a number of steps taken by the government of India and the RBI to address the impact.

- RBI permitted a term-loan moratorium and working capital interest deferment along with an asset classification standstill for this period and other measures to enhance liquidity. RBI also permitted lending institutions, as a one-time measure, to recalculate the drawing power by reducing the margins without an asset classification downgrade.

- Threshold of default under section 4 of the Insolvency and Bankruptcy Code (IBC) was increased from Rs 1 lakh to Rs 1 crore with the intention to prevent triggering of insolvency proceedings against small borrowers.

- Special refinancing facility for Small Industries Development Bank of India (SIDBI) was announced.

- On 6.8.2020, RBI also provided a window under the Prudential Framework on Resolution of Stressed Assets dated June 7, 2019 to enable lenders to implement a resolution plan in respect of eligible corporate exposures exceeding Rs 25 crore which were not more than 30 days past due as on 01.03.2020 and where the stress was on account of Covid-19 pandemic, to be invoked not later than 31 December, 2020 and implemented within 180 days thereafter.

- On 6.8.2020, RBI extended the one-time restructuring scheme for MSMEs till 31.3.2021 for entities that were in default but standard as on 1.3.2020, later on, further extended.

- The Union Cabinet on 1.6.2020 approved Ministry of MSME’s Rs 20,000 crore Subordinate Debt scheme for Stressed MSMEs. Under the scheme, banks provide promoters of stressed MSME units with subordinate debt up to 15% of promoter’s stake or Rs. 75 lakh, whichever is lower. This would be infused by the promoter as equity/quasi equity in the business of MSME.

- The existing Scheme of Partial Credit Guarantee Scheme (PCGS) offering 10% first loss Government of India guarantee to Public Sector Banks (PSBs) for purchasing pooled assets from financially sound NBFCs/HFCs has been extended as PCGS 2.0

- More recently, the coverage of the sector was expanded to Retail and wholesale trade as well.

- What has given a further boost to the sector is the directive that all CPSEs will mandatorily procure from MSMEs through the government-e-marketplace (GeM) portal to achieve the 25% of annual procurement target under Public Procurement Policy for MSEs order.

Incidentally, Budget 2021 had the highest allocation for the sector at Rs 15,700 crore, more than double that of the last year. For the Covid-19 hit MSMEs, the key highlight of the Union Budget 2021 remained a higher outlay to the sector. Further, there was an allocation of Rs 10,000 crore earmarked to Guarantee Emergency Credit Line (GECL) facility to eligible MSME borrowers.

Custom duties were rationalised and an Asset Reconstruction Company was announced for consolidation and takeover of the existing stressed debt which would enable the banks to focus on the actual viability of MSME projects.

New possibilities to revive the sector

The main focus is to improve the demand side and create a likely attraction for Indian entities in the eventuality of the likely space to be released by China against the background of the current geo-political scenario and internal economic issues in that country (such as the rise of labour costs).

The next question to address is that, if China supplies such components and products cheaper and quicker than what say India can manufacture, what’s the incentive for international buyers to change their buying behavior? How do we promote the Indian cause?

Working with industry associations

There are specialised industry associations like IMTMA, Federation of Indian Micro and Small and Medium Enterprises (FISME), SME Chamber of India that are well established. Those associations have seen the various economic cycles and trends in their industries. They also understand the specialisation of each of the specific verticals across various geographies of India.

These associations also take the lead in participating in global trade shows which can be leveraged to showcase Indian prowess across various SME / MSME verticals. Trade shows, if used well, are powerful business drivers, revenue-accretive and powerful branding aspect. It also helps showcase India as an investment destination in those sectors.

Picking up learnings from China and Germany where SMEs/ MSMEs contribute a large proportion of economy, skilling and research capabilities is a must. We need to encourage our universities to work with these sectors to develop new products, especially where our manufacturing verticals are concerned. There is also an example of state government allotting land for the industry body to develop and set up a dedicated machine-tool park. Again, Taiwan has been a pioneer in this and that’s what helped them to become a global exporter of electronics.

Policy engagements

- For MSMEs to achieve their potential, India can immediately create a PACE programme me (Polity & Policy interventions, Advisory access, Credit access, Export competitiveness).

- Indian MSMEs need policy and polity handholding in accessing global markets.

- Exports need to be upped from the existing levels. For that, we have to orient the sector in export competitiveness for which, our investments in developing physical infrastructure across India has to be fast tracked multi-fold.

- Offer advisory inputs especially for MSMEs, around which potential promoters can build businesses and to tap into global markets.

- Access to cheaper and timely / speedier credit is one such way, apart from potential areas of business which impedes growth of the sector.

- Research shows that in 2019, the average number of days it took for enterprises to receive cash for the credit sale was 176, 112 and 81 days for micro, small and medium enterprises, respectively. The TREDS programme marks a beginning in easing delayed payments. But it would be useful to ensure that auto-debit of payment (minus some earnest deposit etc) on due-date could be compulsory default option for all MSME / SME procurement.

- Further, despite all the policy initiatives, banks and other lending institutions have just scratched the surface for MSME/ SME lending. The government has undertaken several initiatives to give collateral free loans, speed-up the process of sanctioning credit and quicker clearance of MSME dues. What can give a further push is increasing digital-lending initiatives where banks & fintechs partner to improve credit access to the MSME / SME ecosystem.

- A boost to the sector can come from handholding, advisory services and persistent engagement with the fintech partners to provide access to credit and lift quality with clear identification of the manufacturing sectors that are low-hanging fruit. MSMEs, for instance, could benefit as a value-chain beneficiary as the nation invests in large infra development across highways, roadways, railways, ports, airports, and telecom infrastructure, provided there is adequate handholding and advocacy.

- Additionally, the sector would need easy access to entrepreneurial capital and lending ecosystem. It would be useful to think of a micro venture capital framework which could encourage equity investment-support to MSME.

Lastly, there is a need to keep the workforce intact and to afford a security cover to the workforce. The MSME sector workforce generally misses out in access to insurance products. Covid pandemic has shown how insurance products across life, property, business, health of the MSME employees could have saved families in breaking up financially. It is imperative to fast-track development of sachet-size insurance products, customised for the MSME sector. This, coupled with availability of social rental housing facilities will give a psychological boost to the large workforce that comprises the sector particularly in the urban areas.

In MSMEs’ stability and growth, lies India’s socio-economic progress and an inclusive society that will make it a strong nation, not just a market.

(Dakshita Das is a civil servant. Srinath Sridharan is an independent markets commentator and visiting fellow, Observer Research Foundation. Views expressed are personal. The authors acknowledge inputs from Bhaskar Choradia, a civil servant.)

Srinath Sridharan is a strategic counsel with 25 years experience with leading corporates across diverse sectors including automobiles, e-commerce, advertising and financial services. He understands and ideates on intersection of finance, digital, contextual-finance, consumer, mobility, Urban transformation, and ESG. Actively engaged across growth policy conversations and public policy issues.